By Scott Welch & Joseph Tenaglia, WisdomTree

This text is related to monetary professionals who’re contemplating providing Mannequin Portfolios to their shoppers. In case you are a person investor taken with WisdomTree ETF Mannequin Portfolios, please inquire along with your monetary skilled. Not all monetary professionals have entry to those Mannequin Portfolios.

We final wrote particularly concerning the Siegel-WisdomTree Mannequin Portfolios again in January 2020. It’s nicely previous time for an replace.

Let’s remind ourselves of the funding mandates we had been fixing for once we constructed these Mannequin Portfolios again in 2019.

First, most buyers have 4 frequent funding aims with respect to their funding portfolios (although every individual’s “weighting” to an goal might differ):

1. Keep or enhance their present way of life

2. Don’t outlive their cash

3. Be sure that household legacy or affect/philanthropic objectives might be met

4. Reduce charges and taxes alongside the best way

These frequent aims face two main challenges as we glance out over the funding horizon.

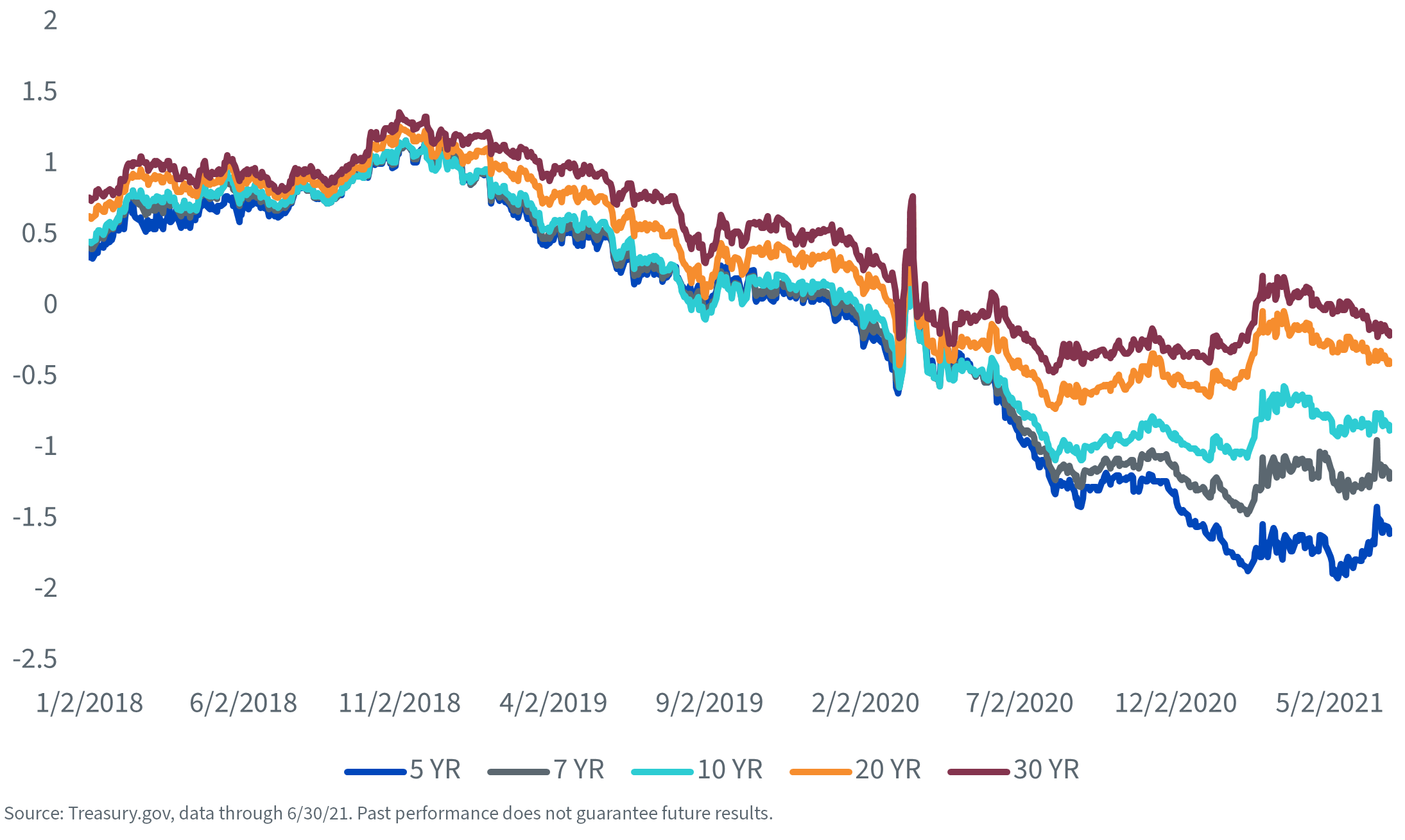

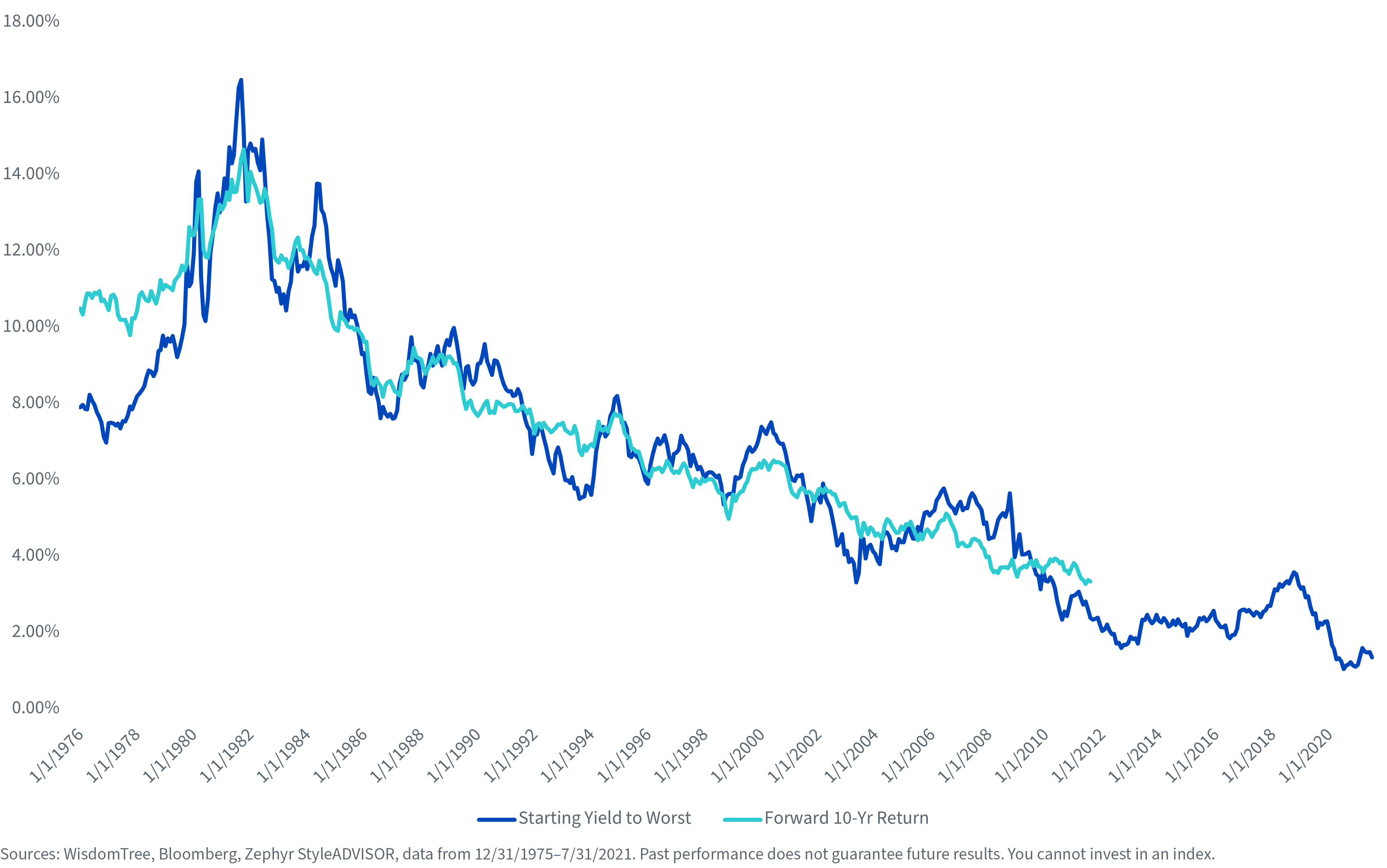

1. Low rates of interest: Rates of interest stay very low, and we merely don’t see many catalysts for driving them considerably increased into the foreseeable future. Accommodative central financial institution insurance policies, an growing old inhabitants and the corresponding demand for “hedge belongings” to fairness market threat are all working to maintain charges low. Charges might grind increased from the place they’re at the moment as the worldwide financial system recovers, however that’s on a relative not absolute foundation. At the moment, Treasury ranges of actual rates of interest are unfavourable throughout the whole yield curve, suggesting buyers are locking within the lack of buying energy in the event that they purchase and maintain these bonds till maturity. Even together with company bonds, the beginning yield has been an especially correct predictor of future bond returns, additional compounding the difficulty dealing with buyers down the street. The implication is that it’s going to stay tough to generate enough present revenue or generate future returns out of a hard and fast revenue portfolio to keep up or enhance present life with out taking undesirable extra threat (i.e., elevated period or credit score threat).

Determine 1: U.S. Treasury Actual Yields (%)

Determine 2: Bloomberg Barclays U.S. Mixture Bond Index

2. Decrease forecasted fairness returns: The potential return on any funding is at the least partly a operate of what you pay for it at the moment. Given at the moment’s fairness market valuations, buyers might doubtlessly face a decrease return regime going ahead. Our personal estimates are for roughly 4.5%–5% actual return versus a historic actual return charge of 6.5%–6.7%. The implication is that it might be harder to construct Mannequin Portfolios which have a enough longevity profile to accommodate elevated life expectations with out taking up extra fairness threat.

So, the query turns into—how can we construct a “higher mousetrap” than the normal “60/40” Mannequin Portfolio that may doubtlessly handle most buyers’ mandates within the face of present and anticipated future market environments?

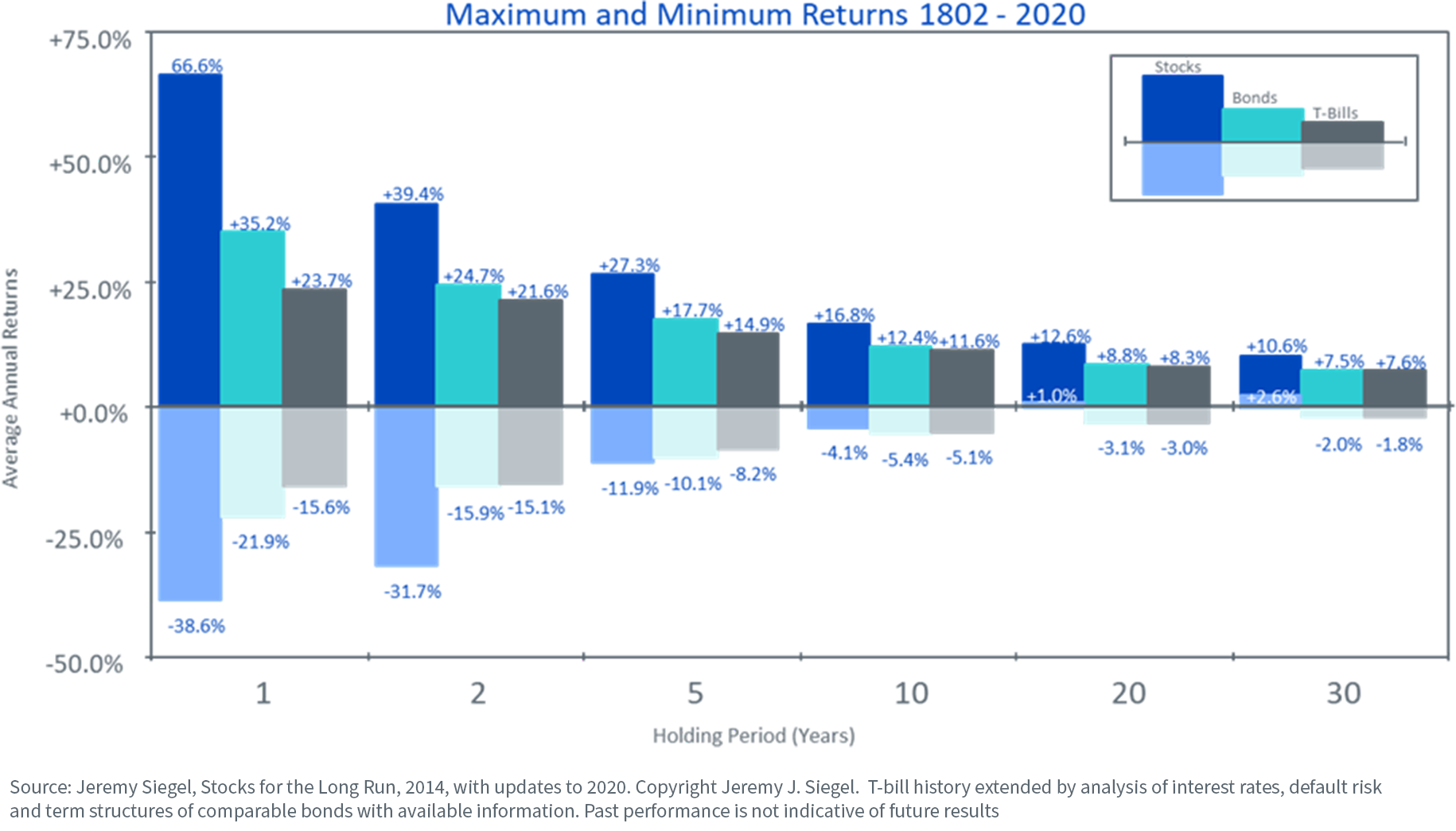

Fortuitously, there are issues we will do. First, drawing on the analysis of Dr. Jeremy Siegel of the Wharton Faculty, we all know that, over an inexpensive time horizon, even the worst-case situation in shares has been higher than that of bonds or money.

Our inner evaluation, primarily based on capital market assumptions of an actual fairness return of 4.5%–5% for equities and an actual return of 0% for bonds, suggests {that a} 75% allocation to equities accomplishes two aims versus a conventional “60/40” portfolio: (1) it doubtlessly minimizes the chance of outliving your cash over a 30-year time horizon, and (2) it additionally doubtlessly will increase the power to fund legacy aims.

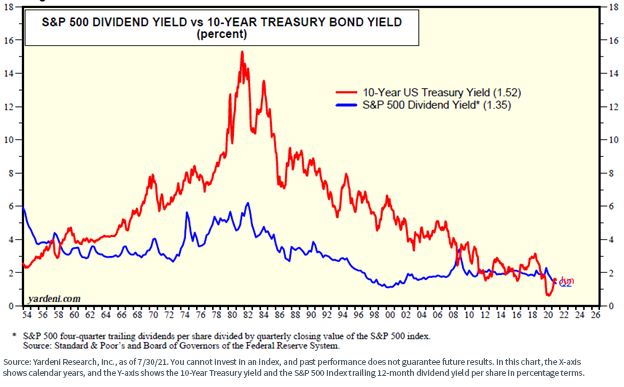

On a further notice, present dividend yields from the fairness markets stay akin to the nominal 10-Yr Treasury yield. We argue, nonetheless, that fairness dividend yields are much more sustainable, with anticipated enchancment as earnings and the financial system recuperate. As well as, we imagine equities maintain the potential for upside whole return, whereas bonds don’t (if held to maturity).

The Siegel-WisdomTree Mannequin Portfolios

The Siegel-WisdomTree Mannequin Portfolios

It was with these “details on the bottom” that, in collaboration with Dr. Jeremy Siegel of Wharton, a since-inception strategic advisor to WisdomTree, we constructed the Siegel-WisdomTree Mannequin Portfolios—a International Fairness Mannequin Portfolio and a “flagship” Longevity Mannequin Portfolio. The Longevity Mannequin Portfolio is explicitly our try and construct a “higher mousetrap” to the normal 60/40 Mannequin Portfolio:

1. A 75% (because the coverage weight) allocation to yield-focused equities to enhance present revenue era, the longevity profile and the legacy potential of the general portfolio (investor aims 1, 2 and three). The yield-focused nature of the chosen fairness securities means they have a tendency to have a decrease fairness beta.

2. The mounted revenue allocation is constructed for high quality revenue era in a risk-controlled method and to behave as an applicable fairness threat hedge (investor goal 1).

3. Selectively implement options corresponding to commodities to assist keep buying energy over time (investor goal 2).

4. The portfolio is constructed fully with ETFs, to doubtlessly optimize charges and taxes (investor goal 4).

We constructed the worldwide all-equity Mannequin Portfolio on the identical rules, however in recognition that many advisors choose to handle their very own mounted revenue portfolios and/or wish to create totally different threat profile portfolios than our prompt 75/25.

The potential outcomes of our asset allocation, portfolio building and safety choice choices are:

1. Improved present revenue era

2. A greater longevity profile (i.e., lowered short-fall threat)

3. Higher potential for funding legacy aims

4. An anticipated barely increased customary deviation than a conventional 60/40 portfolio. That’s, the investor and advisor are accepting barely increased short-term volatility in alternate for elevated present revenue and a greater longevity profile.

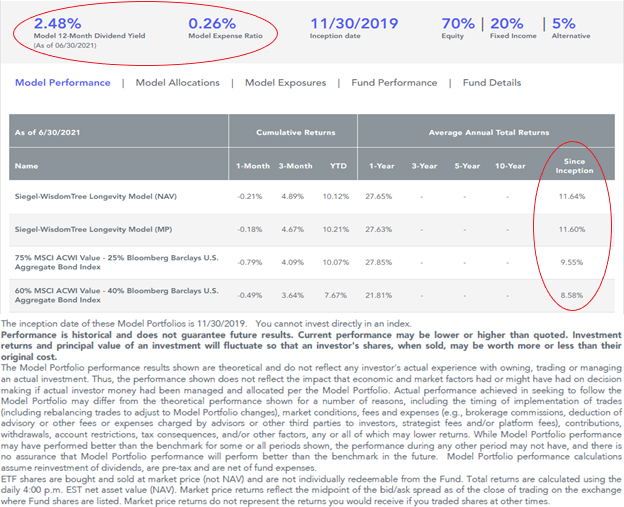

We launched these fashions in late 2019, in order that they now have virtually two years of stay efficiency below pretty excessive market situations (in each instructions), and, to this point, they’ve carried out as anticipated each from a complete return and a yield perspective. The present allocation to “options” displays the truth that we took positions in gold and broad-basket commodities at totally different instances after we launched to mitigate the perceived dangers of inflation because the financial system recovers.

Determine 5: Mannequin Efficiency

For standardized efficiency of underlying funds, please click on right here.

For definitions of Indexes, please go to our glossary.

Conclusion

We launched the Siegel-WisdomTree Mannequin Portfolios in an try to deal with what we imagine are a few of the main points and situations that buyers face now and can face into the foreseeable future. Our view is, merely, that the normal “60/40” portfolio will face vital headwinds in assembly investor aims as we transfer by way of this decade and the subsequent. We imagine we have now succeeded in developing a greater “mousetrap.”

Monetary advisors can be taught extra about these fashions, and tips on how to efficiently place them with finish shoppers, at our newly launched Mannequin Adoption Middle.

Initially revealed by WisdomTree on August 26, 2021.

Necessary Dangers Associated to this Article

WisdomTree’s Mannequin Portfolios are usually not meant to represent funding recommendation or funding suggestions from WisdomTree. Your funding advisor might or might not implement WisdomTree’s Mannequin Portfolios in your account. The efficiency of your account might differ from the efficiency proven for a wide range of causes, together with however not restricted to: Your funding advisor, and never WisdomTree, is accountable for implementing trades within the accounts, variations in market situations, client-imposed funding restrictions, the timing of consumer investments and withdrawals, charges payable and/or different components. WisdomTree shouldn’t be accountable for figuring out the suitability or appropriateness of a method primarily based on WisdomTree’s Mannequin Portfolios. WisdomTree doesn’t have funding discretion and doesn’t place commerce orders on your account. This materials has been created by WisdomTree, and the data included herein has not been verified by your funding advisor and should differ from data supplied by your funding advisor. WisdomTree doesn’t undertake to offer neutral funding recommendation or give recommendation in a fiduciary capability. Additional, WisdomTree receives income within the type of advisory charges for our exchange-traded Funds and administration charges for our collective funding trusts.

WisdomTree Mannequin Portfolio data is designed for use by monetary advisors solely as an academic useful resource, together with different potential assets advisors might think about, in offering companies to their finish shoppers. WisdomTree’s Mannequin Portfolios and associated content material are for data solely and are usually not meant to offer, and shouldn’t be relied on for, tax, authorized, accounting, funding or monetary planning recommendation by WisdomTree, nor ought to any WisdomTree Mannequin Portfolio data be thought-about or relied upon as funding recommendation or as a advice from WisdomTree, together with concerning the use or suitability of any WisdomTree Mannequin Portfolio, any explicit safety or any explicit technique. In offering WisdomTree Mannequin Portfolio data, WisdomTree shouldn’t be performing and has not agreed to behave in an funding advisory, fiduciary or quasi-fiduciary capability to any advisor or finish consumer, and has no accountability in connection therewith, and isn’t offering individualized funding recommendation to any advisor or finish consumer, together with primarily based on or tailor-made to the circumstance of any advisor or finish consumer. The Mannequin Portfolio data is supplied “as is,” with out guarantee of any form, specific or implied. WisdomTree shouldn’t be accountable for figuring out the securities to be bought, held and/or bought for any advisor or finish consumer accounts, neither is WisdomTree accountable for figuring out the suitability or appropriateness of a Mannequin Portfolio or any securities included therein for any third occasion, together with finish shoppers. Advisors are solely accountable for making funding suggestions and/or choices with respect to an finish consumer and will think about the top consumer’s particular person monetary circumstances, funding timeframe, threat tolerance degree and funding objectives in figuring out the appropriateness of a selected funding or technique, with out enter from WisdomTree. WisdomTree doesn’t have funding discretion and doesn’t place commerce orders for any finish consumer accounts. Info and different advertising supplies supplied to you by WisdomTree regarding a Mannequin Portfolio—together with allocations, efficiency and different traits—will not be indicative of an finish consumer’s precise expertise from investing in a number of of the funds included in a Mannequin Portfolio. Utilizing an asset allocation technique doesn’t guarantee a revenue or defend in opposition to loss, and diversification doesn’t get rid of the chance of experiencing funding losses. There is no such thing as a assurance that investing in accordance with a Mannequin Portfolio’s allocations will present optimistic efficiency over any interval. Any content material or data included in or associated to a WisdomTree Mannequin Portfolio, together with descriptions, allocations, information, fund particulars and disclosures, are topic to vary and will not be altered by an advisor or different third occasion in any method.

WisdomTree primarily makes use of WisdomTree Funds within the Mannequin Portfolios until there isn’t any WisdomTree Fund that’s in keeping with the specified asset allocation or Mannequin Portfolio technique. In consequence, WisdomTree Mannequin Portfolios are anticipated to incorporate a considerable portion of WisdomTree Funds however that there could also be the same fund with a better ranking, decrease charges and bills or considerably higher efficiency. Moreover, WisdomTree and its associates will not directly profit from investments made primarily based on the Mannequin Portfolios by way of charges paid by the WisdomTree Funds to WisdomTree and its associates for advisory, administrative and different companies.

References to particular securities and their issuers are for illustrative functions solely and are usually not meant to be, and shouldn’t be interpreted as, suggestions to buy or promote such securities.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com