By Richard Bernstein Advisors

It’s time for our annual August report, “Charts for the Seaside.” Annually we spotlight 5 of our favourite charts we predict consensus is at present overlooking. Load up the cooler, get your towel and chair, and benefit from the charts! As The Happenings sang, “See you in September.”

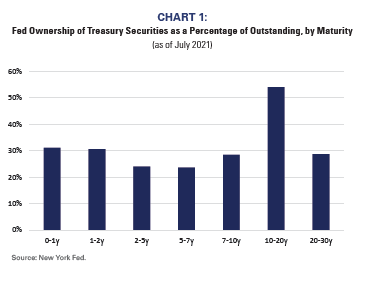

The Fed has cornered the Treasury market

When the Hunt brothers tried to nook the silver market within the early- 1980s, they owned roughly 30-35% of the privately held market. In the present day, the US Federal Reserve owns between 50-55% of the 10-20 yr Treasury market. The Fed has cornered the Treasury market.

This has a number of implications:

- The Treasury market’s out there float has been lowered, so rate of interest actions have grow to be

- The Fed has labored in opposition to its personal targets. The mixture of tighter post-Monetary Disaster laws on leverage and a flat yield curve has constrained financial institution lending and prevented liquidity from flowing to the actual financial system.

- The Fed has fostered a broad vary of bubbles as a result of their large liquidity injections have been trapped within the monetary

- As with every cornered market, there are restricted patrons and costs fall because the “cornerer” Accordingly, bond costs appear more likely to fall (rates of interest rise) when as Fed reduces its cornered positions.

- Rising rates of interest might be the kryptonite to the bubble in long-duration property (long-term bonds, know-how, innovation, disruption, bitcoin, and many others.).

[wce_code id=192]

Don’t be geographically myopic

Traders are likely to grow to be very myopic throughout a bubble, and consider solely a small universe of shares is enticing. Accordingly, innovation and disruption themes have grow to be cornerstones of speculative progress investing within the US in the course of the present bubble. Nonetheless, France, not precisely the hotbed of innovation and disruption, is outperforming NASDAQ to date this yr. No know-how business ranks within the high 10 of MSCI France index’s industries. Myopia throughout a bubble can harm portfolio efficiency.

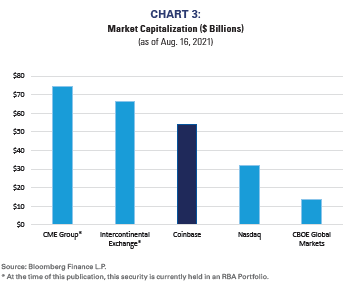

One signal of a bubble: elevated turnover

Did you understand the main bitcoin buying and selling platform has a market capitalization over 50% bigger than the market cap of the change upon which its inventory trades? Elevated turnover is likely one of the basic indicators of a bubble and these elevated crypto buying and selling volumes are mirrored in Coinbase’s outsized market capitalization.

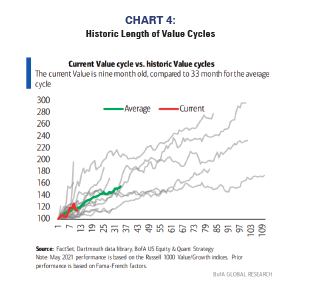

Extra regular than you’d assume

Endurance will not be a phrase used to explain traders nowadays. Nonetheless, investing persistence has traditionally been a advantage. Working example, the present worth cycle appears to be enjoying out in response to historic norms regardless of all of the “I advised you so” concerning the latest underperformance of worth. In line with BofA International Analysis, progress outperforms worth 33% of the time throughout worth cycles and the present worth run appears to certainly be intently mimicking the historic sample.

Cease the Expertise hype!

Traders at all times want to differentiate hype from actuality, however it’s typically troublesome to take action as a result of the underlying story appears so compelling. However information are information.

There’s a clear consensus the elevated use of know-how has improved productiveness and can hinder any inflation potential. The unlucky actuality is know-how hasn’t modified the development in productiveness one bit over the previous 30 years. That’s true within the US and true in most main economies.

Globalization, and its related influence of elevated competitors, extra probably depressed inflation developments than did know-how. When provide is larger than demand and competitors heats up, costs go down. Econ 101 isn’t as horny as a hyped story although.

Don’t miss out on future RBA Insights, subscribe right now.

To be taught extra about RBA’s disciplined method to macro investing, please contact your native RBA consultant.

INDEX DESCRIPTIONS:

The next descriptions, whereas believed to be correct, are in some instances abbreviated variations of extra detailed or complete definitions out there from the sponsors or originators of the respective indices. Anybody inquisitive about such additional particulars is free to seek the advice of every such sponsor’s or originator’s web site.

The previous efficiency of an index will not be a assure of future outcomes. Every index displays an unmanaged universe of securities with none deduction for advisory charges or different bills that would cut back precise returns, in addition to the reinvestment of all earnings and dividends. An precise funding within the securities included within the index would require an investor to incur transaction prices, which might decrease the efficiency outcomes. Indices are not actively managed and traders can not make investments immediately within the indices.

Nasdaq: The Nasdaq Composite Index: The NASDAQ Composite Index is a broad-based market-capitalization-weighted index of shares that features all home and worldwide primarily based widespread sort shares listed on The NASDAQ Inventory Market.

France: The MSCI France Index. The MSCI France Index is a free-float- adjusted, market-capitalization-weighted index designed to measure the equity-market efficiency of France.

About Richard Bernstein Advisors

Richard Bernstein Advisors LLC is an funding supervisor specializing in long-only, international fairness and asset allocation funding methods. RBA runs ETF asset allocation SMA portfolios at main wirehouses, impartial dealer/sellers, TAMPS and on choose RIA platforms.

Moreover, RBA companions with a number of companies together with Eaton Vance Company and First Belief Portfolios LP, and at present has $14.7 billion collectively underneath administration and advisement as of July 31st, 2021. RBA acts as sub‐advisor for the Eaton Vance Richard Bernstein Fairness Technique Fund, the Eaton Vance Richard Bernstein All‐Asset Technique Fund and in addition affords earnings and distinctive theme‐oriented unit trusts by First Belief. RBA can be the index supplier for the First Belief RBA American Industrial Renaissance® ETF. RBA’s funding insights in addition to additional details about the agency and merchandise will be discovered at www.RBAdvisors.com.

Nothing contained herein constitutes tax, authorized, insurance coverage or funding recommendation, or the advice of or a proposal to promote, or the solicitation of a proposal to purchase or put money into any funding product, automobile, service or instrument. Such a proposal or solicitation could solely be made by supply to a potential investor of formal providing supplies, together with subscription or account paperwork or varieties, which embrace detailed discussions of the phrases of the respective product, automobile, service or instrument, together with the principal threat components which may influence such a purchase order or funding, and which must be reviewed fastidiously by any such investor earlier than making the choice to speculate. RBA info could embrace statements regarding monetary market developments and/or particular person shares, and are primarily based on present market situations, which is able to fluctuate and could also be outdated by subsequent market occasions or for different causes. Historic market developments will not be dependable indicators of precise future market habits or future efficiency of any specific funding which can differ materially, and shouldn’t be relied upon as such. The funding technique and broad themes mentioned herein could also be inappropriate for traders relying on their particular funding aims and monetary scenario. Data contained within the materials has been obtained from sources believed to be dependable, however not assured. It’s best to be aware that the supplies are offered “as is” with none categorical or implied warranties. Previous efficiency will not be a assure of future outcomes. All investments contain a level of threat, together with the chance of loss. No a part of RBA’s supplies could also be reproduced in any kind, or referred to in every other publication, with out categorical written permission from RBA. Hyperlinks to appearances and articles by Richard Bernstein, whether or not within the press, on tv or in any other case, are offered for informational functions solely and under no circumstances must be thought of a suggestion of any specific funding product, automobile, service or instrument or the rendering of funding recommendation, which should at all times be evaluated by a potential investor in session along with his or her personal monetary adviser and in gentle of his or her personal circumstances, together with the investor’s funding horizon, urge for food for threat, and skill to face up to a possible loss of some or all of an funding’s worth. Investing is topic to market dangers. Traders acknowledge and settle for the potential lack of some or all of an funding’s worth. Views represented are topic to alter on the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC doesn’t undertake to advise you of any modifications within the views expressed herein.

© Copyright 2021 Richard Bernstein Advisors LLC. All rights reserved. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com