By ALPS Funds

By ALPS Funds

SBIO ON AN ALL-TIME HIGH, TRUMPING JULY’S PEAK

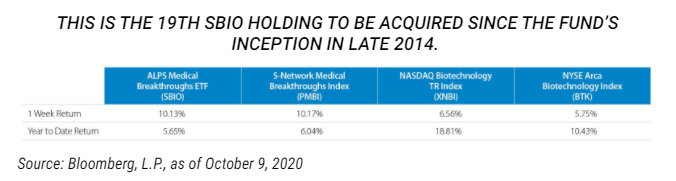

- Whereas broader fairness markets rallied final week, the ALPS Medical Breakthroughs ETF (SBIO) rallied over 10% to surpass its earlier all-time excessive. Biotech shares proceed to achieve momentum after President Trump touted Regeneron Prescription drugs (REGN; not in SBIO) monoclonal antibody to deal with COVID-19, boosting SBIO and plenty of of its immunotherapy names.

- Vir Biotechnology Inc. (VIR, 3.46% weight*) gained almost 23% final week after saying its COVID-19 antibody immunotherapy might be getting into Section Three trials, utilizing an analogous strategy to Regeneron.

- Immunogen Inc (IMGN, 0.56% weight*) rallied almost 25% final week after the FDA granted breakthrough drug remedy for its antibody immunotherapy to deal with a uncommon type of blood most cancers.

- Apellis Prescription drugs (APLS, 1.83% weight*) climbed almost 18% final week after saying constructive Section 2 knowledge for its immunotherapy inhibitor to deal with a uncommon kidney illness.

- Springworks Therapeutics (SWTX, 1.63% weight*) rose almost 18% final week after saying a partnership with Pfizer (PFE; not in SBIO) to check its immunotherapy inhibitor to deal with myeloma, a blood most cancers.

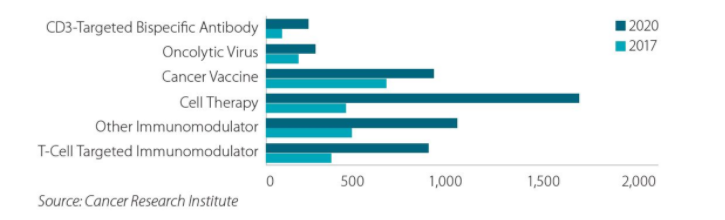

- The amount of immunotherapies to deal with or remedy most cancers (Immuno-Oncology) in preclinical and medical trials continues to develop.

- There was a 22 p.c enhance of I/O medication in improvement from 2019 to 2020, a higher year-over-year enhance than seen from 2018 to 2019, and a 233% enhance since 2017.

BIOTECH M&A CONTINUES TO BE IN PLAY

- Eidos Therapeutics (EIDX; 1.90% weight*), a medical stage biopharmaceutical firm, skyrocketed over 40% this week after saying that majority shareholder, Bridgebio Pharma (BBIO; not in SBIO), has agreed to accumulate the remaining shares of the corporate (~36%) in a inventory or money deal.

Efficiency knowledge quoted signify previous efficiency. Previous efficiency is not any assure of future outcomes in order that shares, when redeemed could also be value roughly than their authentic value. The funding return and principal worth will fluctuate. Present efficiency could also be increased or decrease than the efficiency quoted. For essentially the most present month finish efficiency knowledge please name 844.234.5852. Efficiency contains reinvested distributions and capital good points.

Previous efficiency just isn’t indicative of future outcomes. For standardized efficiency of the fund please click on right here.

* Weights in ACES as of 10/9/2020

Initially revealed by ALPS Funds

Necessary Disclosure & Definitions

An investor ought to take into account the funding goals, dangers, costs and bills rigorously earlier than investing. To acquire a prospectus which include this and different data name 866.675.2639 or go to www.alpsfunds.com. Learn the prospectus rigorously earlier than investing.

ALPS Medical Breakthroughs ETF Shares usually are not individually redeemable. Buyers purchase and promote shares of the ALPS Medical Breakthroughs ETF on a secondary market. Solely market makers or “approved individuals” could commerce instantly with the Fund, sometimes in blocks of 50,000 shares. There are dangers concerned with investing in ETFs together with the lack of cash. Extra data relating to the dangers of this funding is on the market within the prospectus. The Fund is topic to the extra dangers related to concentrating its investments in corporations available in the market sector.

Diversification doesn’t eradicate the danger of experiencing funding losses. An investor can’t make investments instantly in an index.

S-Community Medical Breakthroughs Whole Return Index is designed to seize analysis and improvement alternatives within the pharmaceutical business. PMBI consists of small-cap and mid-cap pharmaceutical and biotechnology shares listed on U.S. inventory exchanges which have a number of medication in both Section II or Section III U.S. FDA medical trials.

NASDAQ Biotechnology Whole Return Index is a modified market capitalization-weighted index designed to measure the efficiency of the all NASDAQ shares within the biotechnology sector.

NYSE Arca Biotechnology Index is an equal-dollar weighted index designed to measure the efficiency of a cross part of corporations within the biotechnology business which can be primarily concerned in the usage of organic processes to develop merchandise or present providers.

The indexes are reported on a complete return foundation, which assumes reinvestment of any dividends and distributions realized throughout a given time interval. The indexes usually are not actively managed and don’t mirror any deductions for charges, bills or taxes. One can’t make investments instantly in an index. Index efficiency doesn’t mirror fund efficiency. This fund might not be appropriate for all traders. There are dangers concerned with investing in ETFs together with the lack of cash.

The Fund is taken into account non-diversified and consequently could expertise nice volatility than a diversified fund. The Fund’s investments are concentrated within the prescription drugs and biotechnology industries, and underperformance in these areas will lead to underperformance within the Fund. Investments in small and micro capitalization corporations are extra risky than corporations with bigger market capitalizations.

The Fund employs a “passive administration”- or indexing- funding approached and seeks to trace the funding outcomes of an index composed of world corporations that enter conventional markets with new digital types of manufacturing and distribution, and are more likely to disrupt an present market or worth community. Not like many funding corporations, the Fund just isn’t “actively” managed. Due to this fact, it could not essentially promote a safety as a result of the safety’s issuer was in monetary bother until that safety is faraway from the Poliwogg Medical Breakthroughs Index. Equally, the Fund doesn’t purchase a safety as a result of the safety is deemed enticing until that safety is added to the Medical Breakthroughs Index.

Corporations within the prescription drugs and biotechnology business could also be topic to in depth litigation primarily based on product legal responsibility and comparable claims. Laws launched or thought of by sure governments on such industries or on the healthcare sector can’t be predicted. Corporations within the prescription drugs business are topic to aggressive forces that will make it troublesome to boost costs and, in actual fact, could lead to value discounting. The profitability of some corporations within the prescription drugs business could also be depending on a comparatively restricted variety of merchandise. As well as, their merchandise can turn out to be out of date resulting from business innovation, modifications in applied sciences or different market developments. Many new merchandise within the prescription drugs business are topic to authorities approvals, regulation and reimbursement charges. The method of acquiring authorities approvals could also be lengthy and expensive. Many corporations within the prescription drugs business are closely depending on patents and mental property rights. The loss or impairment of those rights could adversely have an effect on the profitability of those corporations. The event of recent medication usually has a excessive failure fee, and such failures could negatively impression the inventory value of the corporate creating the failed drug. Biotechnology corporations could have persistent losses throughout a brand new product’s transitionfrom improvement to manufacturing. So as to fund operations, biotechnology corporations could require financing from the capital markets, which can notalways be obtainable on passable phrases or in any respect.

ALPS Portfolio Options Distributor, Inc. is the distributor for the ALPS Medical Breakthroughs ETF.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.