As the 12 months involves an in depth, valuable metals and metals ETFs have take a well-deserved br

As the 12 months involves an in depth, valuable metals and metals ETFs have take a well-deserved breather after a strong efficiency in 2020. Gold, silver and platinum proceed to remain in uptrends, regardless of falling from their final highs, however have been in consolidation for a number of months now.

One of the vital promising metals of the group is silver, which is up 1.38% Wednesday, to commerce at $26.58 an oz..

With inflation probably an element within the coming years, silver and gold are poised to learn. In contrast to paper forex and shares, bodily valuable metals similar to gold and silver are extra insulated from inflation as a result of they derive their worth in another way than paper forex. As well as, a mixture of business calls for for the metallic and a preoccupation with security may bolster silver, in keeping with latest feedback from analysts.

“Analysts see the white metallic rising to $30 an oz. within the subsequent 12 months from the present $23.36, and even greater given the large-scale stimulus wanted to revive economies. It could be a continuation of the pattern this 12 months, which has led to the surge in gold and silver costs as traders hunt for havens,” experiences Liz Moyer for Barron’s.

“Citigroup analysts are much more bullish, with a $40 value goal on silver over the subsequent 12 months, pushed by investor need for security in addition to industrial demand as soon as the restoration picks up. They see a return of the 2010-11 bull market in silver as demand rises 6% in China, from each industrial patrons and retail traders,” added Barron’s.

Are the Silver Bells Tolling?

Some analysts additionally see a technical benefit for silver.

“March silver futures bulls have the agency general near-term technical benefit amid a four-week-old value uptrend in place on the every day bar chart. Silver bulls’ subsequent upside value goal is closing costs above strong technical resistance on the December excessive of $27.635 an oz.. The following draw back value goal for the bears is closing costs beneath strong assist at $25.00. First resistance is seen at this week’s excessive of $26.98 after which at $27.635. Subsequent assist is seen at immediately’s low of $26.26 after which at $26.00,” writes Jim Wyckoff for Kitco Information.

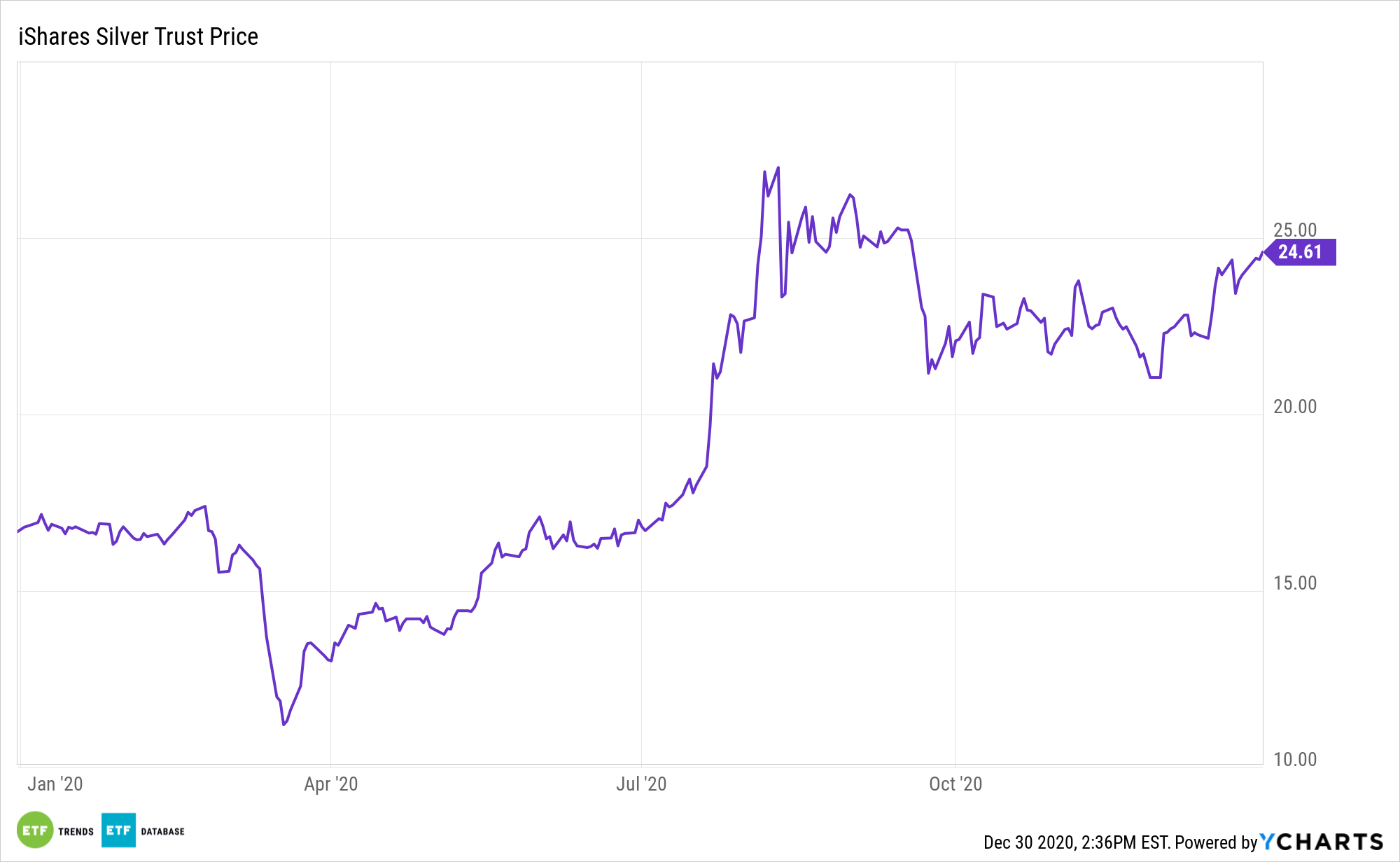

For traders trying to allocate silver into their portfolios utilizing ETFs, there are a number of choices. The iShares Silver Belief (SLV) is a well-liked selection, and just lately boasted $171.1 million {dollars} in inflows just lately. Aberdeen additionally has fairly a group of metals ETFs, together with these targeted on silver. Aberdeen’s suite contains the Aberdeen Normal Gold ETF Belief (SGOL), which comes with a 0.17% expense ratio, and the Aberdeen Normal Bodily Silver Shares ETF (SIVR), which has a 0.30% expense ratio. Moreover, the Aberdeen Normal Bodily Valuable Metals Basket Shares (NYSEArca: GLTR), which has a 0.60% expense ratio, presents a cornucopia of metals together with gold, silver, platinum, and palladium.

For extra information, data, and technique, go to the Fairness ETF Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.