A rising refrain of market observers are wagering t

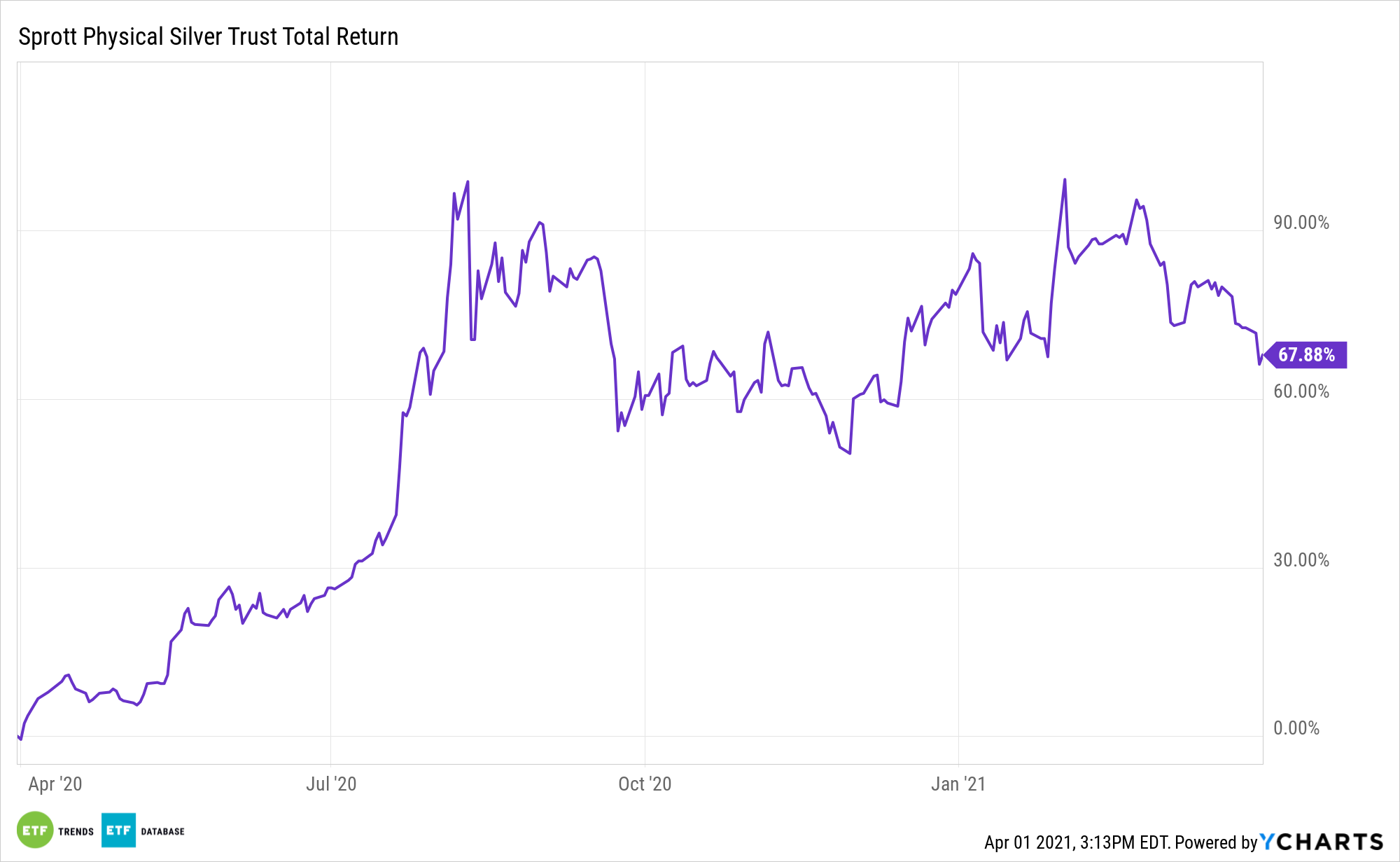

A rising refrain of market observers are wagering that silver and belongings such because the Sprott Bodily Silver Belief (NYSEArca: PSLV) are poised for extra upside following a disappointing first quarter.

PSLV is a closed-end fund that lets traders redeem giant blocks of shares in trade for supply of silver bullion.

The Belief usually trades at a premium to internet asset worth (NAV). Closed-end funds can see giant premiums and reductions, whereas trade traded funds have an arbitrage characteristic that tends to maintain costs in line. PSLV does possess some distinctive advantages nonetheless, and silver is gaining momentum as long-term thought.

“As we head in the direction of the top of 2021’s first quarter, silver has been sleeping. Because the begin of this 12 months, the vary has been $6.31 on the continual futures contract, however the treasured metallic put in a touch greater excessive when it traded to $30.35 on February 1,” stories Looking for Alpha. “Silver was sitting beneath the midpoint of its 2021 buying and selling vary on Monday, March 22, as the valuable metallic is consolidating and digesting its beneficial properties over the previous 12 months.”

PSVL Is a Potent Q2 Concept

The silver outlook is rising increasingly more encouraging, and that would lure extra traders to PSLV, which is among the extra compelling silver funds in the marketplace at present.

Goldman Sachs analysts, in a analysis report printed earlier this 12 months, restated its bullish stance for silver, projecting costs to climb as excessive as $33 an oz as President Biden pushes onward with a plan to enhance various renewable power manufacturing.

Inflation is one other catalyst for PSLV.

“Inflation is traditionally bullish for silver and all commodity costs. Copper stays above $four per pound, the very best stage in a decade. Regardless of the current correction, crude oil is sitting at over $61.50 per barrel. Grains are at over six-year highs, and plenty of different uncooked materials costs are validating the worth motion within the bond market. When actual rates of interest rise, it will increase the price of carrying commodities and weighs on their costs. Nevertheless, when charges transfer to the upside due to inflation, commodities have a tendency to understand,” provides Looking for Alpha. “One other bullish signal for the silver market is its historic value relationship with gold, the yellow metallic that performs an integral function within the international monetary system.”

For extra information, data, and technique, go to the Gold & Silver Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.