What a solution to kick off the brand new 12 months. If you

What a solution to kick off the brand new 12 months.

If you happen to occurred to observe the storming of the Capitol unfold stay on TV on Wednesday of final week, you may need mistaken it for a film adaptation of a Tom Clancy novel.

Regardless of the turmoil, shares have extremely continued to commerce up. On Friday, the S&P 500 opened at a brand new document excessive as disappointing jobs numbers sparked hopes of extra fiscal stimulus.

Such spending appears much more doubtless now that the Democrats have managed to realize management of each chambers of Congress, following Georgia’s particular Senate election.

I’m unsure if a 50-50 cut up constitutes the “blue wave” we saved listening to about within the months main as much as the November election, but it surely offers the Democrats with simply sufficient political capital to understand at the very least among the insurance policies on their want listing, together with inexperienced renewable vitality. President-elect Joe Biden has an bold deadline of 2035 for decarbonizing the U.S. energy grid.

If nothing else, this must be constructive for gold, given the potential for better authorities spending and, due to this fact, inflation.

Keep in mind: Authorities coverage is a precursor to vary. We preferred renewable vitality shares properly earlier than the election, and I imagine traders could be lacking a possibility in the event that they missed them now that the sector might get help from the brand new Congress and administration within the coming months.

2020 in Evaluation: Commodities

That brings me to the principle matter: commodities. As I advised you final week, we’ve up to date our perennial in style Periodic Desk of Commodities. You may go to the interactive desk and obtain your individual pdf by clicking right here.

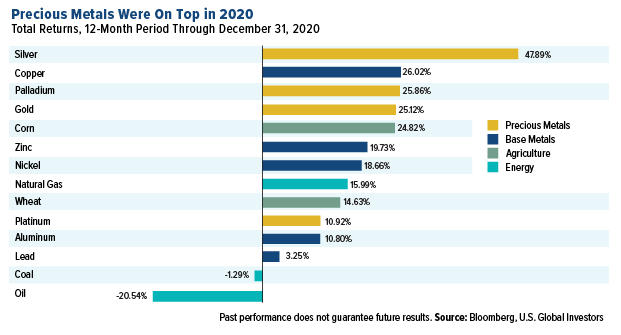

Treasured metals did properly total. Silver stood as the highest performing commodity, up almost 48%, its finest 12 months since 2010, when it rose over 80%. The white steel benefited not solely from haven demand, fueled by unprecedented money-printing, however industrial demand as properly. Amongst different purposes, silver is a essential part of photovoltaic (PV) cells, that are present in photo voltaic panels.

Copper costs had been up in 2020 for very a lot the identical motive. The world’s transition to renewable vitality and electrical automobiles is driving international demand for the extremely conductible steel.

Up 26% for the 12 months, copper is poised to be a prime performer in 2021 as properly. China has traditionally been the world’s largest importer of the steel, however now that its financial system has largely recovered from the pandemic, the nation has been shopping for it at a document clip. However China is not alone. Based on analysis agency Wooden Mackenzie, 2021 is anticipated to be a record-breaker for renewable auctions in Europe.

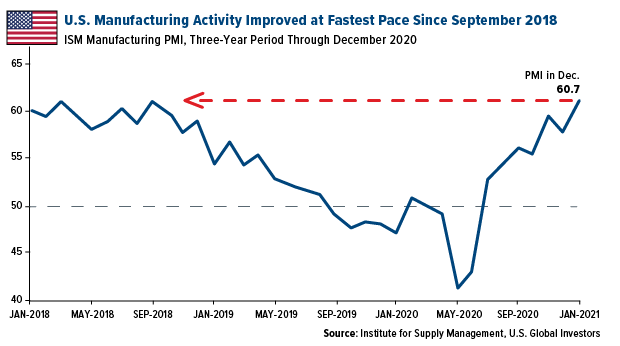

Copper and different industrial metals also needs to get help from the strengthening manufacturing sector within the U.S. The ISM Manufacturing PMI registered 60.7 final month, marking its highest stage since September 2018. December was additionally the eighth straight month that the gauge of producing exercise held above 50.0. All six of the largest manufacturing industries expanded, together with fabricated steel merchandise.

Our favourite copper inventory stays Ivanhoe Mines, which is my prime decide for 2021. The corporate is within the means of constructing three mine improvement tasks in Southern Africa. Amongst them is the world-class Kamoa-Kakula high-grade copper challenge, which is just six months away from scheduled preliminary manufacturing, in line with an organization presentation from final month.

Conventional Vitality Below Strain… A Shopping for Alternative?

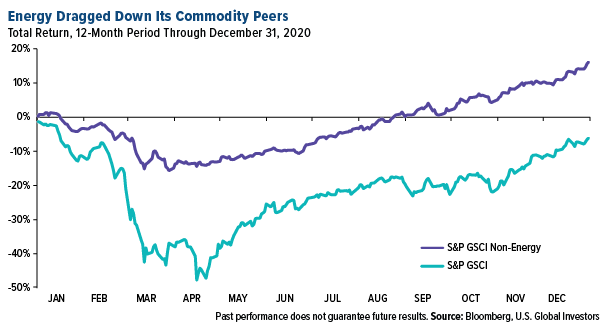

Vitality was the worst performing S&P 500 sector of the 12 months by far. The S&P 500 Vitality Index ended the 12 months down greater than 37%, adopted by the Actual Property Index, down 5%.

The S&P Goldman Sachs Commodity Index (GSCI) couldn’t fairly get well its 2020 pandemic losses by the top of the 12 months, falling some 6%. If you happen to take vitality out, although, the index of commodities ended up greater than 16%.

It’s nonetheless early, I feel, however we might see a robust shopping for alternative in oil and fuel shares. This may require the vaccine to turn into obtainable to a better share of the inhabitants, permitting for companies to stay open and journey to return to regular. To hurry up the method, Biden mentioned on Friday that he would launch almost the entire stockpiled vaccine doses upon taking workplace as an alternative of rolling them out in phases.

Final week the U.Ok. locked down its financial system for the third time for the reason that pandemic started, as a result of emergence of a brand new, extra contagious variant of the virus. The mutated pressure has been discovered within the U.S., together with in California, Colorado, Florida, New York and Texas.

Bitcoin at $40,000

In different information, Bitcoin continues to hit new document highs. Final week it smashed by way of $40,000, doubling its worth in as little as 23 buying and selling days. That was sufficient to push the mixed market cap of the cryptocurrency universe above $1 trillion for the primary time, in line with CoinMarketCap knowledge.

As I mentioned not too long ago, this rally is totally different from the one in late 2017. This time it’s being pushed by high-net price people and institutional traders—hedge funds, pension funds, endowments and extra. The identical drivers of upper gold costs—money-printing, expectations of stronger inflation—additionally seem like supporting Bitcoin.

Early final week, JPMorgan mentioned that Bitcoin might climb to $146,000 over the long run if traders began buying and selling it like digital gold.

Don’t overlook concerning the Periodic Desk of Commodity Returns 2020! Obtain a replica of your individual by clicking right here.

Initially revealed by U.S. Funds, 1/11/21

Some hyperlinks above could also be directed to third-party web sites. U.S. International Buyers doesn’t endorse all info provided by these web sites and isn’t answerable for their content material. All opinions expressed and knowledge supplied are topic to vary with out discover. A few of these opinions might not be applicable to each investor.

The S&P 500 Inventory Index is a well known capitalization-weighted index of 500 widespread inventory costs in U.S. corporations. The S&P GSCI serves as a benchmark for funding within the commodity markets and as a measure of commodity efficiency over time. The S&P GSCI Non-Vitality Index offers traders publicity to all commodities not included within the Vitality sub-index. The S&P 500 Vitality includes these corporations included within the S&P 500 which are categorized as members of the GICS vitality sector. The S&P 500 Actual Property includes these corporations included within the S&P 500 which are categorized as members of the GICS Actual Property sector. The ISM manufacturing index, often known as the buying managers’ index (PMI), is a month-to-month indicator of U.S. financial exercise primarily based on a survey of buying managers at greater than 300 manufacturing corporations. It’s thought-about to be a key indicator of the state of the U.S. financial system.

Holdings might change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Buyers as of 12/31/2020): Ivanhoe Mines Ltd.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.