Getting additional yield within the present market panorama requires buyers to tackle extra danger. One possibility is to move for abroad markets with ETFs just like the Vanguard Worldwide Dividend Appreciation Index Fund ETF Shares (VIGI).

possibility for mounted earnings buyers the place max yields domestically may not be obtainable.

“With rates of interest within the U.S. and different major developed economies nonetheless at comparatively low ranges, many buyers trying to diversify their portfolios internationally search the additional benefit of upper dividend yields obtainable overseas,” an Investopedia article defined. “There are a selection of exchange-traded funds (ETFs) obtainable within the class of worldwide fairness funds that supply dividend yields in extra of 5%.”

As such, VIGI seeks to trace the efficiency of Nasdaq Worldwide Dividend Achievers Choose Index that measures the funding return of non-U.S. firms which have a historical past of accelerating dividends. The index focuses on high-quality firms situated in developed and rising markets, excluding the U.S., which have each the power and the dedication to develop their dividends over time.

Moreover, the supervisor makes an attempt to copy the goal index by investing all, or considerably all, of its property within the broadly diversified assortment of securities that make up the index, holding every inventory in roughly the identical proportion as its weighting within the index. VIGI additionally comes with a low expense ratio of 0.20%.

VIGI:

- Seeks to trace the efficiency of the NASDAQ Worldwide Dividend Achievers Choose Index.

- Supplies a handy strategy to get publicity throughout developed and rising non-U.S. fairness securities all over the world which have a historical past of accelerating dividends

- Employs a passively managed, full-replication technique.

Worldwide Debt Diversification

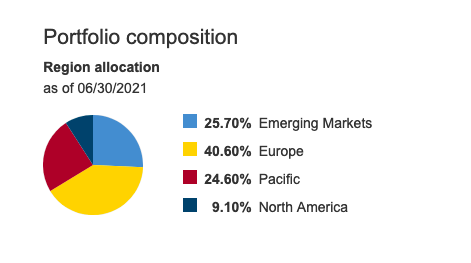

Whereas VIGI does give mounted earnings buyers North American publicity, it solely includes round 9% of the fund. The remainder of the publicity focuses totally on European, Pacific, and rising debt markets.

Total, it provides broad worldwide publicity to dividends which have excessive development potential.

“Worldwide dividend ETFs work very similar to their home excessive dividend counterparts; they merely spend money on worldwide firms as an alternative of these based mostly within the U.S.,” a Forbes article defined. “This sort of worldwide publicity can additional diversify your portfolio.”

For extra information, info, and technique, go to the Mounted Earnings Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.