By Michael W Arone, CFA, State Road World Advisors

“Ain’t nothin’ gonna break my stride

No person gonna gradual me down, oh no

I obtained to maintain on movin’”

— Break My Stride, tune lyrics by Matthew Wilder, 1983

All through summer time traders have been inoculated in opposition to numerous probably infectious market illnesses — the Delta variant surge, China’s regulatory crackdown throughout quite a lot of home industries, D.C. dysfunction, Federal Reserve taper discuss, the US withdrawal from Afghanistan, world climate disasters, plummeting shopper confidence and an financial progress scare. Maybe traders have already acquired their booster photographs, fueling their emotions of invincibility in opposition to believable market dangers. Regardless of all of the doable doom and gloom eventualities, markets are at all-time highs1 and valuations stay above their long-term averages.2 So, what’s the engine that retains shares climbing that proverbial wall of fear to succeed in new heights? Merely, it’s excellent company earnings outcomes.

Come on Really feel the Noise

Traders have quieted one noisy distraction after one other this summer time and that furry listing of dangers hasn’t moved markets as a result of revenues, earnings progress and revenue margins have been phenomenal. And, it hasn’t been simply the newest quarter (Q2’21) — it’s been the previous 5 quarters relationship again to final yr (Q2’20). In line with FactSet, S&P 500 firms on common over the previous 5 quarters (Q2’20–Q2’21) are reporting earnings which can be 19.3% above analysts’ expectations — an earnings shock proportion notably above the 5-year common of seven.8%.

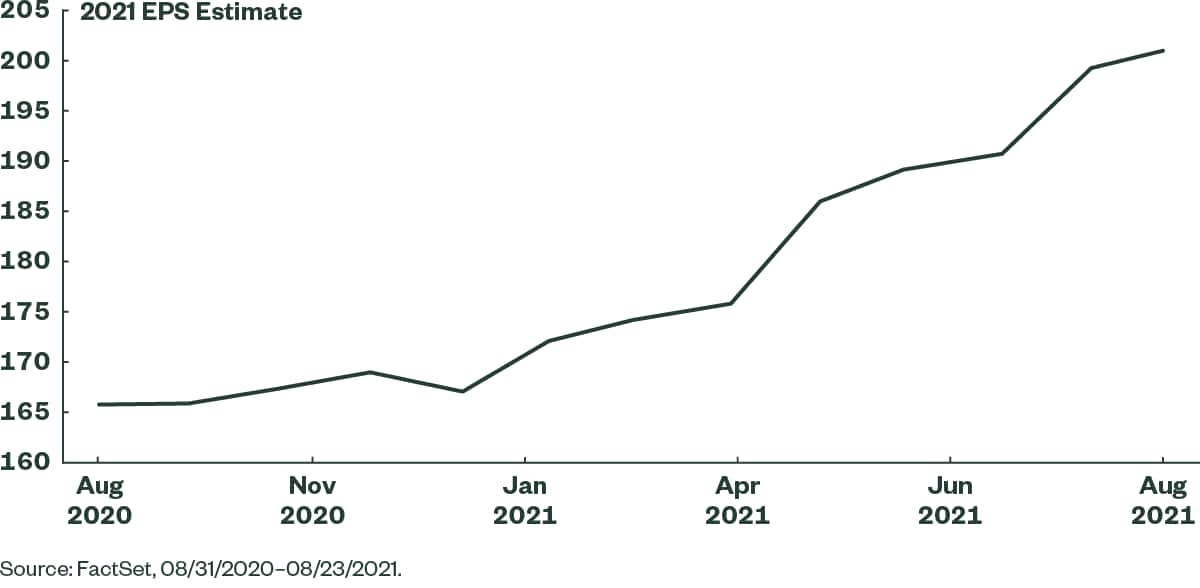

S&P 500 CY 2021 EPS Estimate — Calendar Yr Development

If, as most analysts count on, the second quarter represents the post-pandemic peak in income, earnings and revenue margin progress charges, a minimum of the quarter can have gone out with a bang! In line with FactSet, as of August 13, 87% of S&P 500 firms reported each income and earnings surprises for the second quarter. This marks the best proportion of S&P 500 firms reporting revenues above estimates (87%) and the best income shock proportion (4.9%) for 1 / 4 since FactSet started monitoring these metrics in 2008. Amazingly, firms have been capable of beat income expectations even if analysts stored elevating the bar. For instance, on March 31, the estimated income progress price for the S&P 500 for Q2’21 was 16.6%. By June 30, it was 19.4%. At this time, the year-over-year income progress price for the second quarter of 24.9% marks the best reported determine by the S&P 500 Index since FactSet started monitoring this metric in 2008.

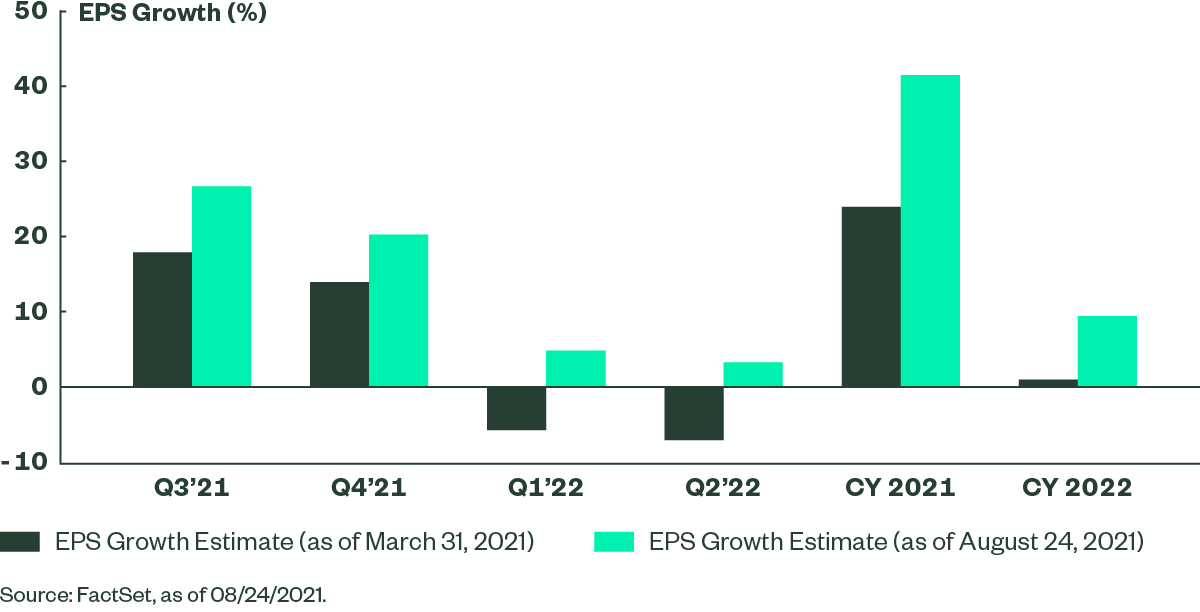

S&P 500 EPS Progress Estimates

The year-over-year earnings progress price for the S&P 500 for the second quarter is a whopping 89%, the best reported determine because the fourth quarter of 2009. The unusually excessive progress price is because of greater earnings in Q2’21 and a better year-over-year comparability to decrease Q2’20 earnings as the results of COVID-19’s detrimental impression on quite a lot of industries. All eleven sectors reported year-over-year earnings progress, led by the power, industrials, financials, shopper discretionary, and supplies sectors.

The S&P 500’s second quarter web revenue margin of 13% — above each the 5-year common of 10.6% and the earlier quarter’s document 12.8% and the best since FactSet started monitoring this metric in 2008 — is the most important shock of the earnings season. With provide chain challenges and rising inflation making headlines all yr, traders have broadly anticipated greater prices to finally slash companies revenue margins. Nevertheless, all eleven sectors are reporting a year-over-year enhance of their web revenue margins, led by the financials, industrials and supplies sectors. Thus far, in mixture, provide chain disruptions and better enter prices haven’t minimize S&P 500 firms’ revenue margins.

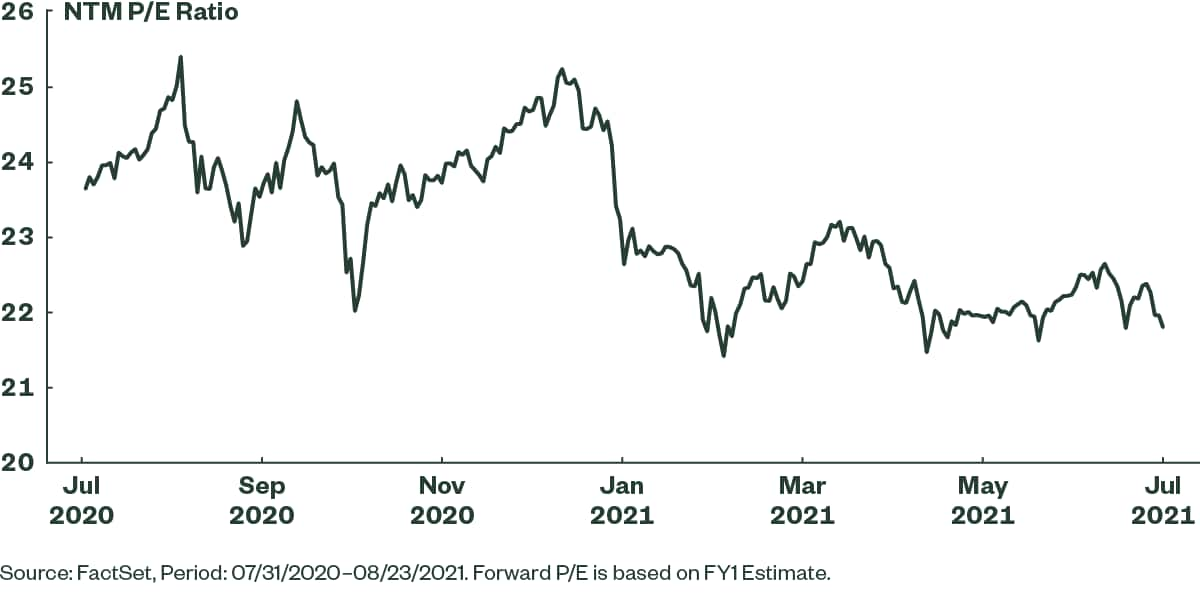

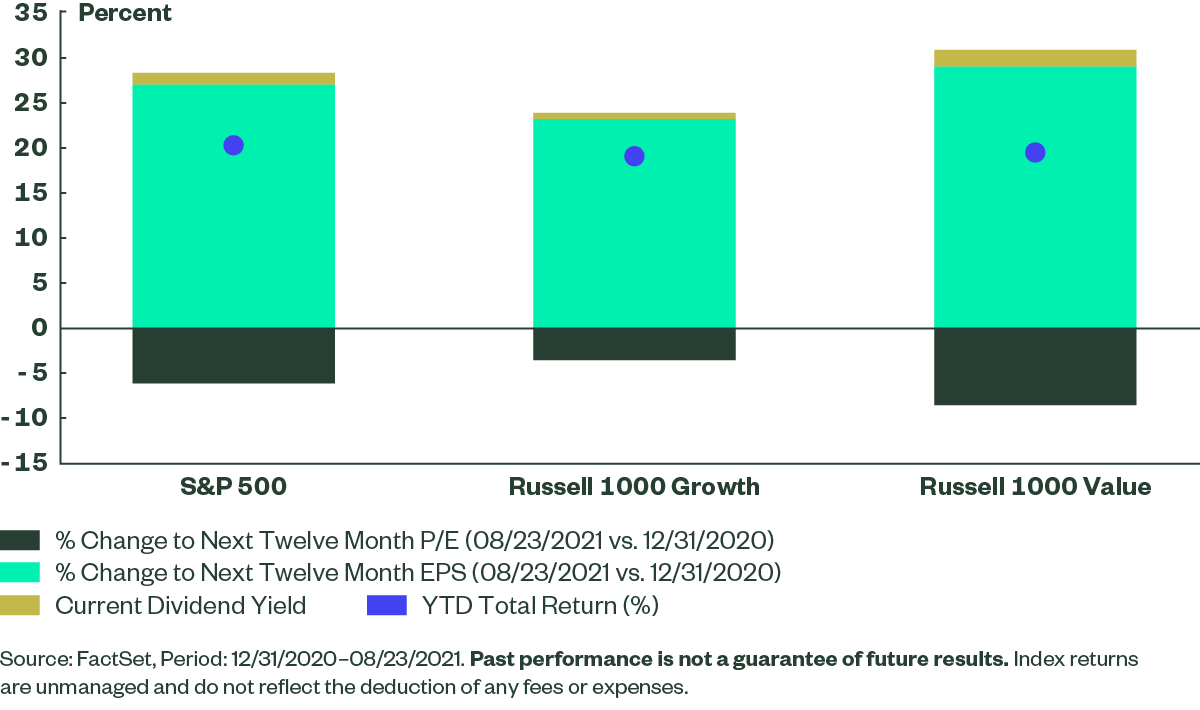

Lastly, there’s one other unusual twist to all these magnificent company earnings outcomes. Whereas the market rally continues, inventory costs have struggled to maintain tempo with surging earnings forecasts. In consequence, ahead price-to-earnings multiples have been declining, falling from 23.2 final August to 20.6 right now. Cheaper price-to-earnings multiples give traders false confidence that valuations have gotten extra engaging and that inventory costs will catch as much as earnings progress. This underscores how earnings have been the overwhelming driver of big inventory value positive aspects through the previous yr.

S&P 500 Ahead P/E Ratio

Don’t Let it Finish

Sarcastically, if stellar earnings outcomes are certainly the first purpose markets preserve setting all-time highs, it simply could be that future earnings outcomes are the market’s greatest threat.

Income and earnings surprises have been so large over the previous 5 quarters as a result of analysts have persistently underestimated each because the center of final yr. And as analysts have continued to extend their estimates to account for this unanticipated progress, declining ahead price-to-earnings multiples have inspired traders to look previous stretched valuations and to imagine that company earnings will at all times simply beat expectations.

Nevertheless, that’s not sometimes the way it works. Originally of every yr, analysts’ earnings estimates are usually far too rosy and are progressively lowered all year long, permitting firms to modestly beat expectations. And it’s beginning to appear like this outdated sample could also be making a comeback. At the same time as traders are busy celebrating this yr’s astonishing earnings outcomes, analysts have begun to sharpen their forecasts for 2022 earnings. Just some weeks in the past, analysts have been forecasting 11.4% earnings progress for S&P 500 firms subsequent yr. Nevertheless, that determine was lately slashed to 9.1% — nonetheless wholesome, however subsequent yr’s precise earnings progress price could be nearer to five%. Will that be sufficient to fulfill traders given the massive returns of the previous two years, markets at all-time highs and lofty valuations?

YTD Returns Pushed by Sturdy Progress in EPS Expectations

After 5 consecutive quarters of eye-popping earnings numbers which have enabled traders to disregard a wide range of market dangers, the long run could deliver a wake-up name just like the one a number of tech giants lately delivered. Though these firms solidly beat income and earnings estimates for the second quarter, shares have been pummeled when the businesses lowered steering.3 Merely suggesting that future income and earnings progress charges might be much less spectacular despatched shares reeling. If this investor response spreads to different financial sectors, the market rally might be in for a tough patch.

Footnotes

1 FactSet, Interval: 01/03/1928–07/31/2021. S&P 500 used to symbolize the general market.

2 FactSet, Interval: 09/29/2006–07/31/2021. S&P 500 used to symbolize the general market.

3 Ben Levisohn, “Shares Are Sturdier Than Massive Tech’s Tumble Suggests,” Barron’s, July 21, 2021.

Glossary

Earnings per share (EPS): A determine describing a public firm’s revenue per excellent share of inventory, calculated on a quarterly or annual foundation.

S&P 500 Index: A inventory market index monitoring the efficiency of 500 massive firms listed on inventory exchanges in the US. It is among the mostly adopted fairness indices.

Initially printed by State Road on August 30, 2021.

Disclosures

The returns on a portfolio of securities which exclude firms that don’t meet the portfolio’s specified ESG standards could path the returns on a portfolio of securities which embody such firms. A portfolio’s ESG standards could outcome within the portfolio investing in trade sectors or securities which underperform the market as an entire.

Investing includes threat together with the danger of lack of principal.

The entire or any a part of this work might not be reproduced, copied or transmitted or any of its contents disclosed to 3rd events with out State Road World Advisors’ specific written consent.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com