While 2020 has been a yr for many to neglect, it has been one to recollect for environmental, socia

While 2020 has been a yr for many to neglect, it has been one to recollect for environmental, social and governance (ESG) investing. The ESG area was highlighted by sustainable fund belongings reaching the $1.2 trillion mark within the third quarter.

“Belongings in sustainable mutual funds and exchange-traded funds globally hit a file $1.2 trillion within the third quarter, up 19% from the second quarter, in response to Morningstar. Within the U.S., belongings in sustainable funds jumped to $179 billion, up 12.5% from $159 billion on the finish of June,” a Barron’s article famous. “Web inflows globally jumped 14% within the third quarter to just about $81 billion, Morningstar stated. The U.S. accounted for 12% of the flows, and Europe 77%.”

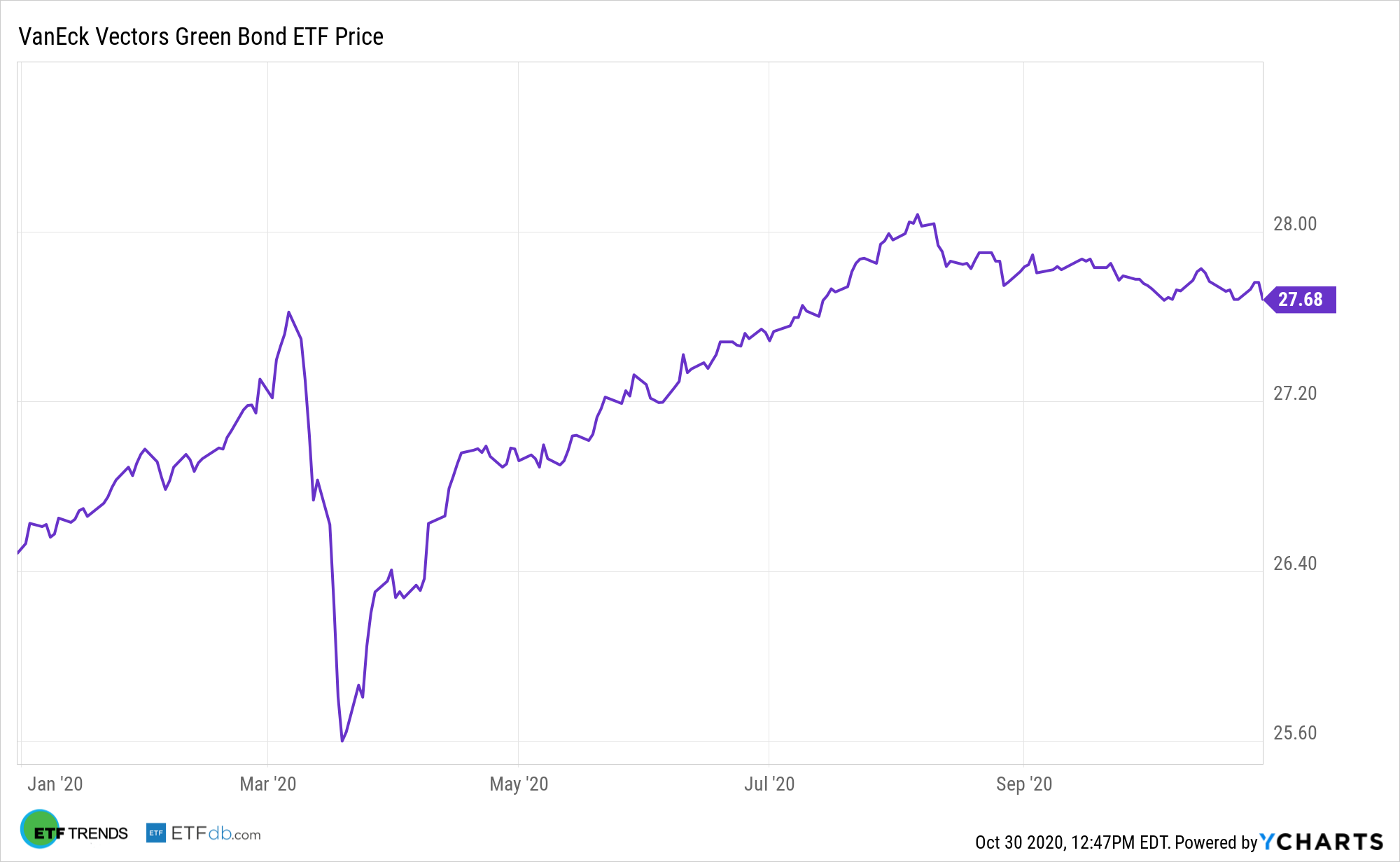

ETF buyers can get this inexperienced publicity by way of equities, but additionally bonds. The bond market was sturdy through the peak of the pandemic and with assist from the Federal Reserve, however for buyers who need the very best of each bond and ESG worlds, there’s the VanEck Vectors Inexperienced Bond ETF (GRNB).

GRNB seeks to duplicate as carefully as attainable, earlier than charges and bills, the worth and yield efficiency of the S&P Inexperienced Bond U.S. Greenback Choose Index (the “index”). The fund usually invests at the very least 80% of its complete belongings in securities that comprise the fund’s benchmark index. The index is comprised of bonds issued for certified “inexperienced” functions and seeks to measure the efficiency of U.S. greenback denominated “inexperienced”-labeled bonds issued globally.

GRNB provides buyers:

- Entry bonds issued to finance initiatives which have a constructive affect on the surroundings

- An ESG answer for a core bond portfolio

- Index consists of solely U.S. dollar-denominated bonds designated as “inexperienced” by the Local weather Bonds Initiative

Shifting in direction of equities, different funds to have a look at embrace the FlexShares STOXX US ESG Affect Index Fund (CBOE: ESG). Buyers who need ESG publicity and international diversification can look to the FlexShares STOXX World ESG Affect Index Fund (CBOE: ESGG).

For extra information and data, go to the Tactical Allocation Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.