By Matt Wagner, CFA, Affiliate, Analysis

Final August, Warren Buffett’s Berkshire Hathaway made a stunning funding in 5 Japanese common buying and selling corporations, often called “sogo shosha.”

For a corporation the scale of Berkshire Hathaway, with almost $900 billion in belongings, the $6 billion funding was comparatively modest.

Maybe as a result of the quantity is only a rounding error for Berkshire, the funding garnered little public consideration. There was preliminary optimism from some—like one article from the Monetary Instances titled “Why Warren Buffett may lead different cash managers into missed Japan”—however that focus has waned.

And fairness flows from worldwide cash managers actually haven’t adopted Buffett’s lead. Whereas there’s been a pickup in current weeks, the cumulative ¥1.Four trillion (about $13 bn) pales compared to the almost ¥16 trillion in investments made in 2013, the final yr of serious international investor flows into Japan.

Cumulative International Web Fairness Funding (¥ bn)

_updated.png)

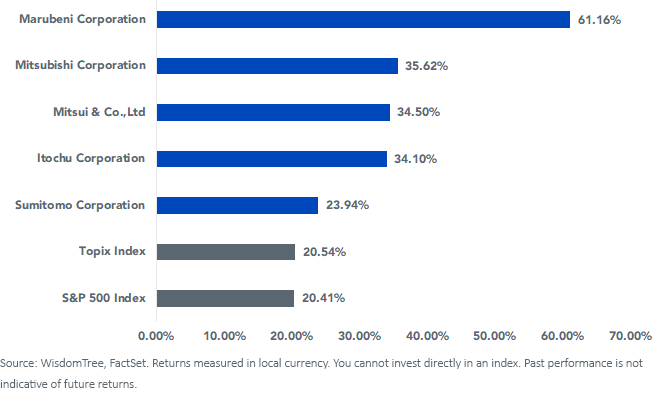

Beneath the radar, these investments have carried out spectacularly. The typical return on these investments has been almost 38% since they have been made public—nicely above the broad Japanese benchmark, the Topix, and the S&P 500.

Whole Return, 8/28/20–4/30/21

Rising Circumstances and Sluggish Vaccine Rollout

As we famous in a current publish, Japanese equities have had a powerful stretch of efficiency because the finish of August. Whereas this outperformance has largely been pushed by its tilts to extra economically delicate sectors like Financials, Industrials and Shopper Discretionary, the federal government’s strong fiscal and financial response has additionally been a tailwind.

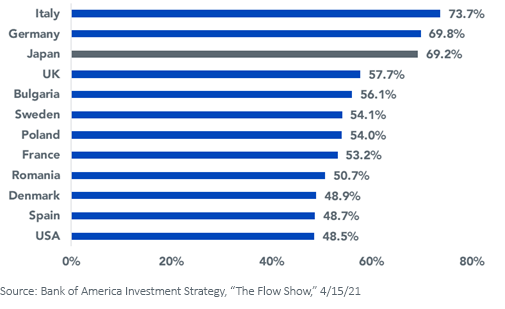

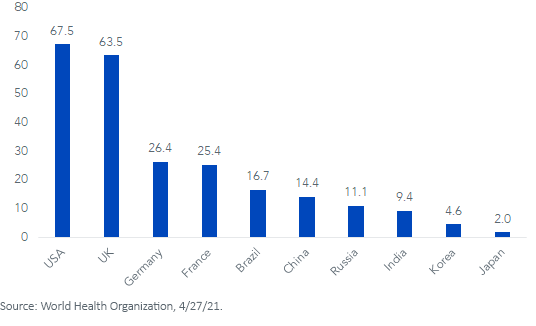

Mixed Fiscal and Financial Response as % of GDP

However prior to now few weeks, the Japanese inventory market’s reflection of optimism for a world financial rebound has met challenges.

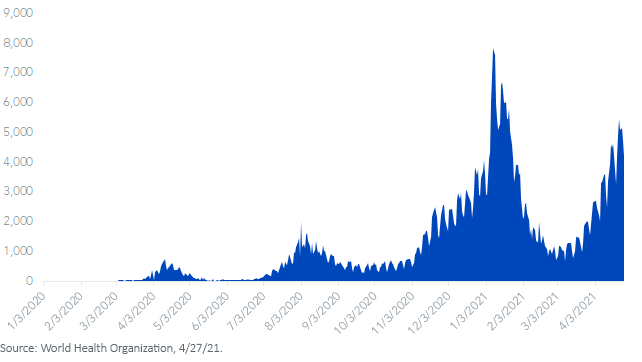

The nation’s largest cities once more entered lockdown phases to regulate the unfold of the coronavirus. This was finished to forestall a fast unfold of the virus in the course of the “Golden Week” vacation from April 29 to Might 5.

Japan Every day New Circumstances of COVID-19

The virus is taking maintain whereas the federal government has been among the many slowest on this planet to roll out vaccinations.

Cumulative Vaccination Doses Administered per 100 Folks

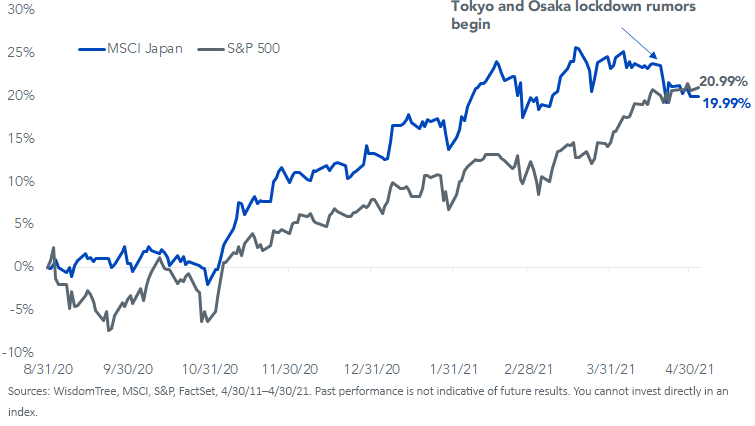

The double whammy of rising instances and a sluggish vaccination marketing campaign have mixed to pump the brakes on the current outperformance of Japanese equities.

Index Cumulative Whole Returns

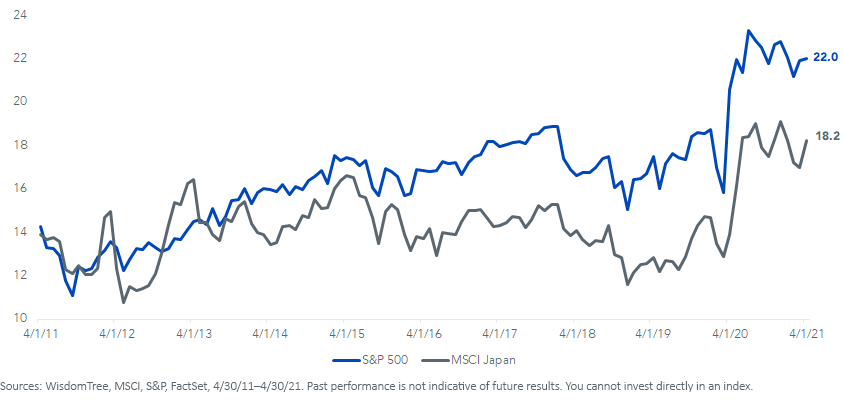

If the previous yr has taught traders something, it’s that present tendencies in virus case counts may be wildly disconnected from inventory market efficiency. For traders apprehensive about low ahead returns from excessive valuations in U.S. markets, Japanese valuations proceed to current enticing relative reductions.

Index Ahead Value-to-Earnings

Whereas valuations inform us little concerning the prospects of relative efficiency over the subsequent six-to-12 months, they have a tendency to matter tremendously over time horizons of five-to-10 years.

And Japan’s current challenges on the virus entrance—which all of us hope swiftly reverse—have created alternative for traders. As Warren Buffet is famously quoted as saying: “Be fearful when others are grasping and grasping when others are fearful.”

Whereas there are any variety of markets to level to on this planet right this moment that look downright grasping, Japanese equities have signaled at the least a contact of worry.

Initially printed by WisdomTree, 5/5/21

Japan Securities Dangers:

There are dangers which can be concerned when investing in Japanese securities. Japanese financial system has solely not too long ago emerged from a chronic financial downturn. Financial development is closely depending on worldwide commerce, authorities assist of the monetary companies sector and different troubled sectors, and constant authorities coverage supporting its export market. Slowdowns within the economies of key buying and selling companions similar to the US, China and/or international locations in Southeast Asia, together with financial, political or social instability in such international locations, may even have a adverse impression on the Japanese financial system as a complete. Foreign money fluctuations may adversely impression the Japanese financial system and its export market. As well as, Japan’s labor market is adapting to an growing old workforce, declining inhabitants, and demand for elevated labor mobility. These demographic shifts and elementary structural adjustments to the labor market might negatively impression Japan’s financial competitiveness.

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which comprises funding goals, dangers, expenses, bills, and different info; learn and take into account fastidiously earlier than investing.

There are dangers concerned with investing, together with doable lack of principal. International investing entails foreign money, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations might expertise higher value volatility. Investments in rising markets, foreign money, mounted revenue and different investments embrace extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency just isn’t indicative of future outcomes. This materials comprises the opinions of the writer, that are topic to vary, and will to not be thought of or interpreted as a advice to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There isn’t a assure that any methods mentioned will work below all market circumstances. This materials represents an evaluation of the market atmosphere at a selected time and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation relating to any safety particularly. The consumer of this info assumes the whole threat of any use fabricated from the knowledge supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Buyers in search of tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially signify the views of WisdomTree or any of its associates.

The MSCI info might solely be used on your inner use, is probably not reproduced or re-disseminated in any kind and is probably not used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a advice to make (or chorus from making) any form of funding resolution and is probably not relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the consumer of this info assumes the whole threat of any use fabricated from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Social gathering have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or some other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can not make investments immediately in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.