By Paul Wong, CFA, Market Strategist, Sprott

By Paul Wong, CFA, Market Strategist, Sprott

Gold bullion[1] is down 8.66% YTD by February 28, 2020, however is up 9.36% YOY. Gold mining equities[3] have fallen 16.78% YTD however have elevated 11.37% YOY. Silver[2] and platinum[19] are the valuable metals standouts for the latest interval, up 1.01% and 11.28% YTD, and 60.02% and 37.71% YOY, respectively. This compares to 1.72% YTD and 31.29% YOY returns for the S&P 500 TR Index.[6]

Month of February 2021

| Indicator | 2/28/2021 | 1/31/2021 | Change | Mo % Chg | YTD % Chg | Evaluation |

| Gold Bullion[1] | $1,734.04 | $1,847.65 | ($113.61) | (6.15)% | (8.66)% | The worst month since 2016 as actual charges rise |

| Silver Bullion[2] | $26.67 | $26.99 | ($0.32) | (1.18)% | 1.01% | Silver persevering with to carry agency |

| Gold Senior Equities (SOLGMCFT Index)[3] | 113.05 | 128.61 | (15.56) | (12.10)% | (16.78)% | Gold equities again to summer season breakout |

| Gold Equities (GDX)[4] | $31.13 | $34.51 | ($3.38) | (9.79)% | (13.58)% | (Similar as above) |

| DXY US Greenback Index[5] | 90.88 | 90.58 | 0.30 | 0.33% | 1.05% | Nonetheless close to the lows |

| S&P 500 Index[6] | 3,811.15 | 3,714.24 | 96.90 | 2.61% | 1.47% | Again to 50 every day transferring common |

| U.S. Treasury Index | $2,488.92 | $2,534.92 | ($46.00) | (1.81)% | (2.75)% | Bond supply of danger and volatility |

| U.S. Treasury 10 YR Yield | 1.40% | 1.07% | 0.34 | 31.85% | 53.84% | Sharp sell-off, touching 1.60% |

| U.S. Treasury 10 YR Actual Yield | (0.75)% | (1.04)% | 0.29 | 28.11% | 31.68% | Again up pushed by nominal yields |

| Silver ETFs (Complete Recognized Holdings ETSITOTL Index Bloomberg) | 964.38 | 939.62 | 24.76 | 2.64% | 8.65% | Silver sustaining accumulation |

| Gold ETFs (Complete Recognized Holdings ETFGTOTL Index Bloomberg) | 104.18 | 106.85 | (2.67) | (2.50)% | (2.41)% | 4 outflow months in a roll |

Gold Blues as Silver Woos

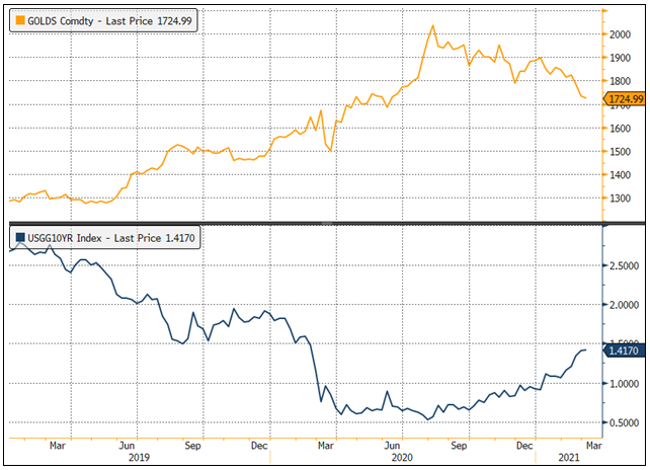

February was a troublesome month for gold, which marked its worst month-to-month efficiency since November 2016. Spot gold fell $114/oz, or 6.15%, to shut the month at $1,734/oz. Half of this decline got here within the two ultimate days of February, as bond promoting spiked into close to panic mode and triggered a multi-asset sell-off into month-end. Determine 1 exhibits how gold has been inversely correlated to bond yields.

February’s pullback occurred on the again of varied developments. Rising power costs and the markets’ view on U.S. authorities spending bolstered the reflation commerce with a rally in broader fairness markets. The U.S. greenback strengthened as markets priced in a swift financial restoration and as U.S. Treasury yields superior to the best stage in a 12 months, with the 30-year bond rising above 2% and the speedy transfer within the 10-year to over 1.5%, which we are going to focus on in additional element. In the meantime, gold ETFs noticed holdings decline in the direction of the top of February. Silver costs held up significantly better as markets sought out bodily possession and acknowledged silver’s undervalued financial deserves. Gold shares had been drawn down in a unstable trend with the gold worth transfer. Valuable metallic equities adopted bodily metals’ efficiency, with silver associated shares outperforming gold shares.

February Ends with a Full Blown Tantrum

For the previous a number of years, Federal Reserve (Fed) insurance policies have pushed yields frequently decrease, and consequently, most asset lessons now have embedded period results. For gold, this period impact is in the actual yield. The sudden backup in actual rates of interest was shockingly fast ― almost 40 foundation factors in six buying and selling periods. The rise in actual yields was pushed nearly completely by the rise in nominal charges on the again of time period premiums (expectations) backing up. There’s simply no escaping the pervasive results and penalties of central financial institution insurance policies in any asset class.

Since August 2020, the U.S. 10-year Treasury nominal yield has been rising, which the Fed has considered as benign and as an indication of higher development, as rising breakeven yields led it.[7] Simply in case, the Fed would reiterate that it was not even serious about elevating charges, and with its new AIT (common inflation concentrating on) coverage, that it could be a very long time earlier than the Fed would elevate rates of interest even within the face of rising inflation. However as soon as 10-year U.S. Treasury yields rose above 1.20%, the bond market started to sell-off and closed out February with a full-blown “taper tantrum.”[8]

Determine 1. Gold’s Decline Tracks Rise in 10-Yr U.S. Treasury Yields

Supply: Bloomberg. Knowledge as of three/1/2021. Gold is measured by the Bloomberg GOLDS Comdty Index. 10-Yr Treasuries are measured by the Bloomberg USGG10YR Index.

The Reflation Narrative Continues to Develop

Since early January, the reflation narrative has continued to construct, igniting a rising bear steepener commerce (buyers demanding larger yields in longer-dated bonds to offset the chance of development and inflation). By the final week of February, tail hedgers had switched from bear steepeners to bear flatteners (yields rising within the curve’s center or stomach). Additionally, new quick positions had been established in three-year Eurodollar futures (greens).[9] These two trades signaled that the Fed would want to tighten (elevate charges) manner forward of its acknowledged schedule. Moreover, this tightening could be by the use of tapering QE (quantitative easing), which might affect the stomach of the U.S. Treasury curve essentially the most (the bear flattener commerce). When CTAs[10] flipped to bearish (mechanical promoting), this compounded the promoting strain. The ultimate catalyst was the failure of final Thursday’s (February 25) 7-year U.S. Treasury notice public sale. Traders confirmed tepid demand for the $62 billion value of notes, with the bid-to-cover ratio at simply 2.04, the bottom within the public sale’s historical past. In response, the U.S. 10-year Treasury yield exploded larger to achieve 1.6085% however reversed sharply to shut at 1.40% for the month, probably a climactic promoting spike.

Gold was not spared by February’s correction, however long-term traits stay in place for our bullish gold view.

Not misplaced in the marketplace was that three-year Treasury yields rose essentially the most final Thursday (2/25/2021) , climbing 9 foundation factors. Fed coverage ought to have stored this a part of the yield curve nailed to the ground, and the Fed’s failure to take action introduced into query its creditability. Not serving to was the Fed’s silence into the month-end taper tantrum promoting panic. If the bond market stays unstable within the close to time period, we’d anticipate some Fed jawboning. If that weren’t sufficient, then the subsequent step could be WAM (weighted common maturity) extension and presumably a change in QE composition. Presently, the Fed is shopping for $80 billion in Treasuries and $40 billion in mortgage-backed securities every month. The Fed can shift in the direction of extra Treasury purchases. The Fed also can convey up the YCC (yield curve management) debate once more and wave that on the market. However the greater query is: Have we reached the purpose the place U.S. 10-year Treasury yields at just one.50% and 10-year actual yields at -0.75% are a risk to the bond market’s stability? Or is instability as a result of charges transferring too quick, too shortly?

Wanting on the flipside excessive, what would occur if the Fed decides (or had been pressured) to extend WAM, QE and herald some type of YCC? This could probably imply limitless liquidity for equities, low yields throughout the curve to finance all fiscal packages and company bond spreads would cut much more. It might even be the final nail within the coffin for worth discovery. Markets would soar till the burden of unsustainability causes a scientific market crash that wipes out the vast majority of wealth — this is without doubt one of the excessive right-tail danger occasions we highlighted in our November commentary, Gold Exams $1,800 Help.

Bullish View on Gold Stays Intact

Though we’re upset by gold’s latest worth weak point, we acknowledge that market flows, positioning and momentum can dominate worth motion within the close to time period in right this moment’s market surroundings. The final week of February was an uncomfortable replay of the 2013 Taper Tantrum in a condensed type. Two situations are probably going ahead. One is that the Fed will taper, and yields will rise. The second is that the Fed stays the course.

The Fed taper situation is a complete non-starter. This is why. If the Fed had been to actually taper, actual yields would rise dramatically. Determine 2 highlights the connection between the S&P 500 ahead P/E multiples[11] and the 10-year actual yield over the previous 5 years (the R-squared is 73%).12 Not solely would P/E multiples collapse, however earnings expectations would see headwinds as larger yields chew into the earnings outlook. Rising actual yields would strengthen the U.S. greenback (USD), additional tightening monetary situations. On this situation, the inventory market would probably enter a bear market given present dot-com-level valuations. With out the present excessive QE stage, additional fiscal enlargement packages would come to a halt, and GDP (gross home product) development expectations would hit the wall. Beneath this taper outlook (principally, the Fed now not offering full assist), one would cut back publicity in equities, bonds, commodities, gold and all the pieces else. The corollary argument is that development is now so sturdy and established (regardless of being within the early levels of the post-COVID restoration) and is now impervious to any taper motion. This could go towards all the notion and objective of AIT (common inflation concentrating on). Regardless of the latest tantrum, the Fed absolutely controls the world’s reserve forex’s printing press (USD). The Fed is the boot, and bond vigilantes stay the ant (bear in mind The Avengers from 2012?). All tantrums will come to an finish, together with this one.

Determine 2. S&P 500 Ahead P/E Multiples and 10-Yr Actual Yield Relationship

Supply: Bloomberg. Knowledge as of two/28/2021.

Rising Volatility Advantages Gold

By staying the course, the market’s important danger could be inflation, which is what the Fed is making an attempt to engineer, and why the bond market is in a tantrum. It isn’t shocking that the bond market reacted on this method; it’s now the first supply of market danger and volatility. Staying the course will imply persevering with large fiscal stimulus resulting in ever-expanding M2 cash provide[13] and persevering with deep destructive actual yields and a weak USD. The yield curve has already steepened and can probably climb larger within the face of such fiscal spending. Determine Three highlights the connection between the 2s10s Treasury yield curve,[14] the MOVE Index (implied bond volatility)[15] and the VIX Index.[16] Traditionally, the yield curve is one of the best predictor of the MOVE Index path. For a number of years, the MOVE Index had been comparatively constrained by Fed coverage, which has now come to an finish. An untethered MOVE Index will improve cross-asset class volatility (MOVE and VIX usually transfer collectively).

Rising volatility in all asset lessons will place a better demand for efficient hedges and diversification. Our 2021 High 10 Watch Record commentary highlighted all these factors (M2 development, actual yields, USD and market volatility) and their relationship to gold. The long-term traits stay in place for a bullish gold view.

Determine 3. 2s10s Treasury Yield Curve, MOVE Index and VIX Index

Supply: Bloomberg. Knowledge as of two/28/2021.

Fed Steering will Influence Quick-Time period Worth Motion of Gold

Because the summer season peak, we had been in search of gold to keep up the assist stage at $1,800 or “stickiness” round $1,800. That stage would have been a high-level assist worth much like what silver is experiencing. The $1,800 stage gave manner within the ultimate two days of February and has fallen to the primary Fibonacci retracement, or assist, at $1,725 and continues to be above the trendline from the 2018 lows (Determine 4). The gold worth can also be sitting in a cluster of assist, marked by the blue dashed traces. The higher blue sprint line marked the resistance stage earlier than the August melt-up to the height.

Regardless of the gyrations, gold stays in a bullish pattern however is now testing essential medium-term assist ranges. The relative energy index (RSI)[17] is at excessive oversold ranges in keeping with prior tradeable lows (backside panel, crimson circles). The motion in yields and Fed steerage will probably decide the short-term worth motion of gold bullion. There are many technical indicators displaying yields have reached a short-term climactic blow-off motion. Longer-term, the likelihood of an early Fed taper appears unlikely, however gold has discounted a few of this already.

Determine 4. Gold Bullion Testing First Fibonacci Help and Trendline

Supply: Bloomberg. Knowledge as of two/28/2021.

Extra Bother with Bonds, Asset Allocation View

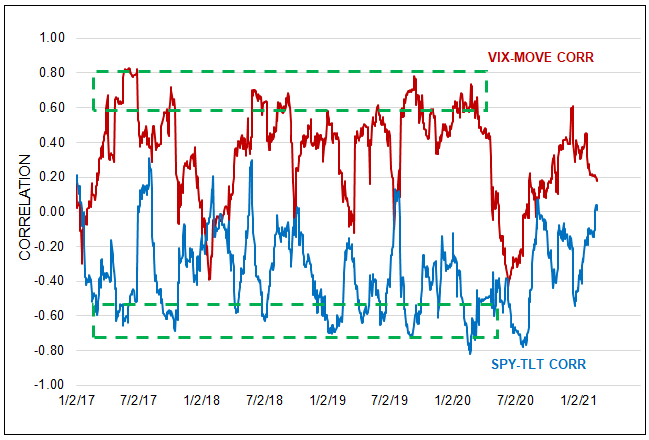

For many years, bond yields have been in some of the extended secular declines in historical past. In latest a long time, when a monetary stress occasion or calamity occurred, central banks shortly lower rates of interest. When it comes to the Fed’s response operate’s prime beneficiary, it has been constantly bonds. Put up the GFC (world monetary disaster), bonds had morphed to develop into more and more negatively correlated to equities and had develop into one of the best hedge in a multi-asset portfolio. However with ZIRP (zero rate of interest coverage), the power of bonds to behave as a hedge is probably going gone until the Fed is keen to go destructive on yields. Bonds will nonetheless work as a diversifier, however the distinction between a hedge and a diversifier is cavernous in any value-at-risk (VaR) based mostly situation.[18] Determine 5 highlights how terribly properly this hedge operate labored earlier than ZIRP. Ideally, the value correlation between belongings must be negatively correlated in a pronounced method.

Utilizing the SPDR S&P 500 ETF (SPY) because the fairness and the iShares 20+ Yr Treasury ETF (TLT) because the bond, from January 2017 up till the Fed going to a ZIRP in March 2020, there was a really marked destructive correlation sample between SPY and TLT (blue line). Maybe nearly as needed, the volatility of equities (VIX) and bonds (MOVE) must be extremely positively correlated in order that volatility occasions are aligned. The higher and decrease inexperienced dashed containers mark this extraordinary interval of hedge safety. Because the begin of ZIRP, the correlations of each SPY-TLT and VIX-MOVE have damaged, and it’s clear the hedge operate is gone. In consequence, we see extra asset lessons, reminiscent of gold, being added to multi-asset portfolios to extend general portfolio diversification with out an efficient hedge.

Determine 5. Worth and Volatility Correlation of Equities and Bonds (Rolling 30-Day Correlation)

Supply: Bloomberg. Knowledge as of two/28/2021.

Bitcoin: Take A Stroll on the Wild Aspect

Earlier than the end-of-month bond market tantrum, essentially the most extraordinary story in February was Bitcoin. Since autumn, Bitcoin has elevated fivefold based mostly on… we’re not totally certain precisely what, precisely. Sometimes when a safety rises fivefold to prime $1 trillion in market valuation, there are clear explanations. For Bitcoin, there are a number of, together with elevated adoption and institutional acceptance as a retailer of worth, a brand new forex, or as a brand new asset class. Nonetheless, Bitcoin has no outstanding worth basis apart from market individuals’ willingness to purchase it and plenty of it.

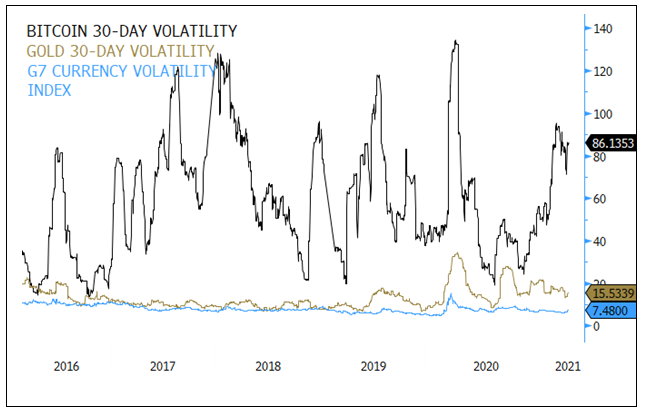

Bitcoin may very well be a useful addition to a valuable metals allocation however not in its place ― take one final take a look at that volatility.

The one unassailable statement, although, is that Bitcoin is unstable, very unstable. Determine 6 exhibits Bitcoin’s rolling 30-day realized volatility in comparison with gold and a G7 forex volatility index. Usually Bitcoin is in comparison with gold from the angle that each are in restricted provide, and each could be considered as a substitute forex. From a volatility perspective, they’re nothing alike. The five-year common of the 30-day realized volatility for Bitcoin (58.5%) is 4.Four occasions larger than gold bullion (13.2%) and seven.2 occasions larger than the G7 forex volatility index (8.1%). Although the five-year common could appear tempered, one take a look at the volatility chart in Determine 6, and the phrase “random stroll” involves thoughts.

Whereas the declare of a restricted provide of every particular person cryptocurrency coin is correct, there are not any limits to the variety of cryptocurrencies out there. Over 8,600 identified cryptocurrencies at the moment are in circulation eventually depend (and rising), with a market worth hitting over $1.7 trillion on the highs. For reference, the Fed states there may be $2.05 trillion in Federal Reserve Notes in circulation. The restricted provide or shortage issue holds for single cash however doesn’t maintain for cryptocurrencies in mixture. The choice forex (or retailer of worth) narrative can also be problematic for Bitcoin, given its excessive volatility. Bitcoin was down by greater than 20% in response to feedback by Elon Musk and Janet Yellen. Typically, most prudent buyers do not wish to see their different shops of worth drop greater than 20% in lower than two days as a result of two individuals stating obvious info, even when it might be up an outstanding 427% year-over-year. The long-term historical past of belongings going hyperbolic doesn’t all the time finish properly.

Are we destructive on cryptocurrencies? No, however we want to be clear and say they don’t seem to be the identical as gold. Not like a tangible asset, cryptos exist solely within the digital realm and, as such, can disappear if governments, for no matter cause, select to take action. However the pace of adoption and market worth of cryptocurrencies can’t be denied. Cryptocurrencies are right here to remain and can proceed to evolve. The extra that cryptocurrencies are adopted, the tougher it will likely be for governments to legislate them out of existence. The info historical past for Bitcoin is restricted relative to most different asset lessons. Nonetheless, apart from excessive volatility, Bitcoin has to this point demonstrated a comparatively low correlation to most asset lessons, making it viable as a diversifier in a multi-asset portfolio, relying on the allowed volatility. For many funds, that will imply a comparatively small allocation. Our early evaluation would point out that Bitcoin may very well be a useful addition to a valuable metals allocation however not in its place ― take one final take a look at that volatility.

Determine 6. Bitcoin vs. Gold, G7 Forex: 30-Day Volatility

Supply: Bloomberg. Knowledge as of two/28/2021.

Metals Miners: An Engaging Shopping for Alternative

printed

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Index. |

| 2 | Spot silver is measured by Bloomberg SILV Comdty Index. |

| 3 | The Solactive Gold Miners Customized Components Index (Index Ticker: SOLGMCFT) goals to trace the efficiency of larger-sized gold mining corporations whose shares are listed on Canadian and main U.S. exchanges. |

| 4 | VanEck Vectors® Gold Miners ETF (GDX®) seeks to copy as carefully as doable, earlier than charges and bills, the value and yield efficiency of the NYSE Arca Gold Miners Index (GDMNTR), which is meant to trace the general efficiency of corporations concerned within the gold mining business. The SPDR Gold Shares ETF (GLD) is without doubt one of the largest gold ETFs. |

| 5 | The U.S. Greenback Index (USDX, DXY, DX) is an index (or measure) of the worth of america greenback relative to a basket of foreign currency echange, sometimes called a basket of U.S. commerce companions’ currencies. |

| 6 | The S&P 500 or Customary & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded corporations. (TR signifies complete return and displays the reinvestment of any dividends). |

| 7 | The 10-year breakeven fee measures the distinction or hole between 10 12 months Treasury Bonds and Treasury Inflation Protected Securities (TIPS). Supply: Investopedia. |

| 8 | “Taper tantrum” refers back to the 2013 collective reactionary panic that triggered a spike in U.S. Treasury yields after buyers discovered that the Federal Reserve was slowly placing the breaks on its quantitative easing (QE) program. Supply: Investopedia. |

| 9 | A Eurodollar bundle consists of the simultaneous sale or buy of 1 every of a sequence of consecutive Eurodollar futures contracts. Eurodollars are typically color-coded to facilitate reference to particular person contract months or to packs and bundles, reminiscent of three-year Eurodollar futures (greens). |

| 10 | Commodity Buying and selling Advisors (CTAs) are quant funds or funding funds that choose securities utilizing superior quantitative evaluation. |

| 11 | The worth-to-earnings ratio (P/E ratio) compares an organization’s share worth to the earnings it generates per share. A variation on this calculation is called the ahead P/E. Traders or analysts might use projected earnings per share, that means the earnings anticipated to be generated per share over the subsequent 12 months. |

| 12 | R-squared values are generally acknowledged as percentages from 0% to 100%. An R-squared of 100% signifies that all actions of a safety (or one other dependent variable) are fully defined by actions within the index, or the impartial variable(s) you have an interest in. Supply Investopedia. |

| 13 | M2 is a measure of the cash provide that features money, checking deposits and simply convertible close to cash. M2 is a broader measure of the cash provide than M1, together with money and checking deposits. Supply: Investopedia. |

| 14 | The 2s10s unfold is without doubt one of the most-watched financial indicators, and it merely represents the distinction between the 10-year and the 2-year U.S. Treasury yields. |

| 15 | The MOVE Index calculates the longer term volatility in U.S. Treasury yields implied by present costs of choices on Treasuries of varied maturities. |

| 16 | The Volatility Index, or VIX, is a real-time market index representing the market’s expectation of 30-day forward-looking volatility. Derived from the value inputs of the S&P 500 index choices, it gives a measure of market danger and buyers’ sentiments. |

| 17 | The relative energy index (RSI) is a momentum indicator utilized in technical evaluation that measures the magnitude of latest worth modifications to judge overbought or oversold situations within the worth of a inventory or different asset |

| 18 | Worth at Threat (VaR) calculates the utmost loss anticipated (or worst case situation) on an funding over a given time interval and given a specified diploma of confidence. |

| 19 | Spot platinum is measured by Bloomberg PLAT Comdty Index |

Essential Disclosure

Previous efficiency is not any assure of future outcomes. You can not make investments instantly in an index. Investments, commentary and statements are distinctive and will not be reflective of investments and commentary in different methods managed by Sprott Asset Administration USA, Inc., Sprott Asset Administration LP, Sprott Inc., or every other Sprott entity or affiliate. Opinions expressed on this commentary are these of the presenter and will fluctuate extensively from opinions of different Sprott affiliated Portfolio Managers or funding professionals.

This content material will not be reproduced in any type, or referred to in every other publication, with out acknowledgment that it was produced by Sprott Asset Administration LP and a reference to sprott.com. The opinions, estimates and projections (“data”) contained inside this content material are solely these of Sprott Asset Administration LP (“SAM LP”) and are topic to alter with out discover. SAM LP makes each effort to make sure that the data has been derived from sources believed to be dependable and correct. Nonetheless, SAM LP assumes no duty for any losses or damages, whether or not direct or oblique, which come up out of the usage of this data. SAM LP is just not beneath any obligation to replace or preserve present the data contained herein. The knowledge shouldn’t be regarded by recipients as an alternative choice to the train of their very own judgment. Please contact your personal private advisor in your explicit circumstances. Views expressed relating to a selected firm, safety, business or market sector shouldn’t be thought-about a sign of buying and selling intent of any funding funds managed by Sprott Asset Administration LP. These views are to not be thought-about as funding recommendation nor ought to they be thought-about a suggestion to purchase or promote. SAM LP and/or its associates might collectively beneficially personal/management 1% or extra of any class of the fairness securities of the issuers talked about on this report. SAM LP and/or its associates might maintain quick place in any class of the fairness securities of the issuers talked about on this report. Throughout the previous 12 months, SAM LP and/or its associates might have acquired remuneration apart from regular course funding advisory or commerce execution providers from the issuers talked about on this report.

SAM LP is the funding supervisor to the Sprott Bodily Bullion Trusts (the “Trusts”). Essential details about the Trusts, together with the funding targets and techniques, buy choices, relevant administration charges, and bills, is contained within the prospectus. Please learn the doc fastidiously earlier than investing. Funding funds will not be assured, their values change incessantly and previous efficiency will not be repeated. This communication doesn’t represent a proposal to promote or solicitation to buy securities of the Trusts.

The dangers related to investing in a Belief depend upon the securities and belongings during which the Belief invests, based mostly upon the Belief’s explicit targets. There is no such thing as a assurance that any Belief will obtain its funding goal, and its internet asset worth, yield and funding return will fluctuate now and again with market situations. There is no such thing as a assure that the total quantity of your authentic funding in a Belief will likely be returned to you. The Trusts will not be insured by the Canada Deposit Insurance coverage Company or every other authorities deposit insurer. Please learn a Belief’s prospectus earlier than investing.

The knowledge contained herein doesn’t represent a proposal or solicitation to anybody in america or in every other jurisdiction during which such a proposal or solicitation is just not approved or to any individual to whom it’s illegal to make such a proposal or solicitation. Potential buyers who will not be resident in Canada or america ought to contact their monetary advisor to find out whether or not securities of the Funds could also be lawfully bought of their jurisdiction.

The knowledge offered is normal in nature and is supplied with the understanding that it will not be relied upon as, nor thought-about to be, the rendering or tax, authorized, accounting or skilled recommendation. Readers ought to seek the advice of with their very own accountants and/or legal professionals for recommendation on the particular circumstances earlier than taking any motion.

© 2021 Sprott Inc. All rights reserved.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.