Growth is important when investing for dividends, which means traders ought to consider corporations with sturdy steadiness sheets and the flexibility to develop payouts.

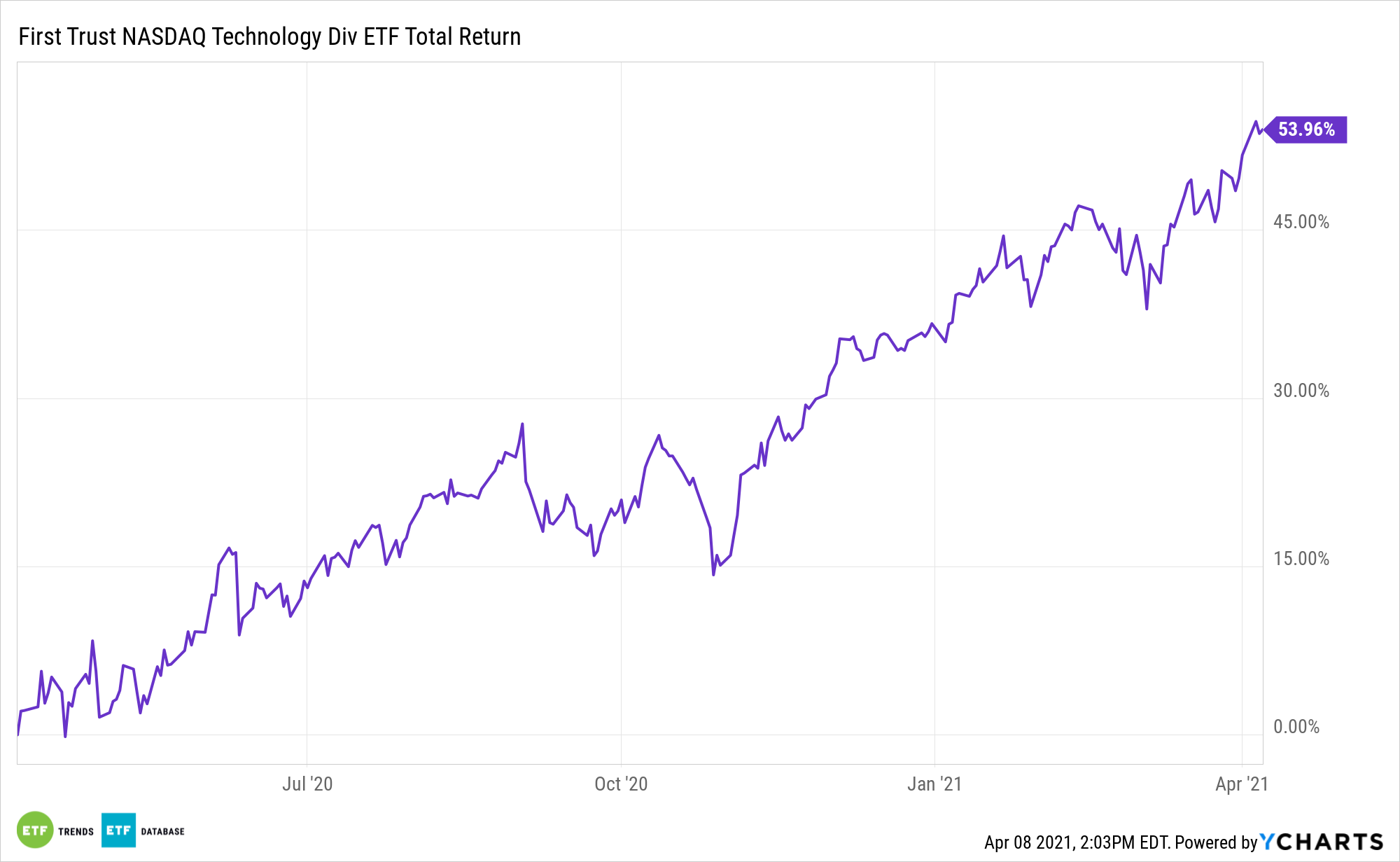

Know-how checks these containers. Enter the First Belief NASDAQ Know-how Dividend Index Fund (NasdaqGS: TDIV). TDIV tracks the NASDAQ Know-how Dividend Index.

TDIV screens for expertise names which have paid an everyday or frequent dividend throughout the previous 12 months, have a yield of not less than 0.5%, and haven’t had a lower in frequent dividends per share paid throughout the previous 12 months.

With dividend progress choosing up throughout the board, TDIV might be a standout for dividend traders.

“Within the first quarter of 2021, corporations have been 14 occasions extra more likely to have positively raised or initiated a dividend than negatively minimize or suspended dividend funds. This was almost triple the ratio from a yr earlier,” notes CFRA Analysis’s Todd Rosenbluth, head of ETF & mutual fund analysis. “Dividend will increase have been frequent throughout the Data Know-how sector, and firms corresponding to Analog Gadgets (ADI) and Utilized Supplies (AMAT) are among the many corporations that can additional enhance money funds, in accordance with CFRA.”

Time to Speak TDIV?

TDIV takes a number of the volatility out of the tech sector whereas offering greater ranges of revenue than what are normally related to this sector.

“The S&P 500 dividend yield on the finish of March 2021 was 1.5%, according to a yr earlier however down from 1.9% two years earlier,” added Rosenbluth. “All through this era, Data Know-how shares sported beneath common yields on common, with the current 1.0% yield down from 1.3% two years earlier. But on the finish of the primary quarter of 2021, 59% of Data Know-how shares within the S&P 500 paid a dividend. Whereas that is decrease than 76% for the broader index, the share was greater than the 49% for the guy growth-oriented Shopper Discretionary sector.”

Whereas yields are low throughout many sectors, together with tech, TDIV is related for revenue traders as a result of it’s house to a gaggle of corporations with massive money stockpiles that may maintain and develop payouts.

For years, expertise was the not first sector traders considered once they considered dividends. The most important sector weight within the S&P 500 is altering that. In reality, in greenback phrases, expertise is now the biggest dividend-paying sector in the US.

For extra information, data, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.