In a spectacular two weeks for

In a spectacular two weeks for crypto belongings, Tesla and Elon Musk have utterly flipped the main focus from digital currencies to carbon emissions. As Bitcoin skilled a decline of over 40% from its excessive on April 15th to Could 21st, a extra clear and controlled various funding alternative has stood out in stark distinction: carbon allowances.

On Could 12th, Tesla and its founder introduced they’d not settle for bitcoin as fee for his or her autos, citing the large quantities of power required to retailer and mine digital belongings and the detrimental results that the ensuing carbon emissions are having on the local weather. Digital belongings, which have been already on shaky floor after Musk’s Could 8th SNL look, plummeted. Musk adopted up on Could 13th, tweeting “It’s excessive time there was a carbon tax!” including extra gasoline to the hearth.

In truth, there’s already a coverage device at work decreasing emissions: carbon credit. Moreover, Tesla is already one of the vital high-profile merchants of carbon credit. In Q1 of 2021 alone, Tesla generated $518 million in income by promoting carbon credit to different automotive producers by the Zero Emission Automobile (ZEV)* carbon allowance program[1] after producing $1.65 billion in 2020.[2] ZEV is a distinct segment carbon allowance market particularly for automotive producers and is smaller than the broader total California Carbon Allowance program. Carbon allowances have been one of many key drivers of Tesla’s profitability. Nonetheless, till just lately, carbon allowance markets weren’t broadly accessible to conventional buyers.

Carbon allowances, cap and commerce, or Emission Buying and selling Techniques (ETS) have been growing globally for the previous 15 years. These applications put a cap on the quantity of carbon emissions allowed in a area, in one-ton increments, after which enable the credit to be traded amongst polluters and non-polluters. These allowances are required to be submitted alongside data of the corporate’s emissions to the related regulator annually. Over-emitting leads to giant fines. The ETS then tapers the public sale of recent allowances, thereby decreasing the cap on emissions. This enables for a free-market worth to develop and for companies to seek out alternate, greener types of manufacturing. The ensuing rise within the worth of carbon might finally scale back emissions according to aggressive international targets.

Regardless of each being profitable investments for Tesla, crypto belongings and carbon allowances couldn’t be extra totally different. In contrast to cryptocurrency, carbon allowances:

- are extremely regulated and managed by regulatory authorities.

- have a clearly outlined utility and tangible pricing dynamics.

- act to scale back carbon emissions as their costs rise

- could be accessed by a 1940 Act regulated ETF (KRBN)

- might characterize a long-term purchase and maintain alternative

Maybe the one similarity is the structurally designed finite and decreasing provide dynamics, which characterize potential tailwinds for each belongings. Carbon allowances could possibly be thought of an environmentally pleasant antithesis of cryptocurrency and certainly characterize a clear alternative for buyers because the world units more and more stringent carbon emission targets.

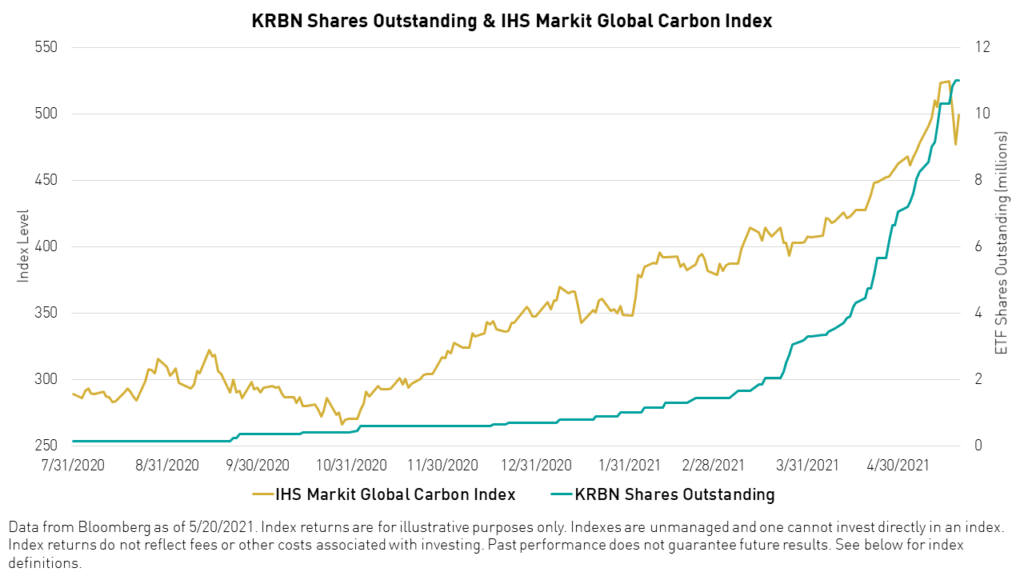

There is just one ETF providing entry to the worldwide carbon allowance market: the KraneShares World Carbon ETF (Ticker: KRBN)**. It holds positions within the three largest international applications and can dynamically add new markets as they attain scale. KRBN was launched on the New York Inventory Trade throughout Local weather Week 2020 as a standard 1940 Act ETF and has already amassed $400 million in belongings and trades at $20 million in common every day quantity.[3]

Efficiency has been sturdy too. For the reason that Fund’s inception final 12 months and as of Could 20, 2021, KRBN’s index (the IHS Markit World Carbon Index) has returned 76.38% and 39.36% year-to-date. The market additionally reveals low correlations to all different asset courses, even commodities. The correlation to US equities is beneath 0.4.[3]

KRBN represents a worldwide basket of the three largest most liquid carbon allowances markets, the European Union Allowance (EUA), California Carbon Allowance (CCA) and the Regional Greenhouse Gases Initiative (RGGI, North Jap US). Emissions have been falling in these areas as carbon allowance costs have risen. At the moment, the blended worth of those credit is $35,[4] although even throughout the basket the costs differ because the applications are separate and non-fungible (to not be confused with Non-Fungible Tokens!). EUAs at the moment commerce round $65, whereas California and RGGI commerce at $18 and $9 respectively.[5] IHS Markit and the World Financial institution forecast that these have to rise towards and past $100 for international emission targets, outlined within the Paris Settlement, to be met.

Given the increasing scope and breadth of world carbon markets, the forecast worth trajectory, and the diversification*** advantages, KRBN could possibly be seen as a long-term funding.

Initially revealed by KraneShares, 5/27/21

*ZEVs should not at the moment a part of the IHS World Carbon Index

**Options can be found through various kinds of securities or funding choices.

***Diversification doesn’t guarantee a revenue or assure towards a loss.

Citations

- Kharpal, Arjun. “What ‘regulatory credit’ are – and why they’re so essential to Tesla,” CNBC. Could 18, 2021.

- Isidore, Chris. “Tesla’s soiled little secret: Its web revenue doesn’t come from promoting automobiles,” CNN Enterprise. February 1, 2021.

- Knowledge from Bloomberg as of March 31. 2021. Month-to-month correlation from July 31, 2014 to March 31, 2021.

- Knowledge from IHS Markit as of March 31, 2021

- Knowledge from EMBER, Regional Greenhouse Gasoline Initiative (RGGI), and California Air Assets Board as of Could, 2021.

Index Definitions

IHS Markit World Carbon Index: The worldwide carbon index is the primary benchmarking and liquid investable index to trace the carbon credit market globally. The IHS Markit World Carbon Index tracks probably the most liquid section of the tradable carbon credit futures markets. Constituents of the World Carbon Index embody futures contracts on European Union Allowances (EUA), California Carbon Allowances (CCA), and the Regional Greenhouse Gasoline Initiative (RGGI), with pricing information from OPIS by IHS Markit Pricing (North American Pricing) and ICE Futures Pricing (European Pricing).

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.