Dividends are an under-consider

Dividends are an under-considered technique to hedge in opposition to inflation, one that may work as properly and even higher than basic strategies akin to cyclical shares, gold, or TIPS, writes Callie Cox, a senior funding strategist at Ally Make investments, in a observe to shoppers.

”Irrespective of the place you look, it’s vital to prioritize money circulation over development potential when inflation is surging. Brief-term payouts may very well aid you maximize long-term development,” she mentioned.

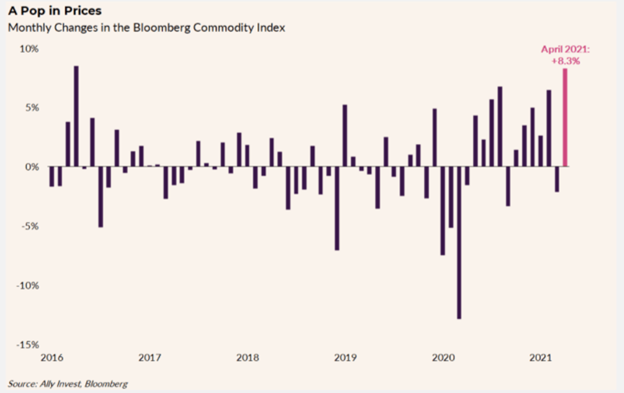

The Fed has beforehand expressed perception that the present elevated ranges of inflation are momentary, however modified their tune after final Wednesday’s assembly. What’s extra, the info retains pointing to rising costs and an ongoing inflationary surroundings. For instance, copper costs have seen file highs, and staples akin to corn and low have elevated 20% since April:

Dividend-paying shares (and dividend ETFs) may seem counterintuitive in an inflationary surroundings, but when inflation erodes funding worth over time, then the earnings acquired now displays the worth of the second.

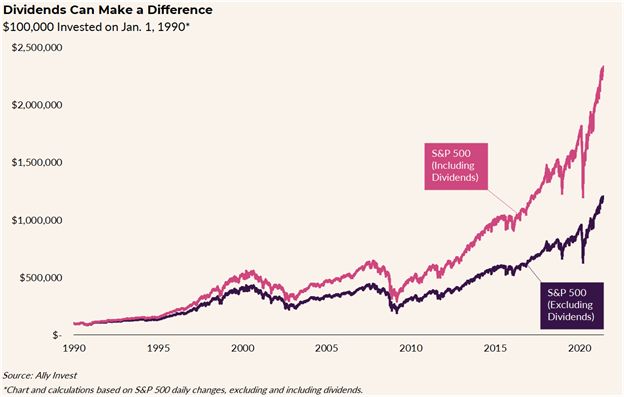

As Cox says: “Whereas dividend payers often aren’t the trendiest corporations – bathroom paper makers, meals distributors and energy corporations – their payouts may assist get money again in your pocket sooner (at a presumably larger current worth). And for those who re-invest that dividend fee, you might be able to supercharge your portfolio’s development over time.”

The Inventory Market Maintains Worth Even When the Greenback Doesn’t

Cox factors out that “the worth of a greenback could fall over time, however the inventory market has traditionally finished the other.”

The S&P 500 index has grown a median of 8% a yr since 1990. Compared, the core CPI has grown a median of two% over the identical interval.

“Inventory market development has traditionally overwhelmed inflation, and that’s why investing is so important for constructing wealth,” added Cox.

Excessive yielding fairness ETFs, such because the Columbia Analysis Enhanced Worth ETF (REVS) or QRAFT AI-Enhanced U.S. Massive Cap Momentum ETF (AMOM), can get earnings in pockets now, and that earnings might be reinvested again into the market, the place its worth will proceed to develop even when the worth of the greenback continues to shrink.

In actual fact, about 76% of the shares within the S&P 500 Index paid a daily dividend, writes Cox, including that many have grown their dividends considerably. Final quarter, S&P corporations boosted their dividend by $20 billion, the most important improve in 9 years.

Whether or not inflation is momentary or not, dividends can profit your portfolio, continues Cox.

“Let the maths work in your favor: Take into consideration how the time worth of cash can influence your investments, and be ready to take benefit if the market slides on an inflation scare.”

For extra information, data, and technique, go to the Dividend Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.