Millions of Individuals, it appears, fe

Millions of Individuals, it appears, felt that the time was proper to commerce of their clunkers for a brand new set of wheels.

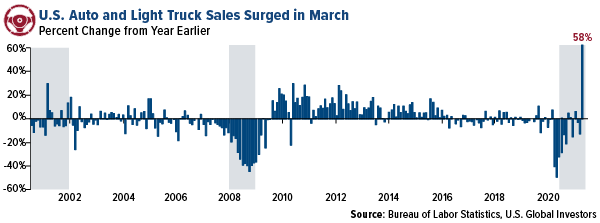

Gross sales of automobiles and light-weight vehicles surged an unbelievable 58% in March in comparison with final 12 months, in keeping with Bureau of Labor Statistics information. Some 1.6 million autos have been pushed off automotive tons through the month, representing over 18 million on a seasonally-adjusted annual fee (SAAR).

click on to enlarge

There might be a number of the explanation why automotive gross sales skyrocketed final month, the obvious being that pandemic restrictions are progressively being lifted. A contemporary infusion of stimulus cash additionally didn’t harm.

However then there’s the matter of value. Because of the world semiconductor chip scarcity, which has quickly halted manufacturing at some North American auto crops, the worth of used autos is up an eye-watering 26% from final 12 months, in keeping with the Manheim Used Car Worth Index. Borrowing prices are additionally on the rise, prompting customers to behave quick.

Final month, I suggested readers to purchase a brand new automotive now in the event that they have been available in the market for one, and it appears to be like as if many Individuals have been of the identical thoughts. I count on costs to climb much more earlier than they begin to plateau.

Luxurious Carmakers Set New Gross sales Data

Trying globally, I used to be stunned to see simply how nicely the luxurious car market carried out within the first quarter. Daimler-owned Mercedes-Benz bought over 78,000 automobiles and vehicles through the interval, a 16% improve from final 12 months. Toyota’s Lexus model took the quantity two spot when it comes to gross sales, shifting 74,000 models for the quarter.

Tesla introduced that it delivered a document 185,000 autos within the three-month interval, nicely over double the quantity within the first quarter of 2020. The electrical car (EV) producer, which reported its first worthwhile 12 months in 2020, is the heaviest weighted inventory within the benchmark S&P World Luxurious Index.

Rolls-Royce Motor Vehicles additionally reported a brand new gross sales document in its 116-year historical past. The superluxury British carmaker, totally owned by Bayerische Motoren Werke (BMW), delivered 1,380 autos, up 62% from the identical interval in 2020 and exceeding the earlier quarterly document set in 2019. Amongst its bestsellers have been the Cullinan, an almost three-ton SUV that begins at $335,000, and its new Ghost mannequin, which has an identical price ticket.

PMIs at Highest Ranges in Many years

All of that is optimistic financial information that tells me we’re greater than able to put the pandemic within the rearview mirror. For the primary time since this all began a 12 months in the past, mMore than a million folks per day have been flying industrial within the U.S. for 30 straight days, the longest streak since this began a 12 months in the past. Much more passengers are anticipated within the coming days and weeks as larger than one in 5 Individuals are actually totally vaccinated in opposition to COVID-19. Eating places and diners throughout America are reportedly struggling to seek out staff quick sufficient to fulfill demand.

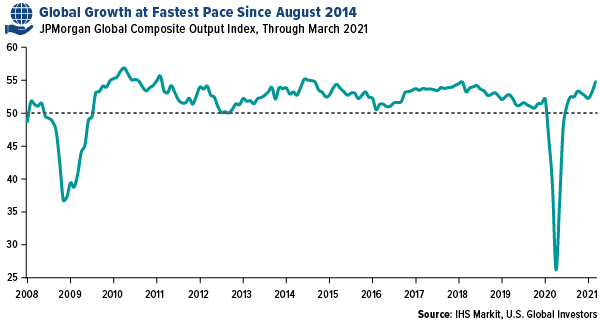

Certainly, in a report final week, LPL Monetary wrote that we have been getting into the “finest enterprise situations of the 21st century.” Each the ISM Manufacturing and Companies PMIs hit their highest ranges in many years on accelerating vaccine distribution and unprecedented fiscal stimulus.

The JPMorgan World Composite PMI, in the meantime, rose to a 79-month excessive of 54.eight in March, one in all its finest readings of the previous decade. U.S. leads the enlargement, with progress not solely at its quickest tempo since August 2014 but additionally operating near an all-time U.S. survey excessive. Trying simply at manufacturing, of the 29 international locations which can be tracked, solely three—Myanmar, Thailand and Malaysia—have been beneath the 50.zero threshold.

click on to enlarge

This growth may run nicely into 2023, Jamie Dimon stated final week. In his annual letter to shareholders, the JPMorgan chief wrote that he sees the U.S. financial system getting into a “Goldilocks second,” buttressed by “extra financial savings, new stimulus financial savings, enormous deficit spending, extra QE, a brand new potential infrastructure invoice, a profitable vaccine and euphoria across the finish of the pandemic.” With the S&P 500 having returned an unbelievable 54% year-over-year on the finish of March, markets “might very nicely be pricing in not solely a booming financial system but additionally the technical issue that a number of the surplus liquidity will discover its manner into shares,” Dimon stated.

In different phrases, the bulls are solidly in cost for the foreseeable future. I count on to see one other quarter of inventory outperformance relative to bonds, although the debt selloff might not be as pronounced on this second quarter because it was within the first.

Gold Miner Debt Close to Document Low

So the place does that depart gold?

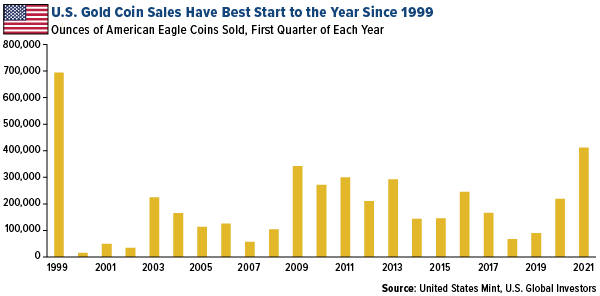

The yellow metallic is off to its worst begin in years, having fallen greater than 10% through the first quarter as traders largely shunned secure haven investments in favor of threat property.

This has created an unbelievable shopping for alternative that different savvy traders have jumped at. The U.S. Mint reported that gross sales of American Eagle gold cash climbed to 412,000 ounces within the first three months of 2021, its finest quarter since 1999. Australia’s Perth Mint additionally had a exceptional quarter, with gross sales in February up 441% year-to-year.

click on to enlarge

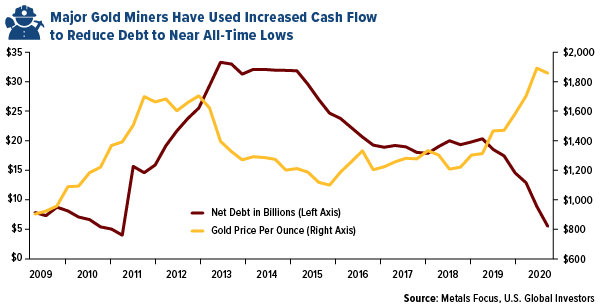

On the finish of final month, I shared with you that gold producers had their most worthwhile 12 months ever in 2020, based mostly on the common all-in sustaining value (AISC) margin. For each ounce of the metallic produced final 12 months, miners pocketed a document $828 on common.

Now we all know what they’ve been doing with their elevated money circulation. Based on a latest report by Metals Focus, gold miners have been paying down their debt, which presently stands at a collective $5.5 billion, the bottom degree since 2011 and close to all-time lows. Two miners in Metals Focus’s peer group are actually internet money optimistic, the dear metals consultancy says.

click on to enlarge

Like bodily gold, inventory within the producers appears to be like like a purchase to me. The entire firms within the peer group are paying common dividends, and with debt discount close to completion, we might be seeing some mergers and acquisitions (M&As) within the sector quickly.

Initially revealed by US Funds, 4/12/21

All opinions expressed and information supplied are topic to vary with out discover. A few of these opinions might not be applicable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. World Traders doesn’t endorse all data provided by this/these web site(s) and isn’t answerable for its/their content material. Beta is a measure of the volatility, or systematic threat, of a safety or portfolio compared to the market as an entire.

The S&P World Luxurious Index is comprised of 80 of the biggest publicly-traded firms engaged within the manufacturing or distribution of luxurious items or the supply of luxurious providers that meet particular investibility necessities. The S&P 500 Inventory Index is a widely known capitalization-weighted index of 500 widespread inventory costs in U.S. firms. The Manheim Used Car Worth Index is a measurement of used car costs that’s unbiased of underlying shifts within the traits of autos being bought. Statistical evaluation is utilized to its database of greater than 5 million used car transactions yearly. The Buying Supervisor’s Index is an indicator of the financial well being of the manufacturing sector. The PMI index relies on 5 main indicators: new orders, stock ranges, manufacturing, provider deliveries and the employment surroundings. A seasonally adjusted annual fee (SAAR) is a fee adjustment used for financial or enterprise information, resembling gross sales numbers or employment figures, that makes an attempt to take away differences due to the season within the information.

Holdings might change each day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. World Traders as of (3/31/2020): Daimler AG, Tesla Inc., Bayerische Motoren Werke AG.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.