As was extensively anticipated, main banks handed the Federal Reserve’s latest stress checks, setting the stage for the central financial institution to log out on dividend will increase and the resumption of share repurchase applications.

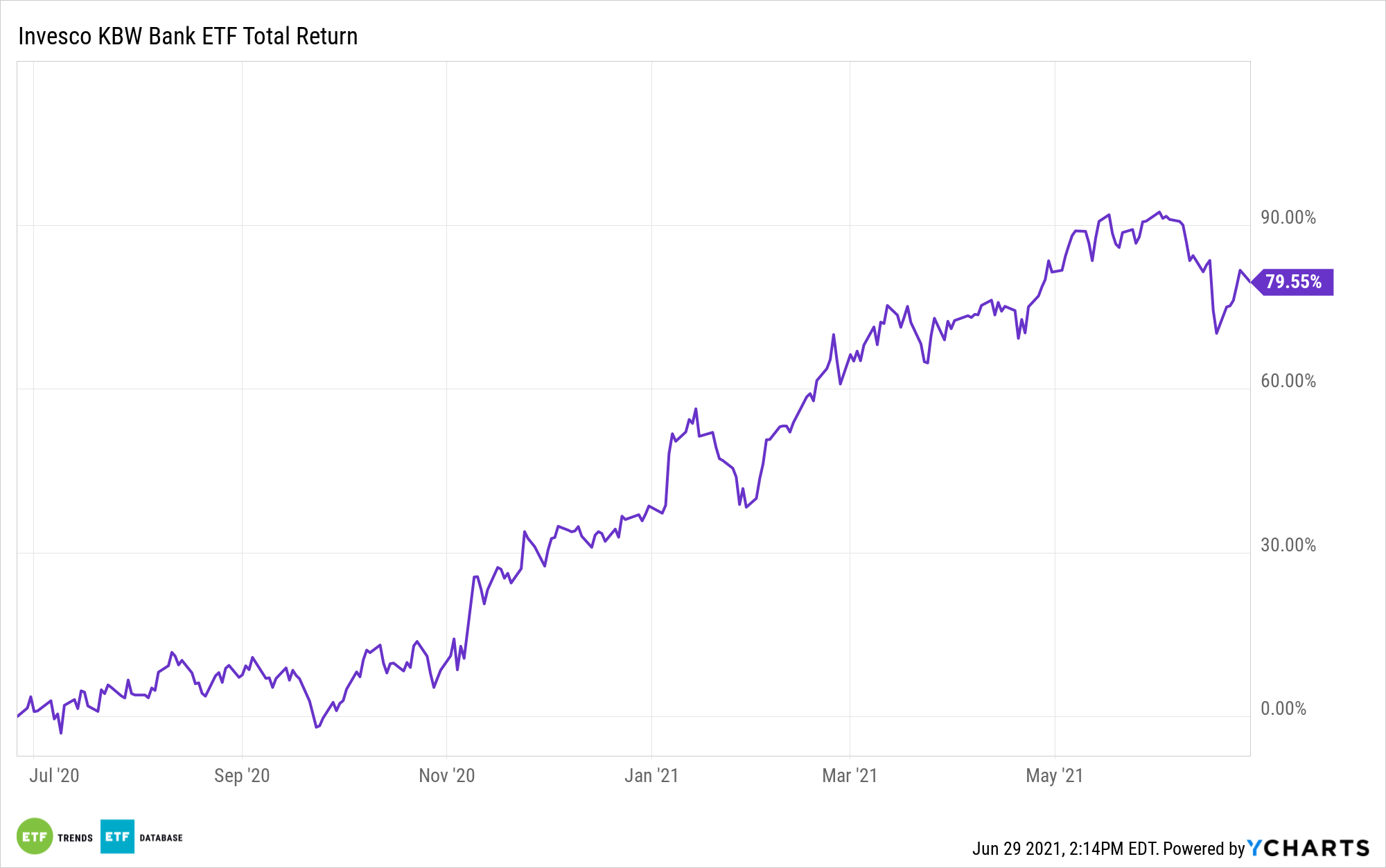

Each could possibly be contributors to extra upside for the already high-flying Invesco KBW Financial institution ETF (NASDAQ: KBWB). KBWB follows the the KBW Nasdaq Financial institution Index, that means it is a pure financial institution change traded fund. None of its 25 holdings are categorized as insurance coverage firms – an indication that it is extremely levered to the Fed approving new shareholder reward schemes.

It is anticipated that dividend hike and share buyback bulletins from banks, together with KBWB, might begin arriving as quickly as early subsequent month.

“Wells Fargo, Goldman Sachs Group, and Morgan Stanley might have a few of the largest dividend will increase among the many huge banks within the wake of the Federal Reserve’s trade stress checks launched on Thursday,” experiences Andrew Bary for Barron’s.

Wells Fargo (NYSE: WFC), which was a 2020 dividend offender, is KBWB’s largest holding at 8.30% of the fund’s weight as of June 25, in accordance with issuer knowledge.

“Massive banks ought to have dividends within the vary of two% to three% after will increase which can be anticipated to common 10% throughout about 20 giant banks, in accordance with Barclays analyst Jason Goldberg,” experiences Barron’s.

Break up the distinction and say main home banks ought to, on common, yield 2.50%; that is nonetheless effectively above the 12-month distribution charge of 1.90% on KBWB.

On a proportion foundation, huge hikes may be coming from Dow element JPMorgan Chase (NYSE: JPM), Financial institution of America (NYSE: BAC), and Citigroup (NYSE: C). That is music to the ears of KBWB traders as a result of these are three of the highest 5 holdings within the Invesco fund. The trio combines for about 22.60% of the fund’s weight.

Barclays’ Goldberg can also be forecasting an honest dividend improve from US Bancorp (NYSE: USB), which is the third-largest element in KBWB at a weight of almost 8%. Pennsylvania-based PNC Monetary (NYSE: PNC) might additionally woo traders with a major payout enhance. That inventory is the seventh-largest holding within the $2.37 billion KBWB at an allocation of 4.15%.

Some analysts are wagering that banks are more likely to be prudent when it comes to dividend will increase, however might unveil huge buyback plans in an effort to spice up earnings per share.

For extra information, info, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.