Sustainability is all the craze today, as asset allocators prioritize environmental stewardship and social and governance progress.

Nevertheless, seasoned dividend buyers know sustainability in one other manner: gauging an organization’s skill to not solely preserve its present payouts, however develop them over the long-term. Many buyers might not notice that some alternate traded funds, together with the Invesco Dividend Achievers ETF (NASDAQ: PFM), already mix each types of sustainability.

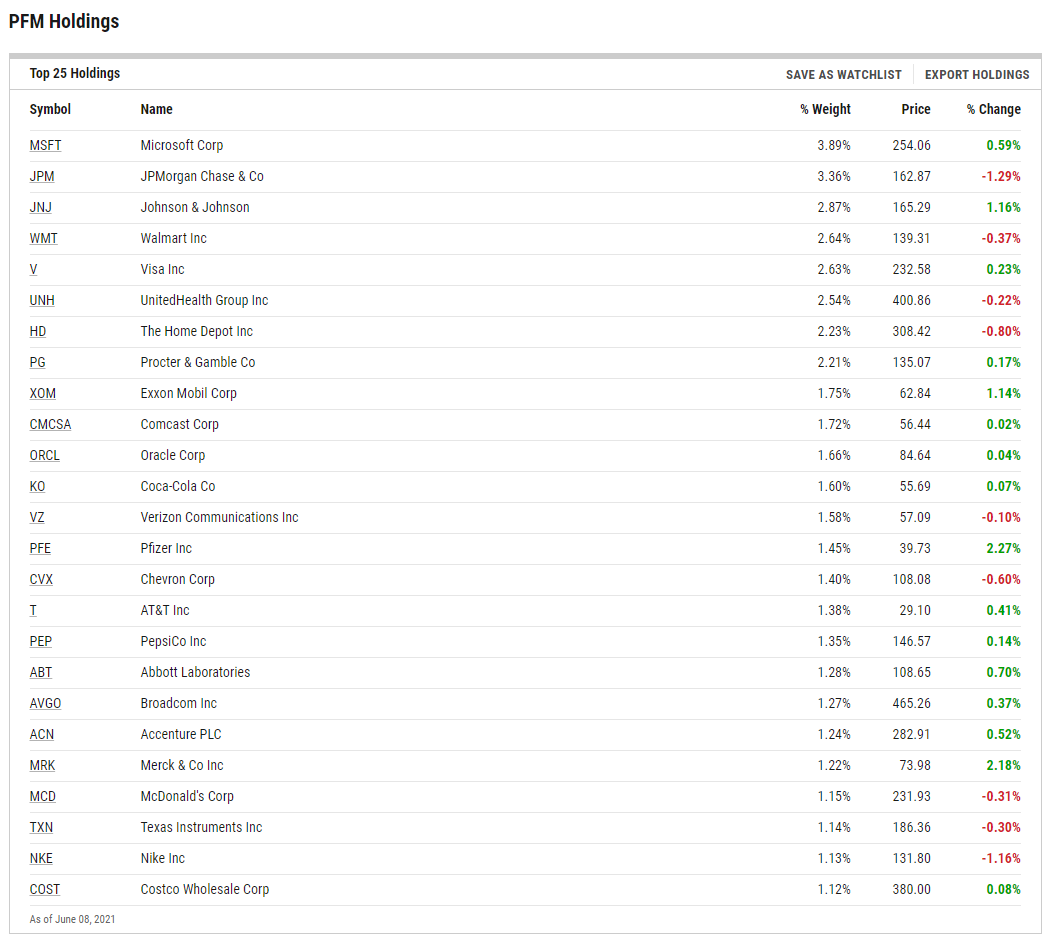

PFM, which turns 16 years outdated in September, follows the NASDAQ US Broad Dividend Achievers Index. That index mandates that member companies have dividend enhance streaks spanning at the very least 10 years. That is a troublesome commonplace to satisfy, however PFM has 353 parts.

Because the dividend panorama adjustments with extra sectors contributing bigger percentages to general home payouts and with extra firms strolling the stroll on the subject of environmental, social, and governance (ESG) speak, PFM may very well be an more and more related concept for buyers trying to verify each containers without delay.

PFM Extra Sustainable Than Meets the Eye

Some PFM parts are already gamers on the dividend development and sustainability phases. Verizon (NYSE: VZ) is an efficient instance. Not solely does it have an enviable payout observe report, however it operates in an area the place firms should prioritize buyer knowledge safety.

“Information privateness and safety points stand out as a result of the corporate’s flip to knowledge monetization methods locations its customers’ knowledge below concern. Nevertheless, Verizon has a powerful score on the subject of managing its publicity to those dangers,” says Morningstar analyst Jokir Hossain.

House Depot (NYSE: HD), the biggest dwelling enchancment retailer and one other PFM holding, has a stellar dividend development observe report. As Hossain factors out, the corporate’s ESG report card is not excellent, however it’s working to deal with potential areas of weak point, equivalent to local weather change and “well being, security, and labor relationship controversies.”

Semiconductor firm Texas Giants (NASDAQ: TXN) operates in an business the place environmental considerations are medium, however one the place ethics and human capital points can come up.

“Human capital and useful resource use as notable materials ESG points. Enterprise ethics is one other space of concern. Nevertheless, the corporate is rated to have a powerful administration of those points,” provides Hossain.

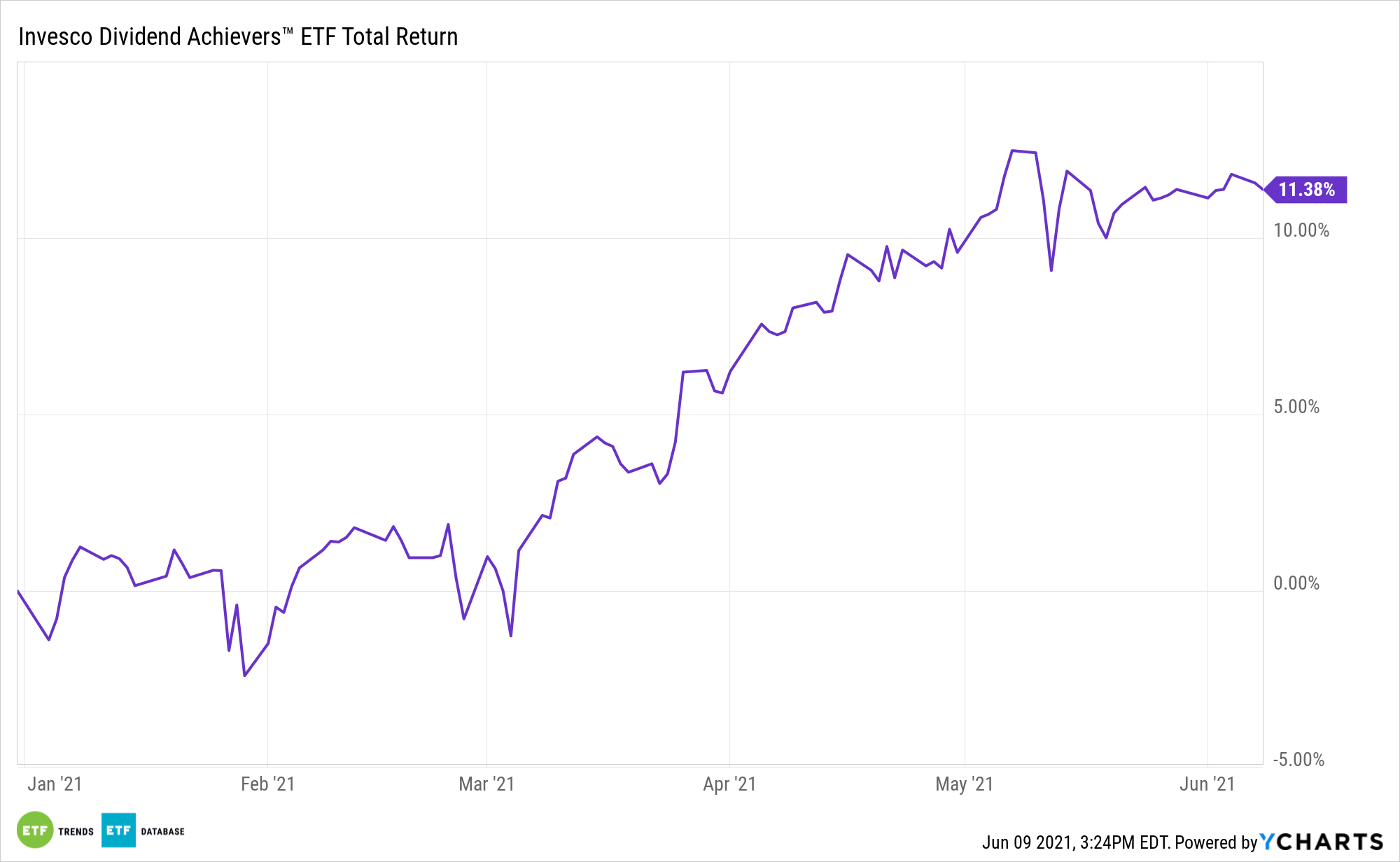

House Depot, Verizon, and Texas Devices mix for about 5% of PFM’s roster. The fund, which yields 1.67%, is increased by 11% year-to-date.

For extra information, data, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.