By Rob Williams, Director of Analysis, Sage Advisory

The Fed’s announcement final week that may pull price hikes ahead by six months was considerably of a shock for buyers. The excellent news is that it doesn’t actually change our thesis, which requires charges to modestly improve over the medium time period; the unhealthy information is that we’re nonetheless in an atmosphere the place yield might be troublesome to return by. Given this backdrop, we consider the most effective plan of action stays to out-yield passive indices by overweighting unfold sectors, keep quick period to reduce adverse value returns from rising charges, and make the most of sector choice to generate further upside.

[wce_code id=192]

Think about the next.

Yields Stalled in 2Q

After a sustained rise within the first quarter, yields have drifted down and stayed in a slender vary within the second quarter. Rangebound situations might proceed near-term because the flood of liquidity within the markets as a consequence of Fed coverage must discover a dwelling; and with T-bills yielding nothing, this implies security consumers like banks shall be shopping for longer Treasuries.

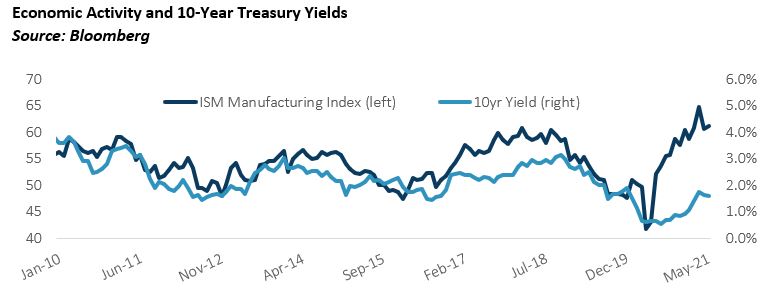

Exercise Suggests Larger Yields, however Watch the Fed

An extended-term view on charges suggests an upward bias to yields given the spiking exercise stage. QE, nevertheless, continues to maintain yields artificially low, and a rise in yields will rely on when the Fed begins unwinding its insurance policies. Our outlook is for contained charges over the following couple months however rising stress within the fall because the Fed continues to message tapering plans.

The Attain for Yield Continues

Demand for yield in low-yield atmosphere coupled with a constructive elementary outlook is a recipe for tight credit score spreads. Given the extent of valuations, a attain for yield makes us cautious, however a powerful elementary backdrop traditionally has stored spreads tight for lengthy intervals of time, even tighter than present ranges. That is excellent news for bond buyers, as the important thing to outperforming static bond indices shall be reaching into unfold sectors for extra yield.

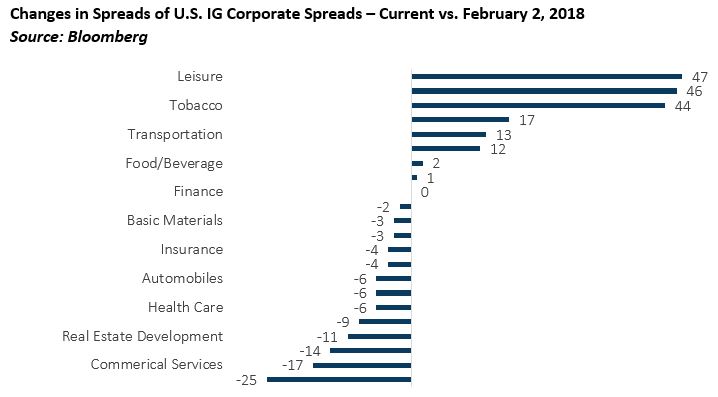

Alternatives Exist Regardless of Report Tight Company Spreads

The fast tempo of re-openings, notably in journey through the summertime, might current a catalyst to the journey and leisure sector, which has enticing valuations (e.g., the leisure sector is 47 foundation factors cheaper than it was in 2018). For these buyers targeted on core funding grade mounted revenue, leisure/journey an instance of excellent worth.

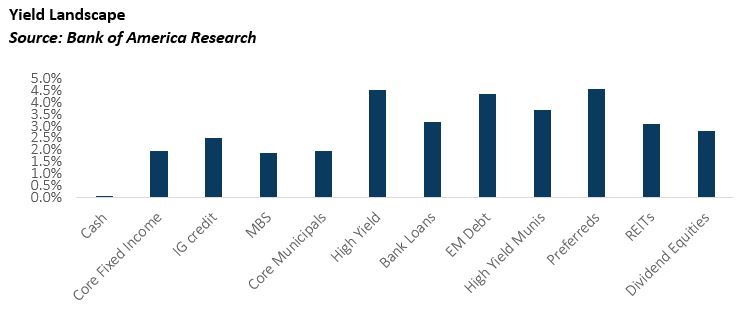

Take a Multi-Asset Strategy

For these buyers which have a better danger tolerance and will not be confined to core mounted revenue, a multi-asset method is greatest. A risk-managed, multi-asset method permits buyers to diversify past rate-sensitive core mounted revenue into higher-yielding alternate options at a time when spreads ought to stay nicely supported. Given our macro and technical outlook, we discover excessive yield, financial institution loans, and most popular shares enticing. For tax-sensitive buyers, municipals, each core and excessive yield, are in a really favorable place.

Disclosures: That is for informational functions solely and isn’t meant as funding recommendation or a proposal or solicitation with respect to the acquisition or sale of any safety, technique or funding product. Though the statements of reality, info, charts, evaluation and information on this report have been obtained from, and are based mostly upon, sources Sage believes to be dependable, we don’t assure their accuracy, and the underlying info, information, figures and publicly out there info has not been verified or audited for accuracy or completeness by Sage. Moreover, we don’t characterize that the data, information, evaluation and charts are correct or full, and as such shouldn’t be relied upon as such. All outcomes included on this report represent Sage’s opinions as of the date of this report and are topic to vary with out discover as a consequence of numerous elements, similar to market situations. Buyers ought to make their very own selections on funding methods based mostly on their particular funding goals and monetary circumstances. All investments include danger and should lose worth. Previous efficiency just isn’t a assure of future outcomes.

Sage Advisory Companies, Ltd. Co. is a registered funding adviser that gives funding administration providers for quite a lot of establishments and excessive web price people. For added info on Sage and its funding administration providers, please view our site at www.sageadvisory.com, or confer with our Type ADV, which is obtainable upon request by calling 512.327.5530.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.