Investors searching for tactical near-term concepts might wish to contemplate the First Belief ISE Water ETF (NYSEArca: FIW).

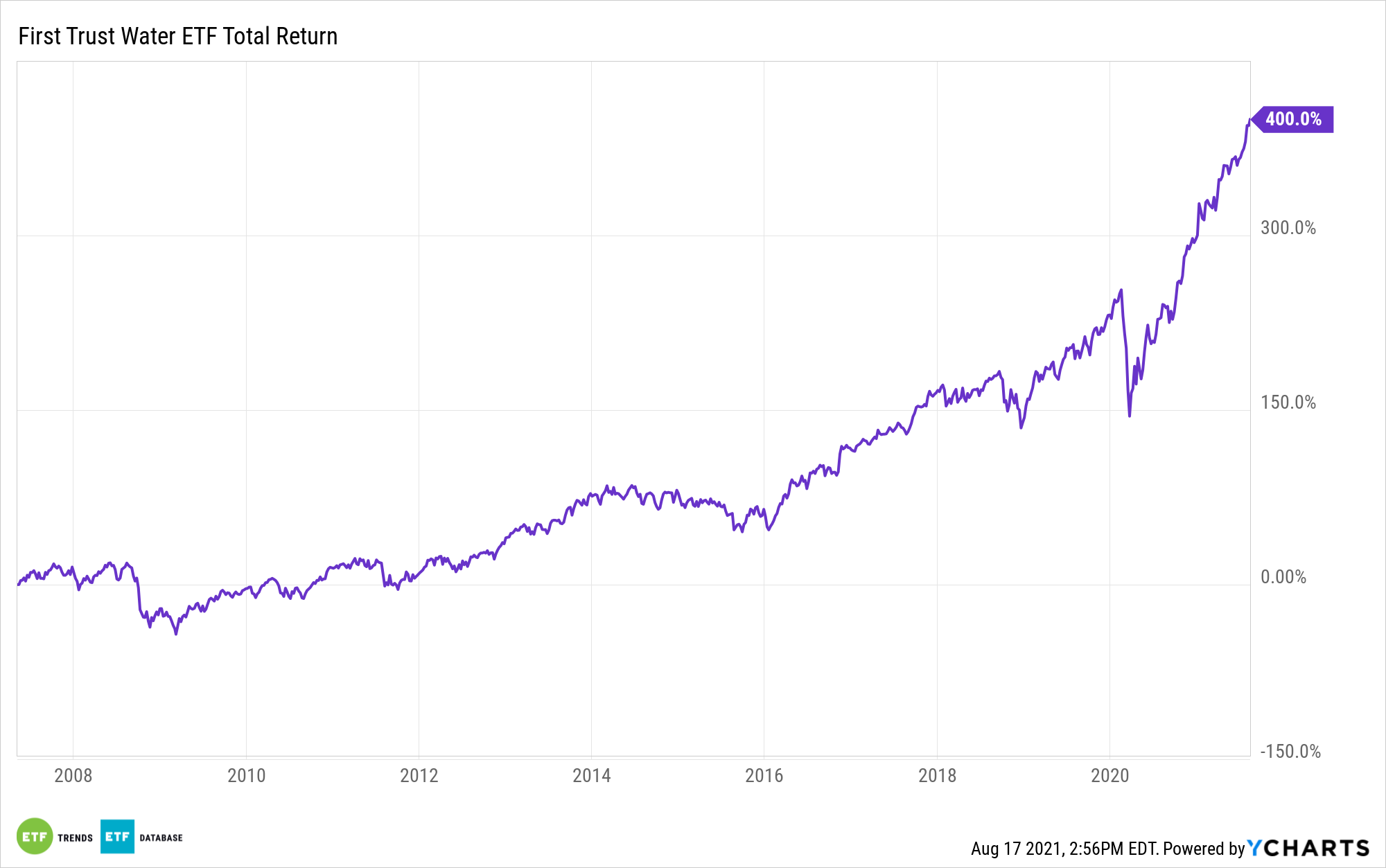

Up 23.56% year-to-date and recent off hitting one other all-time excessive on Monday, the $1.21 billion FIW has loads of tailwinds to supply traders proper now. FIW, which turned 14 years outdated in Could, follows the ISE Clear Edge Water Index and gives publicity to 6 sectors, which is greater than many traders might suspect are present in a water ETF.

With infrastructure producing appreciable buzz of late, traders ought to word that the water infrastructure funding thesis may very well be rewarding for a while.

“Consequently, a lot of the nation’s important water infrastructure has reached or exceeded its helpful life and warrants important capital funding,” writes First Belief CFA and Senior Vice President Ryan Issakainen. “The American Water Works Affiliation estimates that over the following twenty years, a lot of the nation’s consuming water pipes will should be changed or repaired. Furthermore, wastewater remedy crops have a mean lifespan of 40-50 years, which means people who have been constructed within the 1970s or earlier might quickly should be changed.”

As Issakainen factors out, the American Society of Civil Engineers (ACSE) offers U.S. water infrastructure a grade of D+ (the clear consuming water grade is barely greater) and says about $3.Three trillion must be spent to shore up water infrastructure within the nation. Greater than 56% of FIW’s 36 elements are industrial shares, making the fund a perfect means for traders to capitalize on home water infrastructure efforts.

Like all infrastructure venture, water infrastructure is a longer-ranging theme, however some efforts on this entrance may quickly begin up after being halted final 12 months due to the coronavirus pandemic. That highlights potential near-term utility with FIW.

“Many capital funding initiatives have been postponed in 2020 due to lockdowns and price range constraints as a result of Covid-19,” provides Issakainen. “The Congressional Funds Workplace stories that state and native governments account for 90% of public spending on water infrastructure. They confronted important price range shortfalls in 2020. Nevertheless, the $1.9 trillion American Rescue Plan, handed in March 2021, allotted $350 billion for state and municipal governments.”

The Senate lately handed a $1 trillion infrastructure bundle, which options $550 billion for brand spanking new infrastructure initiatives, $55 billion of which goes towards clear consuming water. Put all of it collectively and FIW has favorable elements for each tactical short-term traders and people with longer time horizons.

For extra information, data, and technique, go to the Nasdaq Funding Intelligence Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.