That is the primary weblog submit of a three-part sequence

That is the primary weblog submit of a three-part sequence on the impact of COVID-19 on the November third election.

With greater than 200,000 recorded U.S. COVID-19-related deaths, add in one other plot twist: final night time we discovered that Donald and Melania Trump each contracted it.

As if Ruth Bader Ginsburg’s Supreme Court docket emptiness wasn’t sufficient drama.

As I write, the early indications are that Trump has a sniffle, some cold-like signs, fatigue. At 74, he finds himself in that susceptible age group that would have him nonetheless preventing this factor – or worse – because the election approaches. It’s possible you’ll recall that earlier this 12 months Britain’s Boris Johnson additionally caught it, however he’s 18 years youthful than Trump. One other notable international chief, the “Tropical Trump,” Brazil’s Jair Bolsonaro, caught Covid-19 and obtained over it this summer time. He’s 65 years previous.

In a rustic the place the whole lot is political, our response to COVID-19 cut up down occasion traces months in the past. The face of the lockdown camp is Democrat Andrew Cuomo, governor of New York. Advocating for reopening on the opposite aspect is Ron DeSantis, Florida’s Republican governor. On the federal degree, the identical idea: Cuomo’s fame correlates with Joe Biden’s, whereas DeSantis is the state-level proxy for Donald Trump.

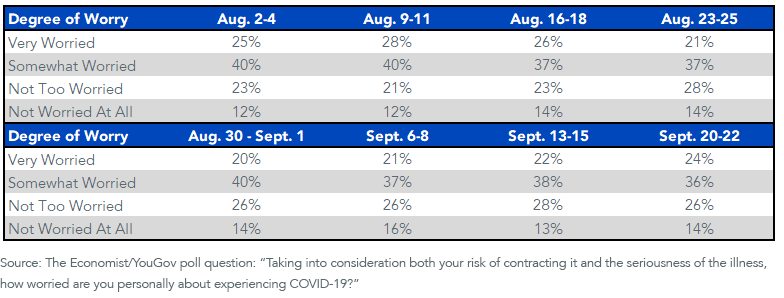

Right here’s a query from the Economist/YouGov ballot:

“Taking into account each your danger of contracting it and the seriousness of the sickness, how fearful are you personally about experiencing COVID-19?”

Observe the wording of the query. It isn’t about your concern that you could possibly catch it and move it to an aged relative. It’s about your private well being.

I’ve wrongly believed for months that the falling development in hospitalizations would elevate the ranks of the “Not Fearful at All” respondents.

That has not occurred (determine 1). Now, with Trump’s constructive COVID-19 take a look at splashed throughout the headlines, you need to marvel if social media’s “danger evaluation through anecdote” situation will shift public sentiment. If Trump deteriorates, societal concern ranges concerning the severity of the virus will spike. On the opposite aspect, the extra seemingly final result, even for a 74-year-old, is that he experiences chilly signs and is again firing a pair weeks from now. In that circumstance, do extra individuals have the dialog about Trump’s COVID-19 from the consolation of a restaurant sales space?

Determine 1: “Fearful About COVID-19”

Nonetheless, with 60% of respondents nonetheless both “Very Fearful” or “Considerably Fearful” about their private susceptibility to COVID-19, Trump has a reelection downside. In case your thesis has the incumbent dropping, try my Biden weblog.

For now, let’s recreation the opposite thesis: The COVID-19 state of affairs improves between now and the election, pushing Trump to victory, an final result that has slipped towards 2-1 odds at this level.

Do I’ve these market reactions about proper?

Biden “On” and Trump “Off” = Different Power

Trump “On” and Biden “Off” = Massive Oil

And this?

Biden “On” and Trump “Off” = Regulate Wall Road

Trump “On” and Biden “Off” = Do Not Regulate Wall Road

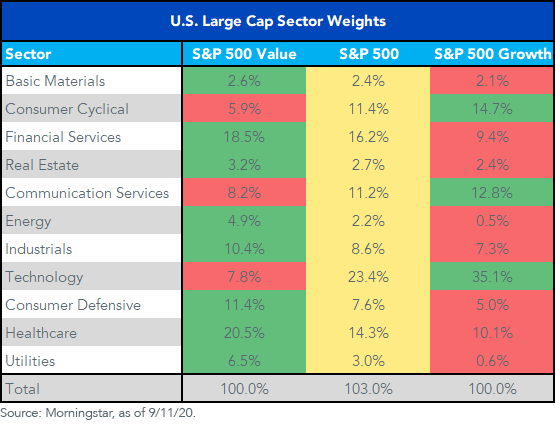

Take a look at the weights of Power and Financials within the S&P 500 Worth and S&P 500 Development Indexes (determine 2). Type an opinion on the election final result and you’ve got your information on progress versus worth.

Trump win? Worth. Biden win? Development.

Determine 2: U.S. Massive-Cap Sector Weights

For the Biden thesis—progress shares—two methods are the WisdomTree Cloud Computing Fund (WCLD) and the WisdomTree Development Leaders Fund (PLAT). The latter might be considered our twist on the NASDAQ.

For the Trump thesis—worth shares—the WisdomTree U.S. LargeCap Dividend Fund (DLN) involves thoughts as a result of it has about 7% within the Power sector. One other thought could also be to shade down the market-cap spectrum. You’ll find a 22% weight to Financials contained in the WisdomTree MidCap Dividend Fund (DON).

Necessary Dangers Associated to this Article

There are dangers related to investing, together with attainable lack of principal. Funds focusing their investments on sure sectors, resembling DLN and DON, improve their vulnerability to any single financial or regulatory improvement. This will end in better share worth volatility.

International investing entails particular dangers, resembling danger of loss from forex fluctuation or political or financial uncertainty; these dangers could also be enhanced in rising, offshore or frontier markets. Know-how platform firms have important publicity to shoppers and companies, and a failure to draw and retain a considerable variety of such customers to an organization’s merchandise, providers, content material or expertise may adversely have an effect on working outcomes. Technological adjustments may require substantial expenditures by a expertise platform firm to switch or adapt its merchandise, providers, content material or infrastructure. Know-how platform firms usually face intense competitors, and the event of latest merchandise is a fancy and unsure course of. Issues concerning an organization’s services or products that will compromise the privateness of customers, or different cybersecurity considerations, even when unfounded, may harm an organization’s fame and adversely have an effect on working outcomes. Many expertise platform firms presently function below much less regulatory scrutiny however there’s important danger that prices related to regulatory oversight may improve sooner or later. PLAT invests within the securities included in, or consultant of, its Index no matter their funding advantage, and the Fund doesn’t try to outperform its Index or take defensive positions in declining markets. The composition of the Index is closely depending on quantitative and qualitative data and knowledge from a number of third events, and the Index could not carry out as supposed.

WCLD invests in cloud computing firms, that are closely depending on the Web and using a distributed community of servers over the Web. Cloud computing firms could have restricted product traces, markets, monetary assets or personnel and are topic to the dangers of adjustments in enterprise cycles, world financial progress, technological progress and authorities regulation. These firms usually face intense competitors and doubtlessly fast product obsolescence. Moreover, many cloud computing firms retailer delicate shopper data and may very well be the goal of cybersecurity assaults and different kinds of theft, which may have a unfavourable influence on these firms and the Fund. Securities of cloud computing firms are usually extra unstable than securities of firms that rely much less closely on expertise and, particularly, on the Web. Cloud computing firms can usually interact in important quantities of spending on analysis and improvement, and fast adjustments to the sector may have a cloth adversarial impact on an organization’s working outcomes. The composition of the Index is closely depending on quantitative and qualitative data and knowledge from a number of third events, and the Index could not carry out as supposed.

Please learn every Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.