By Ryan O’Malley, Fixed Income Portfolio Strategist

Not all commodities have benefitted equally in the reflation/economic reopening trade. Some have long-term structural supply/demand imbalances, while others have seen short-term speculative price increases that have proved unsustainable.

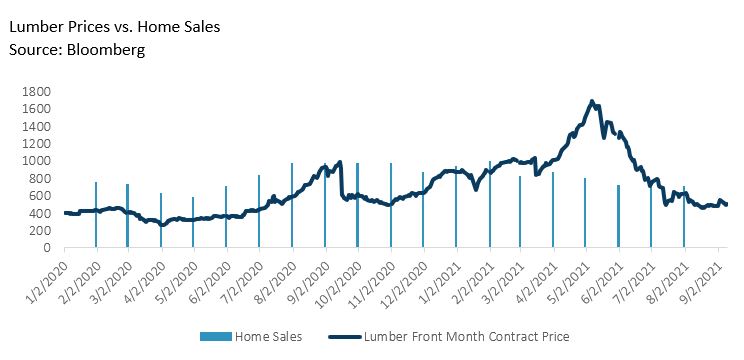

Forest Products/Lumber

This sector benefitted from a hyperbolic housing market in the latter part of 2020 and early 2021 as many former city dwellers took advantage of the work-from-home revolution and moved to the suburbs; however, after mortgage rates bottomed in February, the cost of home ownership quickly rocketed to unsustainable levels for many middle-income Americans. The speculative bubble in lumber futures quickly reversed course, and lumber prices are now down 65% in the past three months, and lower than where they started 2021 as home sales have cooled considerably.

[wce_code id=192]

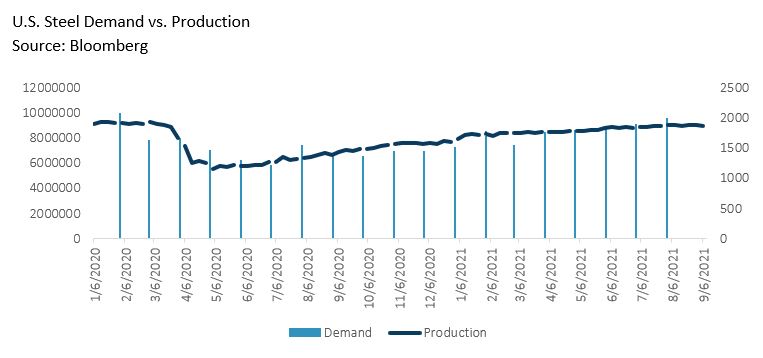

Industrial Metals

Aluminum and Steel have continued to maintain their peak prices despite concerns about a global slowdown, indicating that there might be a longer-term structural supply/demand imbalance afoot.

Tailwinds, such as the trillion-dollar infrastructure bill, combined with a large backlog of commercial property build-outs that were stalled during the worst of the Covid-19 crisis, have led the demand growth for steel and its peers to far outstrip supply growth. From the nadir of June 2020, steel demand in the U.S. has grown approximately 65%, while supply has grown only 44%.

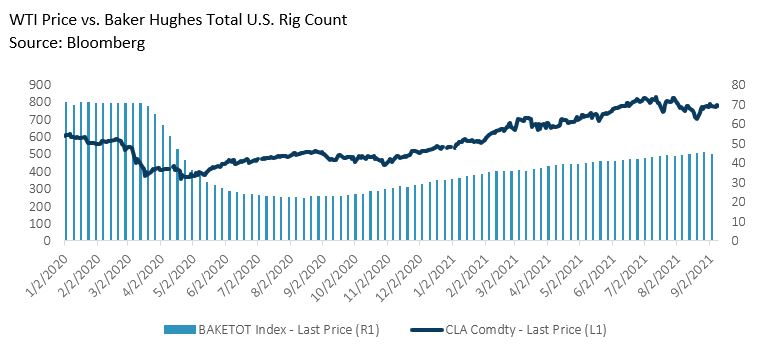

Energy

Energy commodities have proven even more resilient. Demand has nearly reached pre-pandemic levels, but supply remains muted as U.S. shale producers have kept production below 2019 levels and shown great discipline with their balance sheets. West Texas Intermediate crude oil has hovered around $70/barrel for the past two months, a level not seen consistently since 2018. And natural gas is poised to pierce $5/MMBtu, a level not seen since 2014.

Top Picks

Given this dichotomy in commodities, our favorite investment grade credits include Energy Transfer Partners (ETP) and Cenovus (CVECN). Both should benefit from continued robust demand as the economy reopens and they use excess cash to remake their balance sheets.

Within the high-yield space, we favor U.S. Steel (X) and Alcoa (AA). Both are large producers of industrial metals and have favorable positions within the supply chain to take advantage of the extremely strong demand for their products. We also like Occidental Petroleum (OXY), a fallen angel oil producer that is using the strong price environment to sell non-core assets to get its leverage back to investment grade levels. Lastly, we favor Teekay Corp. (TK), a provider of marine transportation for liquified natural gas (LNG). The company is benefitting from the voracious demand for LNG from countries in Asia and Latin America that do not have the monstrous supply that the United States has.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com