By Frank Holmes Gold ended the buying and selling session d

By Frank Holmes

Gold ended the buying and selling session down 4.41% on Monday, November 9, its worst one-day droop since mid-August, on promising coronavirus vaccine information.

Regardless of the selloff, the yellow metallic has had a rare 12 months. Fueled by historic quantities of fiscal stimulus and negative-yielding debt, in addition to financial and geopolitical uncertainty, the value of gold touched a brand new file excessive this previous summer time. As of November 6, it was up greater than 28%.

Traders have piled into international ETFs backed by gold. In response to the World Gold Council (WGC), October was the 11th straight month of web inflows into gold-backed ETFs, bringing whole mixed holdings as much as a file $235 billion.

Apart from investing in gold instantly, many buyers favor getting publicity through gold mining shares. And even then, buyers have a variety of decisions, from the “seniors” (large-cap) to “juniors” (small-cap) to treasured metallic royal corporations.

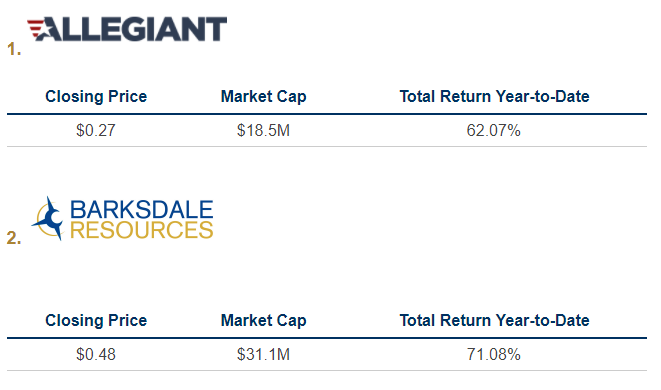

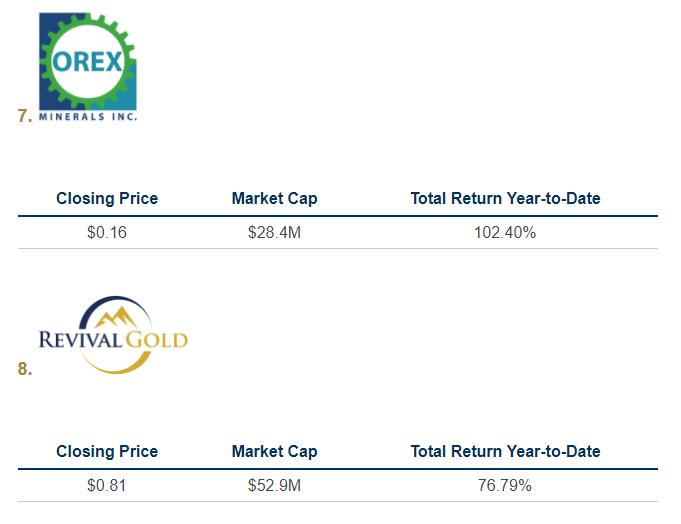

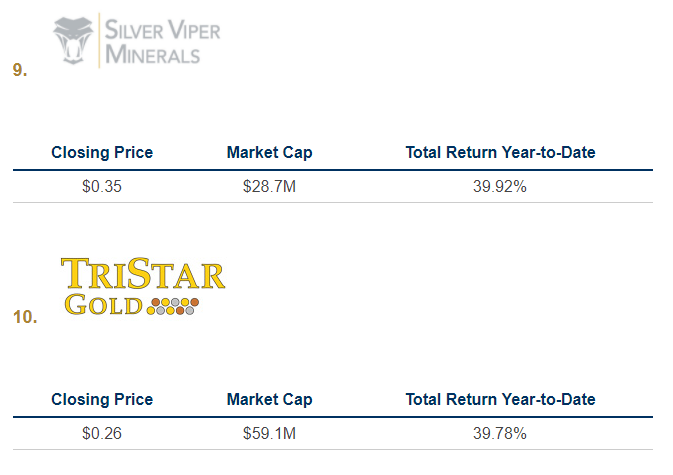

Under is a listing of my favourite junior treasured metallic mining corporations, the biggest amongst them being Gran Colombia with a market cap of $305 million. All knowledge is as of the shut on Friday, November 6, and priced in U.S. {dollars}.

The businesses above have a pair extra issues in widespread. Primary, all of them are both at the moment held in our World Valuable Minerals Fund (UNWPX) or they have been at one time very lately.

And quantity two, each will take part within the first ever Digital Junior Mining Expo, to be held this Thursday, November 12, at 1:00 pm EST.

Co-hosted by my mates at Streetwise Experiences, the digital occasion will function all 10 junior mining corporations. Every one will current 20 slides, with simply 20 seconds per slide. We designed the occasion with a “PechaKucha” model to maintain issues brisk and but complete and academic.

And the most effective half? You’re invited!

To register for the free occasion, simply comply with the hyperlink under. We hope to see you there!

SIGN ME UP!

printed

Foreside Fund Companies, LLC, Distributor. U.S. International Traders is the funding adviser.

Efficiency knowledge quoted represents previous efficiency. Previous efficiency is not any assure of future outcomes. Present efficiency could also be larger or decrease than the efficiency knowledge quoted. The principal worth and funding return of an funding will fluctuate in order that your shares, when redeemed, could also be value kind of than their authentic price. Get hold of Fund efficiency at www.usfunds.com or 1-800-US-FUNDS.

Gold, treasured metals, and treasured minerals funds could also be vulnerable to antagonistic financial, political or regulatory developments as a result of concentrating in a single theme. The costs of gold, treasured metals, and treasured minerals are topic to substantial worth fluctuations over quick durations of time and could also be affected by unpredicted worldwide financial and political insurance policies. We recommend investing not more than 5% to 10% of your portfolio in these sectors. Mutual fund investing entails threat. Principal loss is feasible.

Fund portfolios are actively managed, and holdings could change each day. Holdings are reported as of the newest quarter-end. Fund holdings shouldn’t be thought-about a advice to purchase or promote any safety. Holdings within the World Valuable Minerals Fund as a proportion of web property as of 9/30/2020: Allegiant Gold Ltd. 0.89%, Barksdale Assets Corp. 0.95%, Barsele Minerals Corp. 2.63%, Brixton Metals Corp. 0.70%, Gran Colombia Gold Corp. 0.00%, Magna Gold Corp. 1.44%, Orex Minerals Inc. 1.04%, Revival Gold Inc. 1.17%, Silver Viper Minerals Corp. 1.04%, TriStar Gold Inc. 7.16%.

All opinions expressed and knowledge offered are topic to alter with out discover. A few of these opinions will not be applicable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. International Traders doesn’t endorse all info provided by this/these web site(s) and isn’t chargeable for its/their content material.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.