I hope all of my American readers and subscribers had a protected, completely happy Thanksgiving Da

I hope all of my American readers and subscribers had a protected, completely happy Thanksgiving Day and weekend. This yr has been exceptionally difficult for a wide range of causes, however I imagine there’s nonetheless a complete lot to be grateful for. I belief you had been in a position to spend a while with family and friends, whether or not in individual or over Zoom, and located the time to rely your blessings.

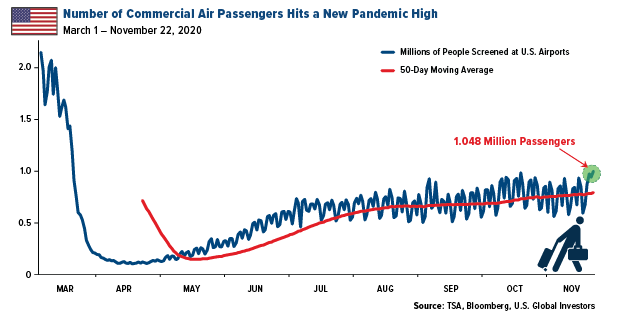

People appeared to buck Thanksgiving journey warnings from the Facilities for Illness Management and Prevention (CDC), with the variety of business air passengers hitting a brand new pandemic excessive. Practically 1.05 million passengers took to the skies the Sunday earlier than final, beating the earlier document of 1.03 million folks on October 18. That determine was crushed once more yesterday, when 1.18 million folks had been screened to fly.

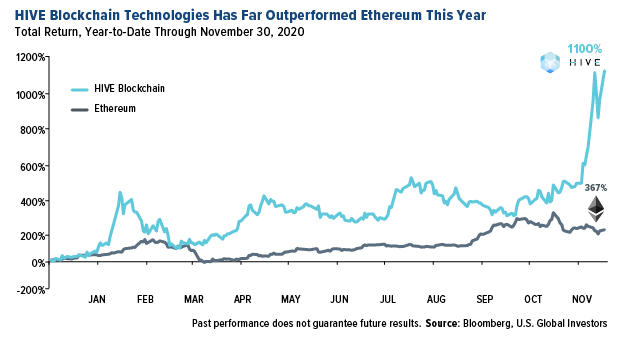

One of many issues I’m most grateful for is how nicely HIVE Blockchain Applied sciences has performed over the previous 18 months. As I’m certain lots of you recognize, I function HIVE’s interim government chairman, and U.S. International Buyers (NASDAQ: GROW) owns 10 million shares of the corporate, the very first publicly traded cryptocurrency mining agency.

Again in June 2019, HIVE managed to settle all disputes with Genesis Mining, bringing again transparency, accountability and duty. Primary company governance, in different phrases.

The settlement settlement additionally allowed us to drive down prices. This, coupled with larger Ethereum and crypto costs, signifies that HIVE is doing higher now than ever earlier than. 2020 has been marked by wholesome enlargement in mining capability, the latest instance being HIVE’s acquisition of an information heart campus in Grand Falls, New Brunswick, that can give the corporate entry to a further 50 megawatts (MW) of low-cost inexperienced vitality.

Up to now this yr, HIVE shares have soared an unimaginable 1,100%, nicely previous Ethereum’s achieve of 367%. That is very constructive information for shareholders not simply of HIVE but additionally GROW. Cryptocurrency costs stay extremely risky, the identical as shares of HIVE, which transfer in the identical course as Ethereum about 90% of the time.

With that, I invite you to affix us tomorrow for the HIVE earnings webcast for the fiscal quarter ended September 30. This quarter represents a full yr for the reason that firm has been 100% within the driver’s seat of its operations, and although I clearly can’t give any particulars away proper now, I’m very excited so that you can hear them your self.

You may register for the webinar by clicking right here.

Gold Beginning to Look Like a Purchase

The worth of bitcoin swung wildly final week, together with gold, flirting with its all-time excessive on Wednesday earlier than plunging greater than $3,000. The digital forex appeared prepared for a correction after hovering in overbought territory for a few month, in line with the 14-day relative power index (RSI).

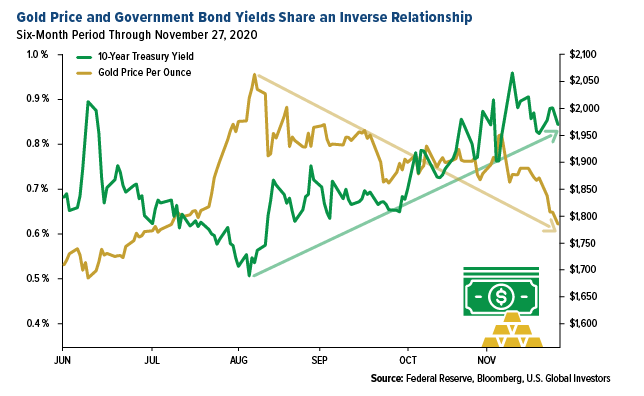

Gold, alternatively, is beginning to look oversold, particularly after Friday’s selloff on hopes of a vaccine and broad financial restoration.

The yellow metallic has additionally been underneath strain from rising bond yields. The yield on the 10-year Treasury has been on the upswing, and as I’ve defined a variety of instances earlier than, this will have a huge effect on the course of gold costs. Have a look beneath. Gold hit its all-time excessive of almost $2,070 an oz on August 6, when the 10-year yield traded as little as 0.5%. Keep in mind, that is the nominal yield. Adjusted for inflation, it’s beneath zero.

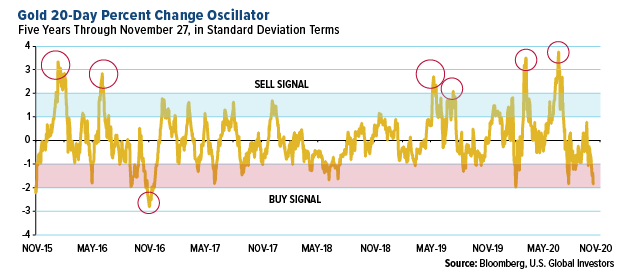

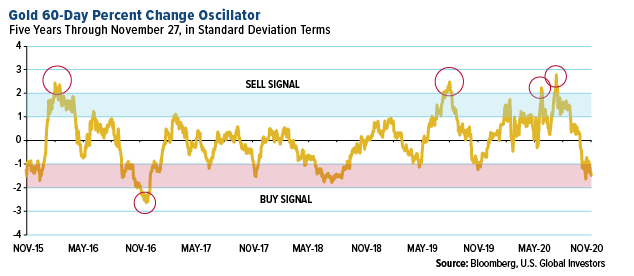

I imagine gold is a purchase at these costs. The next 20-day and 60-day oscillator charts bear this out.

Trying on the 20-day, gold was buying and selling down near 2 commonplace deviations from its five-year imply, which means its nicely throughout the “purchase” vary. The information says we may even see a rally in costs within the quick time period.

The 60-day oscillator chart additionally reveals that gold is oversold, although not as pronounced. The metallic was down 1.5 commonplace deviations from its five-year imply. That is about as oversold as gold has been since September 2018.

Gold Miners Reporting File Free Money Movement

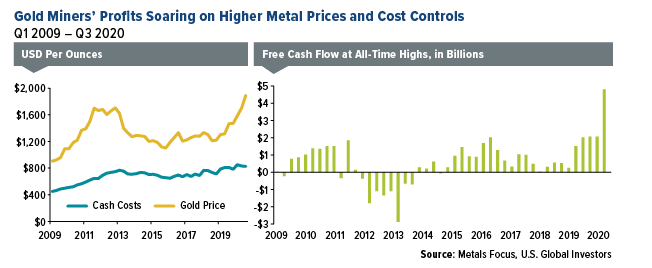

Like HIVE, gold miners have put value controls in place as the value of the underlying metallic rose to new all-time highs. This has resulted in document free money circulate, in line with Metals Focus.

In a report dated November 25, the London-based group mentioned that money circulate after capital expenditures for the world’s main gold miners reached a document excessive of $4.Eight billion within the third quarter of this yr. That’s a big enhance of $2.7 billion from the earlier quarter, a good larger enhance of $3.Three billion from the identical quarter a yr in the past.

In accordance with Metals Focus, “prices have been contained, with firms remaining centered on sustaining working and capital value self-discipline to maximise worth from their [existing] mines.”

This is superb information for traders as this will likely imply larger shareholder payouts sooner or later.

Nonetheless Haven’t Had a Likelihood to Watch the Mining Expo?

Lots of you continue to haven’t gotten an opportunity to look at the Digital Junior Mining Expo, which I co-hosted lately with StreetSmart Dwell! The occasion was an enormous success, bringing 10 of essentially the most thrilling junior metallic producers and explorers to curious traders comparable to your self.

For these of you who missed it or wish to watch it once more, a recording is now obtainable. Simply click on right here!

Initially revealed by U.S. Funds, 11/30/20

Frank Holmes has been appointed non-executive chairman of the Board of Administrators of HIVE Blockchain Applied sciences. Each Mr. Holmes and U.S. International Buyers personal shares of HIVE. Efficient 8/31/2018, Frank Holmes serves because the interim government chairman of HIVE. Commonplace deviation is a measure of the dispersion of a set of information from its imply. The extra unfold aside the info, the upper the deviation. Commonplace deviation is also called historic volatility. The relative power index (RSI) is a momentum indicator utilized in technical evaluation that measures the magnitude of current value adjustments to guage overbought or oversold situations within the value of a inventory or different asset.

All opinions expressed and knowledge supplied are topic to vary with out discover. A few of these opinions will not be acceptable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all data provided by this/these web site(s) and isn’t answerable for its/their content material.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.