Here are three iShares ETFs that may end 2020 with huge features and might be poised for much more

Here are three iShares ETFs that may end 2020 with huge features and might be poised for much more in 2021.

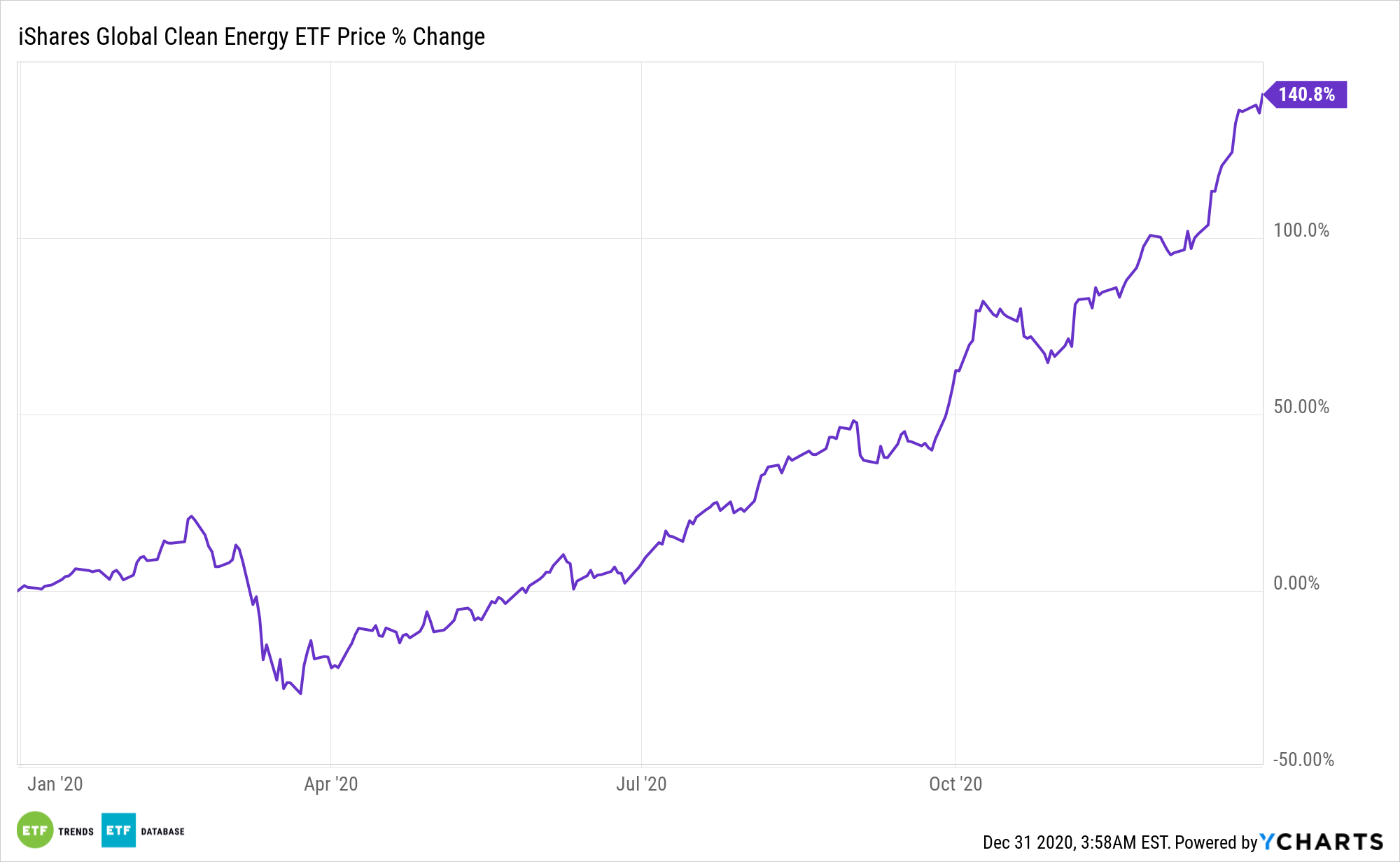

A Clear Power Play

While you’re up over 140% for the yr, you are clearly doing one thing proper. The iShares World Clear Power ETF (ICLN) seeks to trace the S&P World Clear Power Index, which is designed to trace the efficiency of roughly 30 clear energy-related corporations.

Total, ICLN offers traders entry to:

- Publicity to corporations that produce vitality from photo voltaic, wind, and different renewable sources

- Focused entry to scrub vitality shares from around the globe

- Use to specific a worldwide sector view

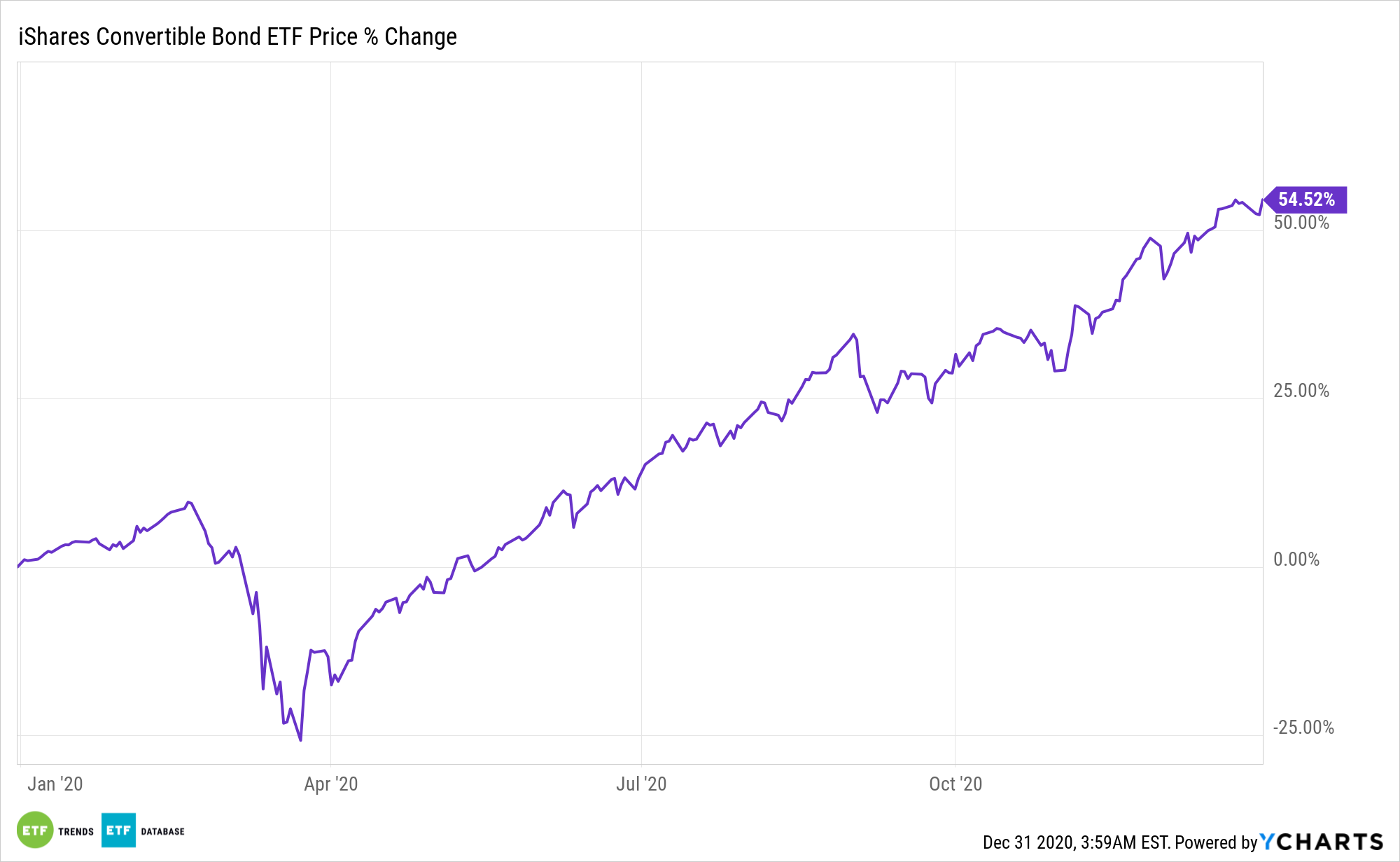

A Convertible Bond Possibility

One other fund to think about is the iShares Convertible Bond ETF (ICVT), which is up about 60%. The fund seeks to trace the funding outcomes of the Bloomberg Barclays U.S. Convertible Money Pay Bond > $250MM Index (the “underlying index”).

The fund typically will make investments at the very least 90% of its belongings within the part securities of the underlying index and should make investments as much as 10% of its belongings in sure futures, choices and swap contracts, money and money equivalents, in addition to in securities not included within the underlying index. The underlying index is a subset of the Bloomberg Barclays U.S. Convertibles: Money Pay Bonds Index, which measures the efficiency of the U.S. dollar-denominated convertibles market.

ICVT offers traders:

- Potential for upside participation and draw back safety – Convertible bonds are uniquely positioned to supply the expansion potential of shares, however with the revenue and draw back danger administration traits of conventional bonds.

- A technique to guard towards rising charges – In rising fee environments, shares are inclined to outperform bonds. Since a convertible bond’s value is influenced by the worth of its underlying equities, their costs are typically much less influenced by modifications in rates of interest than different fastened revenue securities.

- Diversified publicity – Convertible bonds have demonstrated low correlations to conventional bond markets and may probably present engaging diversification advantages inside a broad portfolio.

An Autonomous Driver (of Positive aspects)

Final up is a fund that is up that is grown about 60%, the iShares Self-Driving EV and Tech ETF (NYSEArca: IDRV). IDRV seeks to trace the funding outcomes of an index composed of developed and rising market corporations which will profit from development and innovation in and round electrical autos, battery applied sciences, and autonomous driving applied sciences. Particularly, it tracks the NYSE FactSet World Autonomous Driving and Electrical Car Index (the “Underlying Index”), which measures the efficiency of fairness securities issued by corporations that produce autonomous driving autos, electrical autos, batteries for electrical autos, or applied sciences associated to such merchandise.

IDRV offers traders:

- Entry to corporations on the forefront of self-driving and electrical automobile (EV) innovation

- Publicity to world shares alongside the total worth chain of self-driving and EV industries, throughout sectors and geographies

- Lengthy-term development with entry to corporations that may form the worldwide financial future

For extra information and data, go to the Fairness ETF Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.