By Eric Positive, Portfolio Supervisor, VanEck The VanEck R

By Eric Positive, Portfolio Supervisor, VanEck

The VanEck Rising Markets Bond Fund (EMBAX) makes use of a versatile strategy to rising markets debt investing and invests in debt securities issued by governments, quasi-government entities or companies in rising markets international locations. These securities could also be denominated in any forex, together with these of rising markets. By investing in rising markets debt securities, the Fund presents publicity to rising markets fundamentals, typically characterised by decrease money owed and deficits, increased development charges and unbiased central banks. The expanded PDF model of this commentary might be downloaded right here.

Market Assessment

Our fundamental stance stays and the modifications we made had been largely telegraphed in earlier monthlies—we’ve typically been extra diversified and selective after the “purchase of the century” view began to get absolutely priced in July. Since then, we’ve progressively decreased a few of the high-flying winners, as mentioned in our monthlies. These have typically been in USD. Changing them are largely EM native forex markets. Importantly, we’d notice that not all native forex markets are the identical and a lot of EM native forex markets (equivalent to China’s) are low volatility affairs. Anyway, given these developments within the portfolio, we thought we’d evaluation “the case for EM native forex”.

What’s the case for EM native forex? EMFX has lagged and plenty of currencies have good coverage that may supply a mix of defensive and offensive (i.e., beta to development) traits. We’ll go into that argument intimately, beneath. What we should always add, although, is that the worldwide context helps EM native forex bond markets in some ways. International authorities bond markets are present process two critical challenges proper now. First, a lot of them pay low yields or perhaps a excessive chance of losses. Their security worth is arguably absolutely priced, if not topic to distortive “hothouse” results. Second, the traditional “60/40” shares/bond portfolio is challenged by these low or unfavourable yields on many developed markets (DM) bonds. We predict EM bonds shall be a rising reply to filling in no matter that, maybe declining, “40” is.

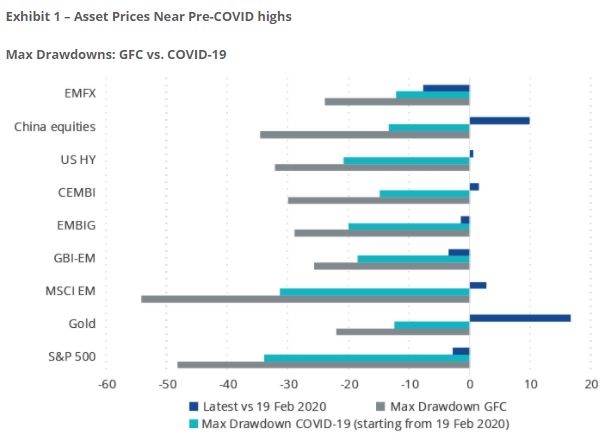

EMFX hasn’t even retraced half of its pre-COVID lows. Let’s focus on lagging and catching-up, first. Exhibit 1 beneath makes the purpose that almost all asset costs are largely again to their pre-COVID highs, with gold (wow!) and Chinese language equities (much more spectacular!) being properly above pre-COVID highs. (VanEck occurs to have main funds in each gold and EM equities). All the pieces else—together with all of the EM debt classes such because the EMBIG and CEMBI—is again to pre-Covid ranges. Aside from EMFX, although—it’s solely retraced beneath half of its pre-COVID lows.

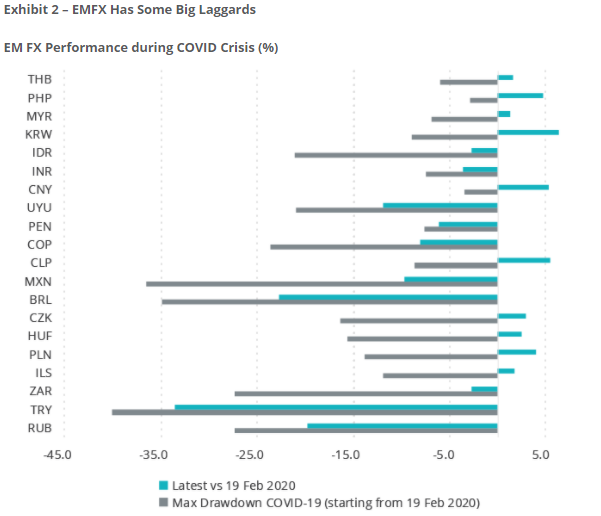

There are a variety of particular person EM foreign currency echange which have lagged considerably, however which shouldn’t have an apparent basic that deteriorated sufficient to clarify it: why is the Russian ruble down in keeping with the (to this point) de-rating Turkish lira? Exhibit 2 goes by way of the main EMFX intimately. The ruble actually stands out to us, given the nation’s low debt, excessive reserves, loads of fiscal and financial area and bettering financial construction. We don’t see an excellent purpose for this lagged forex efficiency. Equally for Peru, which has beta to world development attributable to its mining sector, but additionally nice defensive traits attributable to its sturdy steadiness sheet and good coverage observe document. Each of those examples pay excessive actual rates of interest relative to their fundamentals, according to the core of our funding course of, after all.

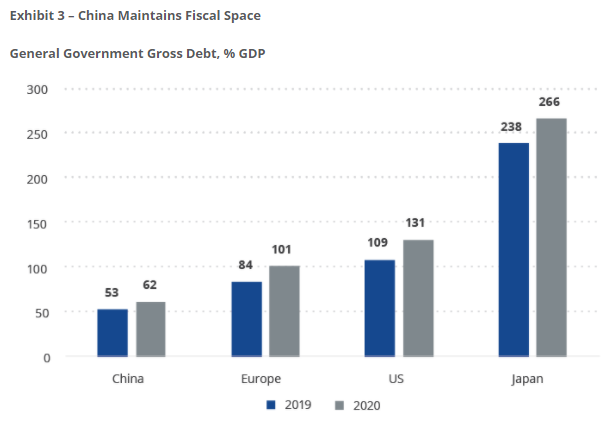

Another excuse supportive of native forex is their policymakers’ typically orthodox stances—paying excessive actual rates of interest and sustaining fiscal area through limiting debt and deepening structural reform. China shall be our poster baby for this sort of bond market. First, let’s take a look at Chinese language authorities debt, relative to DM. Positive, a big portion of Chinese language debt is on the a part of corporates with various levels of implicit authorities assist, however let’s put that apart given the tightness of the nation’s monetary controls. China has plenty of flexibility to stimulate, if development is required to drive asset costs, but additionally pays excessive actual yields if development doesn’t materialize shortly.

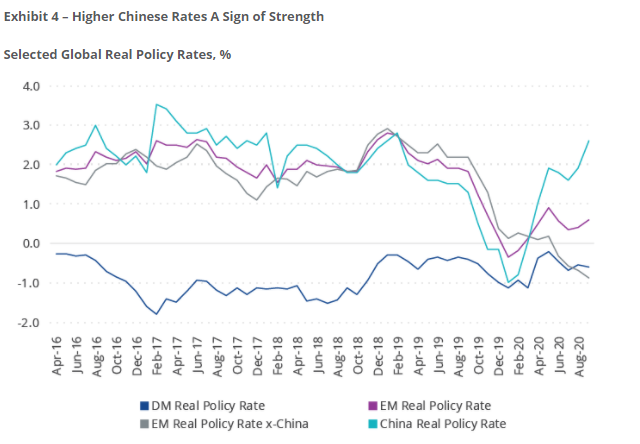

One other instance of coverage orthodoxy which rewards authorities bondholders additionally comes from China. The Exhibit beneath exhibits the upper actual coverage charges supplied by Chinese language bonds. This can be a reflection of the Chinese language authorities’ place of energy. They don’t have to gin-up development and markets with out finish and might afford to tighten coverage when wanted. This clearly optimizes long-term outcomes, as a result of any adversity might be met by loosening. It’s an indication of energy to be tightening coverage within the present nascent development atmosphere.

Publicity Sorts and Important Modifications

The modifications to our prime positions are summarized beneath. Our largest positions in October had been: Mexico, China, South Africa, Thailand and Indonesia.

- We elevated our native forex exposures in South Africa and Russia. The principle driver in South Africa was the expectation that the federal government’s funds presentation shall be life like, with a transparent path to the stabilization of the debt-to-GDP ratio. These expectations absolutely materialized. As regular, there are implementation dangers, however for now these developments improved the nation’s coverage check rating. As well as, there are clear indicators that the traditionally low prime fee is having a constructive affect on consumption and development. By way of our funding course of, this improves the nation’s financial check rating. As regards Russia, plenty of unhealthy information associated to geopolitics is already priced in (for instance, the ruble is among the many worst-performing currencies regardless of stellar macroeconomic fundamentals), which improves the nation’s technical check rating. In opposition to this backdrop, it’s changing into more and more tough to justify having an enormous underweight in Russia.

- We additionally elevated our native forex exposures in Malaysia and Peru. One purpose for selecting Malaysia is that the forex has one of many highest historic correlations with CNY, so it presents a great way to get diversified publicity to the area and categorical the China development outperformance theme. By way of our funding course of, this improved the nation’s technical check rating. Peruvian property suffered rather a lot previously months attributable to a really excessive COVID mortality fee, a really deep recession and plenty of political noise related to withdrawals from native pension funds and makes an attempt to question the president. These developments improved native valuations and restricted future vulnerabilities, strengthening the nation’s technical check rating. We additionally imagine that Peru is more likely to expertise massive international trade inflows if there may be one other spherical of pension fund withdrawals, which bodes properly for the forex (along with the sizable worldwide reserves and restricted exterior account pressures).

- Lastly, we elevated our arduous forex quasi-sovereign publicity and native forex publicity in Indonesia. The principle purpose is {that a} non permanent scare associated to a possible coverage rollback—which could have affected the central financial institution’s independence—appears to be over. Indonesia is slowly reverting to the fiscally orthodox path, whereas the not too long ago ratified Job Creation Legislation (Omnibus Legislation) supplies a firmer basis for development going ahead. On the exterior aspect, the present account is anticipated to point out additional enchancment in 2020, which ought to cut back strain on the central financial institution to tighten. By way of our funding course of, this improved the nation’s coverage check rating.

- We decreased our arduous forex sovereign publicity in Costa Rica and arduous forex company publicity in Mongolia. The Costa Rican authorities unexpectedly determined to tug and reassess its preliminary proposal to the IMF following large-scale demonstrations. The truth that the nation’s congress was not on board was a serious contributing issue. By way of our funding course of, this worsened the nation’s coverage check rating. As regards Mongolia, the company bond that we held there skilled 20+ factors value appreciation since Might. We noticed no discernible catalyst for additional value upside and there was little assist on the secondary market. By way of our funding course of, this worsened the technical check rating for the corporate.

- We additionally continued to divest from arduous forex company and quasi-sovereign publicity in Argentina and native forex publicity in Uruguay. In Argentina, we finalized the post-restructuring exit and took income from the debt trade by which we participated. Coverage-wise, it’s tough to seek out any constructive developments in Argentina. The federal government doesn’t appear to be able to dealing with the COVID pandemic, the worldwide reserves proceed to fall, the restoration stumbles, the hole between the official and market trade charges is extensive and there’s no prospect of reforms. So, each financial and coverage check scores for the nation proceed to worsen. The choice to exit Uruguay mirrored extra benign concerns—native valuations not look enticing and compelling after an enormous rally (by which we fortunately participated).

- Lastly, we decreased our arduous forex sovereign and company exposures in Israel. Our sovereign publicity was a low-spread off-index bond with a deteriorating technical check rating. As regards the company publicity, this was additionally a technical downgrade—the corporate’s valuation went down by one “Bucket”, and, as well as, our holding was diluted by a mum or dad firm. So, we selected to take revenue on our place and make use of the cash elsewhere.

Fund Efficiency

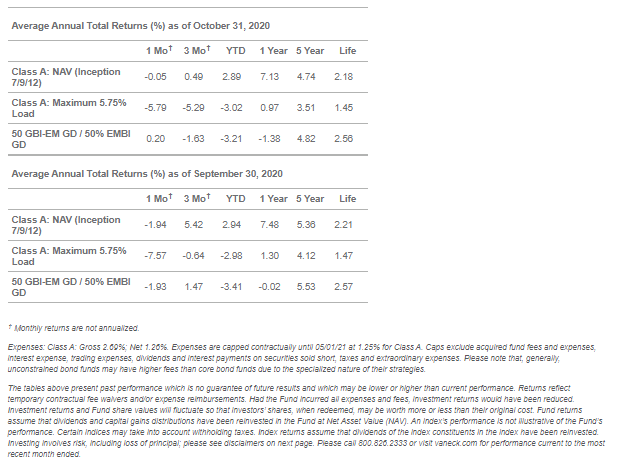

The VanEck Rising Markets Bond Fund (Class A shares excluding gross sales cost) misplaced 0.05% in October in comparison with a acquire of 0.20 % for the 50/50 J.P. Morgan Authorities Bond Index-Rising Markets International Diversified (GBI-EM) native forex and the J.P. Morgan Rising Markets Bond Index (EMBI) hard-currency index.

Turning to the market’s efficiency, GBI-EM’s greatest winners had been Mexico, Indonesia, and South Africa. Its greatest losers had been Turkey, Brazil and Poland. The EMBI’s greatest winners had been South Africa, Egypt, and Ukraine. Its losers had been Sri Lanka, Argentina and Costa Rica.

Initially printed by VanEck, 11/23/20

Disclosures

Supply of all Information: VanEck, Bloomberg.

Previous to Might 1, 2020, the fund was often called the VanEck Unconstrained Rising Markets Bond Fund.

Worth in danger (VaR) is a statistic that measures and quantifies the extent of monetary danger inside a agency, portfolio or place over a selected timeframe. Beta is a measure of the volatility–or systematic danger–of a safety or portfolio in comparison with the market as an entire. Correlation a statistic that measures the diploma to which two securities transfer in relation to one another.

Period measures a bond’s sensitivity to rate of interest modifications that displays the change in a bond’s value given a change in yield. This length measure is acceptable for bonds with embedded choices. Quantitative Easing by a central financial institution will increase the cash provide participating in open market operations in an effort to advertise elevated lending and liquidity. Financial Easing is an financial device employed by a central financial institution to cut back rates of interest and improve cash provide in an effort to stimulate financial exercise. Correlation is a statistical measure of how two variables transfer in relation to 1 different. Liquidity Phantasm refers back to the impact that an unbiased variable may need within the liquidity of a safety as such variable fluctuates time beyond regulation. A Holdouts Problem within the mounted earnings asset class happens when a bond issuing nation or entity is in default or on the brink of default, and launches an trade supply in an try and restructure its debt held by current bond holding traders. Carry is the profit or price for proudly owning an asset.

All indices are unmanaged and embrace the reinvestment of all dividends, however don’t mirror the cost of transaction prices, advisory charges or bills which might be related to an funding within the Fund. Sure indices might keep in mind withholding taxes. An index’s efficiency is just not illustrative of the Fund’s efficiency. Indices usually are not securities by which investments might be made. The Fund’s benchmark index (50% GBI-EM/50% EMBI) is a blended index consisting of 50% J.P. Morgan Authorities Bond Index-Rising Markets (GBI-EM) International Diversified and 50% J.P. Morgan Rising Markets Bond Index (EMBI). The J.P. Morgan GBI-EM International Diversified tracks native forex bonds issued by Rising Markets governments. The J.P. Morgan EMBI International Diversified tracks returns for actively traded exterior debt devices in rising markets, and can also be J.P. Morgan’s most liquid U.S. greenback rising markets debt benchmark.

Data has been obtained from sources believed to be dependable however J.P. Morgan doesn’t warrant its completeness or accuracy. The Index is used with permission. The index is probably not copied, used or distributed with out J.P. Morgan’s written approval. Copyright 2020, J.P. Morgan Chase & Co. All rights reserved.

Please notice that the knowledge herein represents the opinion of the portfolio supervisor and these opinions might change at any time and every so often and portfolio managers of different funding methods might take an reverse opinion than these acknowledged herein. Not supposed to be a forecast of future occasions, a assure of future outcomes or funding recommendation. Present market situations might not proceed. Non-VanEck proprietary info contained herein has been obtained from sources believed to be dependable, however not assured. No a part of this materials could also be reproduced in any type, or referred to in some other publication, with out categorical written permission of Van Eck Securities Company.

Investing entails danger, together with lack of principal. You may lose cash by investing within the Fund. Any funding within the Fund must be a part of an general funding program, not an entire program. The Fund is topic to dangers related to its investments in beneath funding grade securities, credit score, forex administration methods, debt securities, derivatives, rising market securities, international forex transactions, international securities, hedging, different funding firms, Latin American issuers, administration, market, non-diversification, operational, portfolio turnover, sectors and sovereign bond dangers. Investing in international denominated and/or domiciled securities might contain heightened danger attributable to forex fluctuations, and financial and political dangers, which can be enhanced in rising markets. Because the Fund might put money into securities denominated in foreign currency echange and a few of the earnings acquired by the Fund shall be in foreign currency echange, modifications in forex trade charges might negatively affect the Fund’s return. Derivatives might contain sure prices and dangers equivalent to liquidity, rate of interest, and the danger {that a} place couldn’t be closed when most advantageous. The Fund can also be topic to dangers related to non-investment grade securities.

Traders ought to take into account the Fund’s funding goal, dangers, prices, and bills of the funding firm fastidiously earlier than investing. Bond and bond funds will lower in worth as rates of interest rise. The prospectus and abstract prospectus include this and different info. Please learn them fastidiously earlier than investing. Please name 800.826.2333 or go to vaneck.com for efficiency info present to the latest month finish and for a free prospectus and abstract prospectus.

© 2020 VanEck.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.