Last month I forecasted we’d see a journey growth this summer time as newly vaccinated People e book their first massive journeys and holidays for the reason that pandemic started.

At this time I’m much more satisfied this can occur, following new steerage from the Facilities for Illness Management and Prevention (CDC) saying that totally vaccinated individuals can journey “at low threat to themselves.” What’s extra, vacationers inside the U.S. now not have to take a COVID-19 take a look at or self-quarantine afterward. The identical goes for worldwide journey until the vacation spot nation requires it. You possibly can learn the total steerage for your self by clicking right here.

That is all very constructive information for journey and hospitality shares generally, and airline shares particularly.

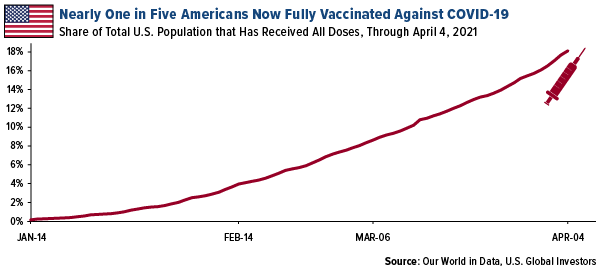

The restoration in business flight demand is already properly underway because the vaccine rollout accelerates. This previous Saturday, over Four million doses had been administered in a single 24-hour interval for the primary time. As of April 5, 18.8% of People over the age of 18—or almost one in 5—had been totally vaccinated towards COVID-19, in response to CDC information.

click on to enlarge

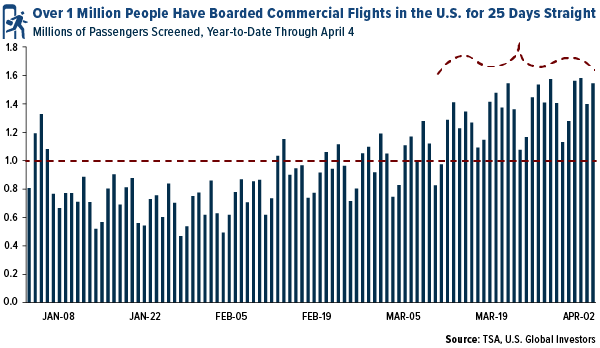

Consequently, increasingly more People are gaining the boldness to fly once more, regardless that quite a lot of research have proven that there’s low threat of transmission throughout flights. For 25 days straight, as of April 4, over 1 million individuals per day have been screened at U.S. airports, a exceptional signal that persons are able to get again to life as they remembered it.

click on to enlarge

Airways are in place to benefit from the upcoming demand growth, with many carriers having already expanded their networks. Beginning Might 1, Delta Air Strains will start promoting the center seat for the primary time since April 2020, making it the final main U.S. service to take action. “Now, with vaccinations turning into extra widespread and confidence in journey rising, we’re prepared to assist prospects reclaim their lives, Delta CEO Ed Bastian stated in a press release.

A New “Golden Age” of Journey?

Taking these constructive developments into consideration, quite a lot of analysts have revealed bullish outlooks on the trade. This week, Morgan Stanley analyst Ravi Shanker stated he sees 30% upside potential for choose airline shares within the close to time period, and 45% positive factors long term. “We’d not be stunned to see the return of the ‘golden age’ of journey within the 2020s,” he writes, likening at present’s state of affairs to the Roaring Twenties and Swinging Sixties.

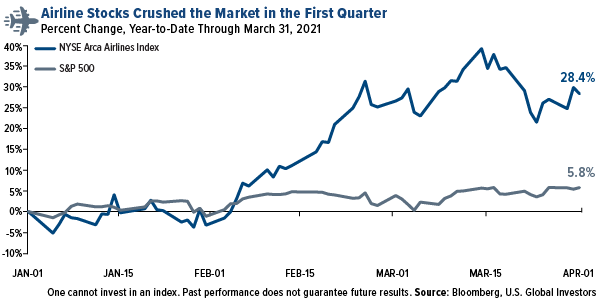

Within the first quarter of 2021, airline shares soared near 30%, handily outperforming the market. Among the many greatest performing carriers had been American Airways, up 55.5%; JetBlue Airways, up 46.3%; and Alaska Air Group, up 42.5%.

click on to enlarge

Providers Sector Expands at Quickest Tempo on Document

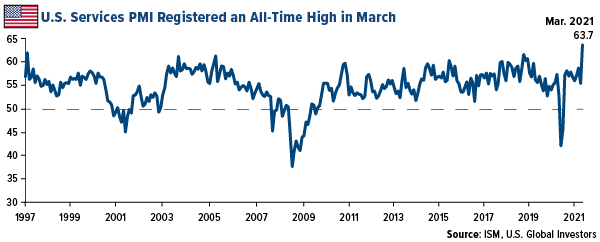

One other signal that the companies sector, which incorporates airways, has entered a high-growth interval is the Institute for Provide Administration’s (ISM) newest Report on Enterprise. In March, the Providers PMI clocked in at 63.7, the quickest price on document, exceeding the earlier document excessive set in November 2018.

click on to enlarge

The constructive report comes as forecasts for U.S. GDP progress in 2021 proceed to be revised up. At this time the Worldwide Financial Fund (IMF) up to date its projection, saying it now believes the U.S. financial system will develop at an annual price of 6.4%, up 1.Three share factors from its January forecast.

Frank Discuss Turns 14

On a last be aware, I’m happy to share with you that this month marks 14 years since I started writing Frank Discuss. To provide you some concept of how way back that’s, Twitter wasn’t but a yr previous, Barack Obama had simply introduced his candidacy for president and Donald Trump was nonetheless internet hosting The Apprentice. Few individuals had been speaking a few subprime mortgage disaster.

I wish to thank all of my readers, previous and new. With out you, none of this may have been potential.

Having stated that, if you happen to discover any worth in Frank Discuss, please take into account forwarding it on to a good friend or colleague you assume may get pleasure from it additionally. Ensure you allow them to know they’ll subscribe by clicking right here.

Initially revealed by US Funds, 4/7/21

Some hyperlinks above could also be directed to third-party web sites. U.S. International Traders doesn’t endorse all info provided by these web sites and isn’t liable for their content material. All opinions expressed and information offered are topic to vary with out discover. A few of these opinions will not be applicable to each investor.

The NYSE Arca International Airline Index is a modified equal greenback weighted index designed to measure the efficiency of extremely capitalized and liquid worldwide airline corporations. The S&P 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded corporations. The Providers PMI is a composite index based mostly on the diffusion indexes for 4 of the indications with equal weights: Enterprise Exercise (seasonally adjusted), New Orders (seasonally adjusted), Employment (seasonally adjusted) and Provider Deliveries.

Holdings could change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Traders as of (3/31/2020): Delta Air Strains Inc., American Airways Group Inc., JetBlue Airways Corp., Alaska Air Group Inc.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.