I’ve been writing about the pot

I’ve been writing about the potential for larger inflation for months, and now it seems to have lastly made landfall. Could’s headline client worth index (CPI) got here in at 5% year-over-year, the very best in over a decade.

The actual charge is probably going even larger.

Vitality commodities, and gasoline specifically, jumped essentially the most of every other measured merchandise. Vitality elevated 54.5% year-over-year, gasoline 56.2%, as oil costs hit multiyear highs this week on sturdy journey demand. A barrel of West Texas Intermediate (WTI) touched $71 at this time, a degree we haven’t seen since October 2018.

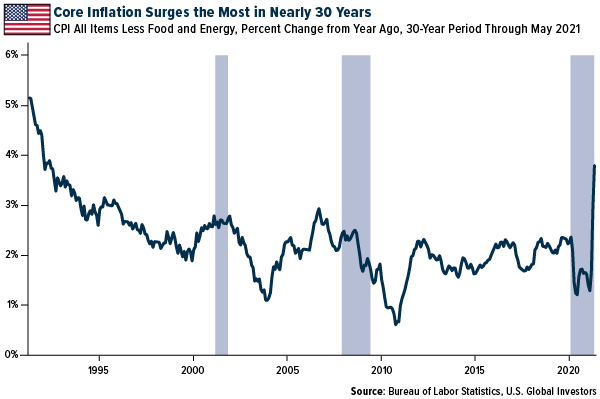

Check out what occurs if you strip out unstable vitality and meals costs. Core inflation, because it’s referred to as, surged 3.8% in comparison with final yr—which doesn’t sound spectacular till you understand that’s the quickest charge in almost 30 years. The final time we noticed core inflation this excessive, the highest movies in America have been White Males Can’t Bounce and Fundamental Intuition, and Normal Motors topped the record of Fortune 500 corporations.

click on to enlarge

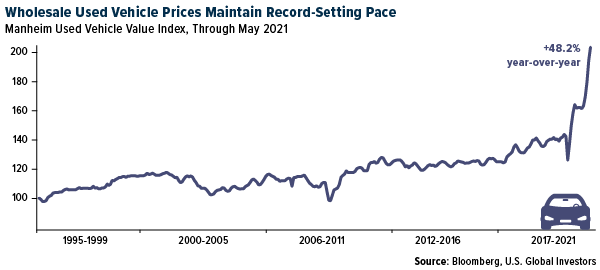

I hope nobody studying that is available in the market for a brand new automobile proper now. Because of the continued semiconductor chip scarcity, the availability of recent automobiles has all however evaporated, pushing up the value of beforehand owned vehicles and vehicles. The Manheim Used Automobile Worth Index hit a contemporary all-time excessive in Could, suggesting a 48% enhance in costs in comparison with final yr. Pickup vehicles have been up a staggering 70%.

click on to enlarge

Expectations are combined for the way for much longer the chip scarcity will final. Goldman Sachs chief Asia economist Andrew Tilton instructed CNBC final week that he believes we’re in “the worst interval” proper now, insinuating we’ll see some enchancment within the second half of the yr. Patrick Gelsinger, CEO of chipmaker Intel, isn’t so positive. He says the scarcity might final one other two years.

Hope for the Greatest, Put together for the Worst

I believe policymakers and analysts are simply as torn in regards to the potential longevity of this present rash of inflation. The Federal Reserve insists on describing it as “transitory,” largely in an effort to allay traders’ fears and calm markets.

Solely time will inform if this evaluation was correct, however in the meanwhile, the gesture appears to be working: The S&P 500 closed at a brand new file excessive final Thursday, the identical day inflation knowledge was launched. In the meantime, gold, traditionally used as an inflation hedge, barely budged, and bitcoin, a digital model of gold, retreated by as a lot as 1.8%.

It’s doable that Could’s inflation charge was already priced in. That being stated, I’d nonetheless strongly contemplate including to my gold publicity, together with gold mining shares. Bitcoin must also be a consideration.

As I’ve identified earlier than, I consider the CPI considerably understates the affect inflation has on family wealth. The actual charge is probably going a lot larger. An alternate measure, John Williams’ Shadow Authorities Statistics, reveals that inflation might really be nearer to 13% year-over-year. Make investments accordingly.

On the Street Once more

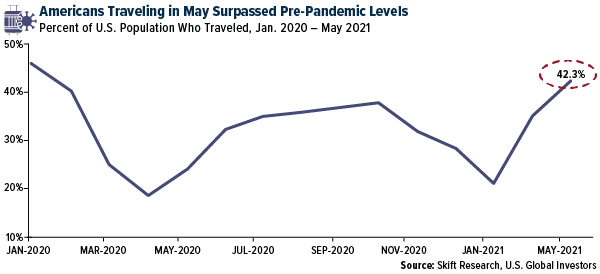

On the identical time that new automobiles are briefly provide, Individuals have begun to journey as a lot as they ever have, a key driver behind rising gas costs. In response to the journey trade information web site Skift, the variety of Individuals who traveled in Could surpassed those that traveled in February 2020, earlier than the pandemic. Greater than 42% of Individuals stated they traveled throughout the U.S., in comparison with 40.5% 16 months in the past.

click on to enlarge

And it’s not simply vehicular journey we’re speaking about right here. U.S. airports have gotten so unexpectedly busy that the Transportation Safety Administration (TSA) is searching for inside workplace volunteers to deal with non-screening duties akin to administration of safety strains

That is massively supportive of journey trade equities, airways specifically, as we progress deeper into the busy summer season journey season.

Though solely 2% of Individuals traveled outdoors of the U.S. in Could, in comparison with 7% in February 2020, I anticipate this to vary quickly as vaccination charges enhance. Final week, France turned the most recent European Union (EU) member to begin accepting vaccinated guests from the U.S. and elsewhere, and a new journey move that enables individuals to maneuver extra freely between European nations was lastly endorsed by EU lawmakers.

“Journey corporations should be ready” for the summer season surge, commented Haixia Wang, VP of analysis at Skift.

That’s exactly what home and worldwide airways proceed to do. Air France is about to convey 22 plane out of storage with a purpose to considerably enhance flights to the U.S. Air Canada will reportedly resume quite a few worldwide flights this month, from Canada to India, Mexico, the Caribbean and extra.

Initially revealed by US Funds, 6/14/21

All opinions expressed and knowledge supplied are topic to vary with out discover. A few of these opinions will not be acceptable to each investor. By clicking the hyperlink(s) above, you’ll be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all info equipped by this/these web site(s) and isn’t chargeable for its/their content material. Beta is a measure of the volatility, or systematic threat, of a safety or portfolio compared to the market as a complete.

The S&P 500 Inventory Index is a well known capitalization-weighted index of 500 frequent inventory costs in U.S. corporations. The buyer worth index (CPI) measures the typical change in costs over time that customers pay for a basket of products and companies, generally often called inflation. The Fortune 500 is an annual record compiled and revealed by Fortune journal that ranks 500 of the biggest United States firms by whole income for his or her respective fiscal years. The Manheim Used Automobile Worth Index is a time-series measurement of wholesale used automobile costs.

Holdings could change every day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. International Buyers as of (03/31/2021): Air Canada.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.