A United Arab Emirates country-specific alternate traded fund rallied Tuesday as extra internationa

A United Arab Emirates country-specific alternate traded fund rallied Tuesday as extra international traders flock into this rising market.

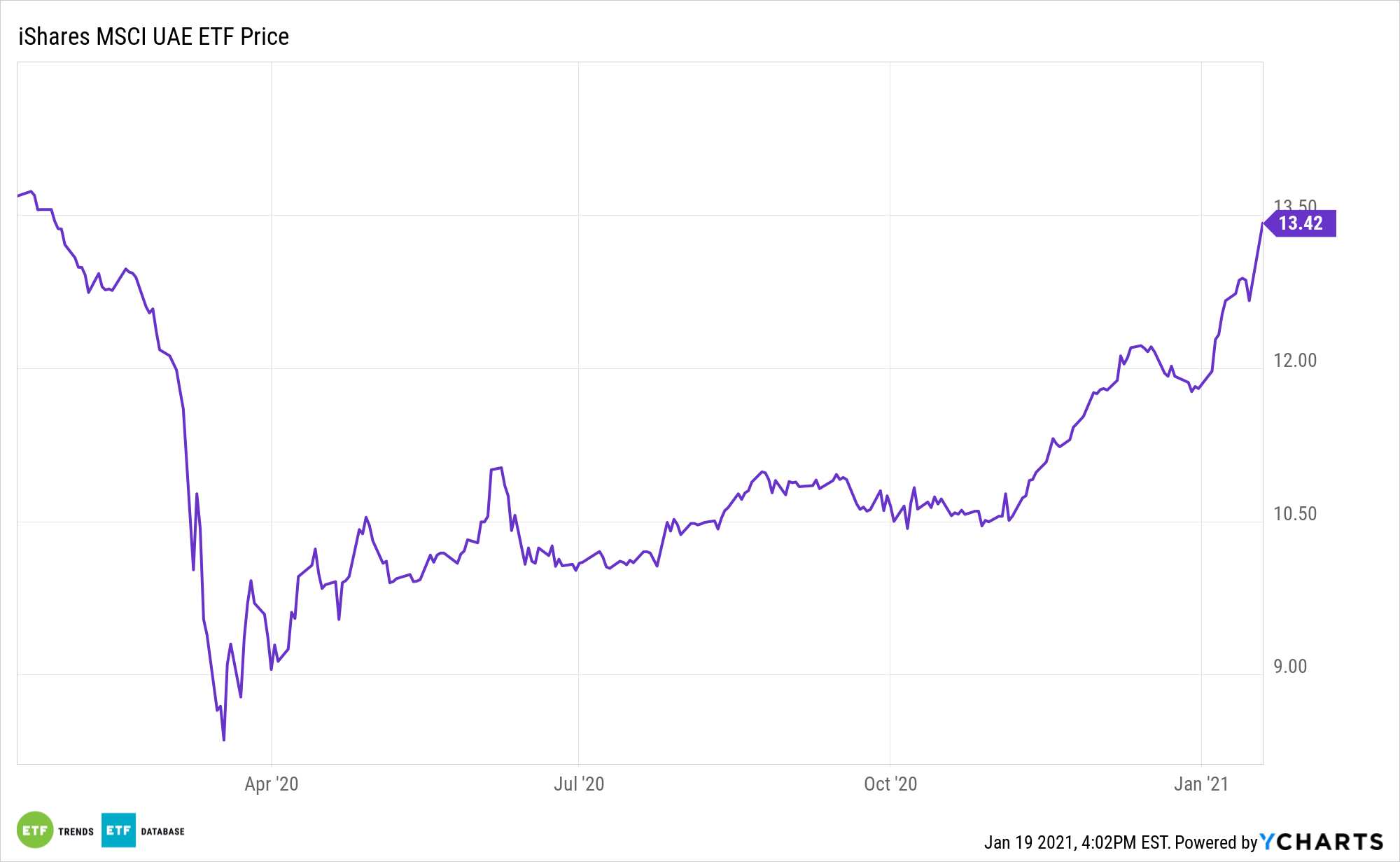

The iShares MSCI UAE ETF (UAE) was among the many greatest performing non-leveraged ETFs of Tuesday, leaping 5.9%. In the meantime, the broader iShares Core MSCI Rising Markets ETF (NYSEArca: IEMG) was 1.5% increased.

U.A.E. markets superior Tuesday, powered by the nation’s telecommunication companies, on prospects that non-U.A.E. traders will likely be rising their stakes within the rising economic system.

The 2 important cellphone operators within the United Arab Emirates jumped after stating they may increase the bounds on international possession, becoming a member of others within the Gulf area attempting to draw extra abroad capital, Bloomberg studies.

Among the many high gainers, Etisalat and Du each surged as a lot as 15% shortly after the open in Dubai and Abu Dhabi, hitting the utmost restrict underneath the exchanges. Etisalat reached a report excessive whereas Du was at its highest degree since 2016.

UAE features a 13.2% place in Etisalat.

The upper allotted cap on international possession will enable index suppliers like MSCI Inc. and FTSE Russell to lift their publicity for benchmark indices on emerging-market equities, probably attracting much more passive inflows into the market.

Foreigners at present maintain about 4.8% of Etisalat’s shares and make up solely 0.48% of Du.

The boards of each Etisalat and Du will meet on January 20, in response to regulatory filings.

The UAE has elevated efforts to draw funding into the economic system, which has been exhausting hit by the coronavirus pandemic and the pullback in oil costs. Abu Dhabi, the capital of the UAE, loosened its firm legal guidelines late final 12 months to permit extra international possession of its markets because it sought to lift its personal sector exercise. The UAE beforehand stated it should enable foreigners to carry 100% of companies throughout its industries.

For extra information and data, go to our Fairness ETF Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.