ETF buyers could make a play on electrical automobiles with the International X Lithium & Batte

ETF buyers could make a play on electrical automobiles with the International X Lithium & Battery Tech ETF (LIT).

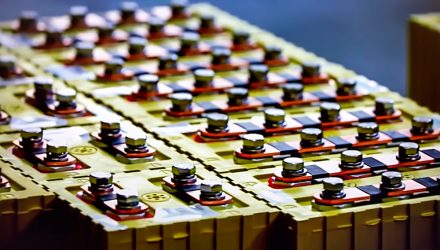

LIT seeks to supply funding outcomes that correspond usually to the value and yield efficiency of the Solactive International Lithium Index, which is designed to measure broad-based fairness market efficiency of world corporations concerned within the lithium business. LIT provides buyers:

- Environment friendly Entry: LIT affords environment friendly entry to a broad basket of corporations concerned in lithium mining, lithium refining, and battery manufacturing.

- Thematic Publicity: The fund is a thematic play on lithium and battery expertise.

LIT was a excessive flyer in 2020, hovering to beneficial properties of over 120%. With the rise of electrical automakers like Tesla, extra energy might be forward.

A Tesla Provider Making Huge Strikes

Tesla is one among LIT’s high 10 holdings as of December 31, 2020. Its provider, Modern Amperex Know-how Co Ltd (CATL) is making massive strikes within the lithium area.

Per a Yahoo Finance report, CATL “is eyeing elevated manufacturing capability to satisfy the rising calls for of inexperienced power automobile producers. CATL is planning to speculate a complete of 39 billion yuan ($6 billion) in lithium-ion battery manufacturing initiatives in three cities in Fujian, Sichuan and Jiangsu provinces, CNTech Submit reported.”

“With new power automobile demand more likely to obtain an impetus from the hunt to include air pollution globally, demand for batteries is more likely to enhance,” the article added. “Batteries account for roughly 40%-50% of the price of an EV. They’re additionally central to rising the effectivity and vary of EVs. The growth of battery suppliers might be thought of as main indicator for EV demand, and due to this fact ought to bode nicely for EV makers.”

Technically Talking, Is It Time to Purchase?

The query now could be whether or not LIT can maintain its cost from 2020 into 2021. The fund is up about 20% from its 50-day shifting common, and its relative energy index (RSI) indicator has been in overbought ranges for the reason that finish of November.

What goes up ultimately has to come back down, however a shifting common convergence divergence (MACD) filter reveals the exponential shifting common (EMA) above its sign line, which generally means a shopping for alternative. The amount spike in November and past actually helps the excessive curiosity within the fund.

For extra information and data, go to the Thematic Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.