By DeFred Folts III, Managing Accomplic

By DeFred Folts III, Managing Accomplice, Chief Funding Strategist, and Eric Biegeleisen, CFA, Managing Director, Analysis Portfolio Supervisor

Abstract

-

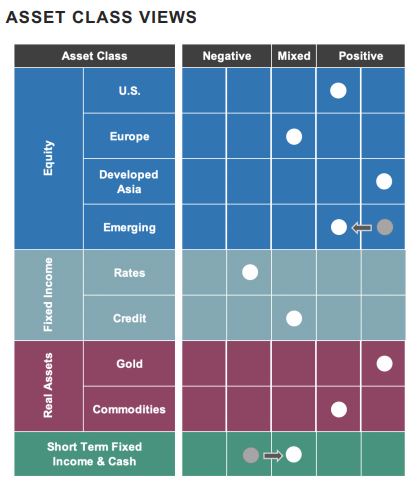

- Japanese equities stay pretty valued and will profit from improved progress prospects supported by sustained financial and monetary stimulus. U.S. fairness markets stay overvalued by our measures; nevertheless, financial and monetary stimulus stays supportive. Ought to latest will increase in short-term rates of interest in Rising Markets proceed, this might sign a financial tightening and create a headwind for continued progress. European equities stay blended.

- At the same time as rates of interest have risen considerably, U.S. Treasuries proceed to supply an unattractive risk-return trade-off. Whereas the Fed continues to assist credit score markets, dangers stay because of the document quantity of company debt.

- Gold continues to be supported by unfavourable actual rates of interest. Commodities stay comparatively undervalued and may benefit from a rise in international demand and the potential for additional greenback weak spot.

[wce_code id=192]

Outlook

Outlook

Our mannequin analysis continues to search out fairness asset courses comparatively enticing presently because of continued financial and monetary assist and narrowing high-yield credit score spreads. Japanese equities stay probably the most enticing fairness asset class, benefitting from extra cheap valuations, optimistic prospects for financial progress and up to date optimistic value momentum. Throughout January, the relative attractiveness of Rising Market equities declined considerably because of a rise in short-term rates of interest in China and rising Asia, however the outlook for EM equities is optimistic general. U.S. equities stay decidedly overvalued however proceed to learn from financial and monetary stimulus, continued tightening of high-yield credit score spreads, favorable investor conduct and optimistic This autumn 2020 company earnings experiences. The outlook for European equities is blended; they’re firmly in overvalued territory, however like different fairness asset courses additionally profit from tightening credit score spreads.

Though yields on U.S. Treasuries have risen not too long ago, they proceed to yield lower than the market’s anticipated inflation price (unfavourable actual yields) throughout all maturities, which presents an unattractive risk-return trade-off. The mixture of traders reaching for yield and the Fed’s continued tacit assist of the credit score markets (company bonds), credit score spreads – the distinction between company and authorities bond yields – have narrowed even additional. Nonetheless, with document quantities of company debt excellent and with document low yields for high-yield bonds, there may be heightened danger that any accident within the monetary markets might trigger credit score spreads to widen abruptly.

The persevering with story of unfavourable actual yields (nominal yields much less anticipated inflation) and the prospect for extra fiscal stimulus from the Biden administration proceed to make Gold a comparatively enticing asset class supplied actual yields stay unfavourable. Commodities stay enticing because of the longstanding relative undervaluation of actual property, the prospect for U.S. greenback weak spot and the potential for a rise in demand from China and the remainder of Asia.

Brief-Time period Mounted Earnings & Money sometimes serves as dry-powder for shoppers, although a lot stays deployed within the alternatives offered above.

About 3Edge Asset Administration

3EDGE is a multi-asset funding administration agency that makes use of a proprietary mannequin to investigate market valuation metrics (long-term), financial forces (medium-term), and investor behavioral elements (brief time period) that we consider drive the worldwide capital markets. Our crew of pros attracts on a long time of funding administration expertise and their analysis in quantitative strategies, together with system dynamics, machine studying, synthetic intelligence, and multi-player sport principle to hunt to determine undervalued and overvalued asset courses throughout the globe that could be poised to enter a interval of market outperformance or underperformance. Whereas we goal to generate enticing risk-adjusted returns, we additionally prioritize risk-management in an effort to restrict portfolio declines for our shoppers, notably during times of utmost market disruptions. Our shoppers embody people, household places of work, institutional traders, and registered funding advisors.

DISCLOSURES: This commentary and evaluation is meant for info functions solely and is as of January 6, 2021. This commentary doesn’t represent a proposal to promote or solicitation of a proposal to purchase any securities. The opinions expressed in View From the EDGE® are these of Mr. Folts and Mr. Biegeleisen and are topic to alter with out discover in response to shifting market situations. This commentary just isn’t meant to supply private funding recommendation and doesn’t have in mind the distinctive funding goals and monetary state of affairs of the reader. Traders ought to solely search funding recommendation from their particular person monetary adviser. These observations embody info from sources 3EDGE believes to be dependable, however the accuracy of such info can’t be assured. Investments together with widespread shares, mounted revenue, commodities, ETNs and ETFs contain the chance of loss that traders must be ready to bear. Funding within the 3EDGE funding methods entails substantial dangers and there could be no assurance that the methods’ funding goals might be achieved. Previous efficiency might not be indicative of future outcomes.

Actual Belongings (Gold & Commodities) contains valuable metals comparable to gold in addition to investments that function and derive a lot of their income in actual property, e.g., MLPs, metals and mining companies, and so forth. Brief-Time period Mounted Earnings and Money contains money, money equivalents, cash market funds, and stuck revenue funds with a mean length of two years or much less. Intermediate-Time period Mounted Earnings contains mounted revenue funds with a mean length of larger than 2 years and fewer than 10 years.

View from the EDGE is a registered trademark of 3EDGE Asset Administration, LP

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.