By Christopher Carpentier, CFA, FRM, Funding Strategist; Arkady Ho, CFA, Fastened R

By Christopher Carpentier, CFA, FRM, Funding Strategist; Arkady Ho, CFA, Fastened Revenue Portfolio Specialist

Ought to institutional buyers take into account including Bitcoin as an asset class inside a well-diversified portfolio? Tales within the enterprise press about cryptocurrency values and market capitalization[1] might sound to level to critical consideration, and we’ve obtained many requests for steering on this matter. As a result of every of our institutional purchasers has distinctive threat and return necessities, in addition to constraints, that may be addressed in numerous methods, we don’t have a single reply to the cryptocurrency query.

Extra related for many events, we imagine, is how State Avenue World Advisors constructions its eager about Bitcoin and different cryptocurrencies.[2] We firmly imagine that every funding in a portfolio ought to have recognized drivers and relationships that describe the environments by which it excels or underperforms. This isn’t at present the case for Bitcoin and different non-asset-backed cryptocurrencies.

On this paper, we’ll discover the query of Bitcoin’s relevance to institutional buyers in some depth. We first overview a few of the functions {that a} Bitcoin allocation could be proposed to serve in an institutional portfolio. Second, we give attention to recognized challenges that institutional buyers would possibly face when investing in Bitcoin, and focus on the problems which may must be clarified or resolved for investments in unbacked cryptocurrencies to be acceptable for an institutional allocation. Lastly, as a result of this market is rising so shortly and evolving so quickly, we focus on what the approach ahead for cryptocurrencies would possibly appear like and the way this would possibly have an effect on future consideration by institutional buyers.

Potential Functions of a Bitcoin Allocation

Foreign money Various. Bitcoin was launched in 2009 with the intent to exchange fiat currencies, that are sometimes backed by “the complete religion and credit score” of a sovereign state. Bitcoin was meant to function a freestanding retailer of worth and medium of alternate, envisioned to be immune from potential manipulation by any centralized authority, together with central banks and governments.

Bitcoin’s creators[3] supposed to keep away from the implied connection that established currencies have with central banks and governments. Which means buyers, confronted with an unstable or untrustworthy authorities, would possibly discover it interesting to instrumentalize cryptocurrencies as a retailer of worth. Particularly with respect to nations with a historical past of capital controls, there could also be a bonus in being unconnected to the political fortunes of a given nation.

Three fundamental qualities describe currencies: they’re a broadly accepted medium of alternate, they function a unit of account, and they’re a steady retailer of worth. Whereas Bitcoin aspires to turn into a longtime forex, it at present fails when measured towards every of those three qualities.

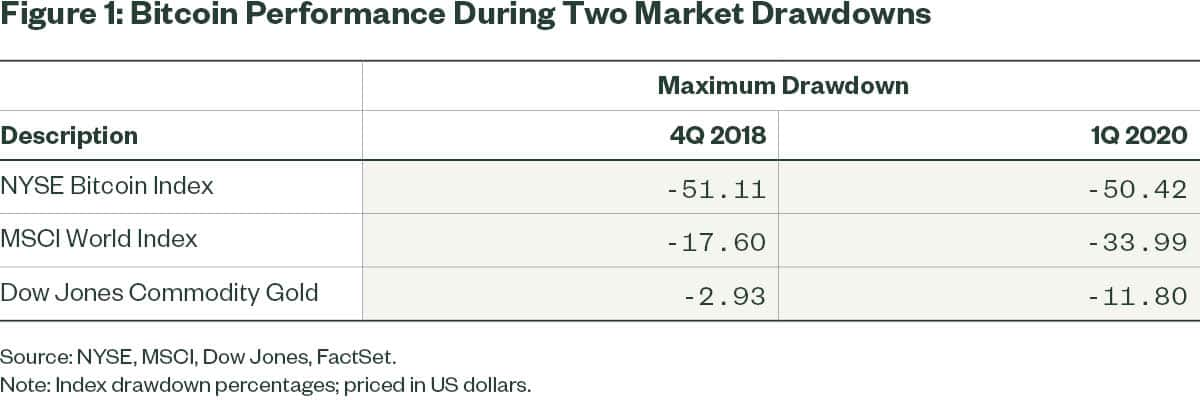

Capital Safety. When contemplating Bitcoin as a capital safety asset, gold is the benchmark towards which we measure. Gold is interesting to buyers when actual rates of interest are low, a time that usually coincides with excessive fairness market volatility and drawdowns. two current risky drawdown occasions – the heightened commerce struggle rhetoric of 4Q 2018 and the COVID-19 pandemic of 1Q 2020 – we see excessive sell-offs in Bitcoin and an accompanying lack of draw back safety. As proven in Determine 1, the utmost drawdown in Bitcoin considerably exceeded that of each international equities and gold; Bitcoin seems to lack the traits of a “worth retailer.”

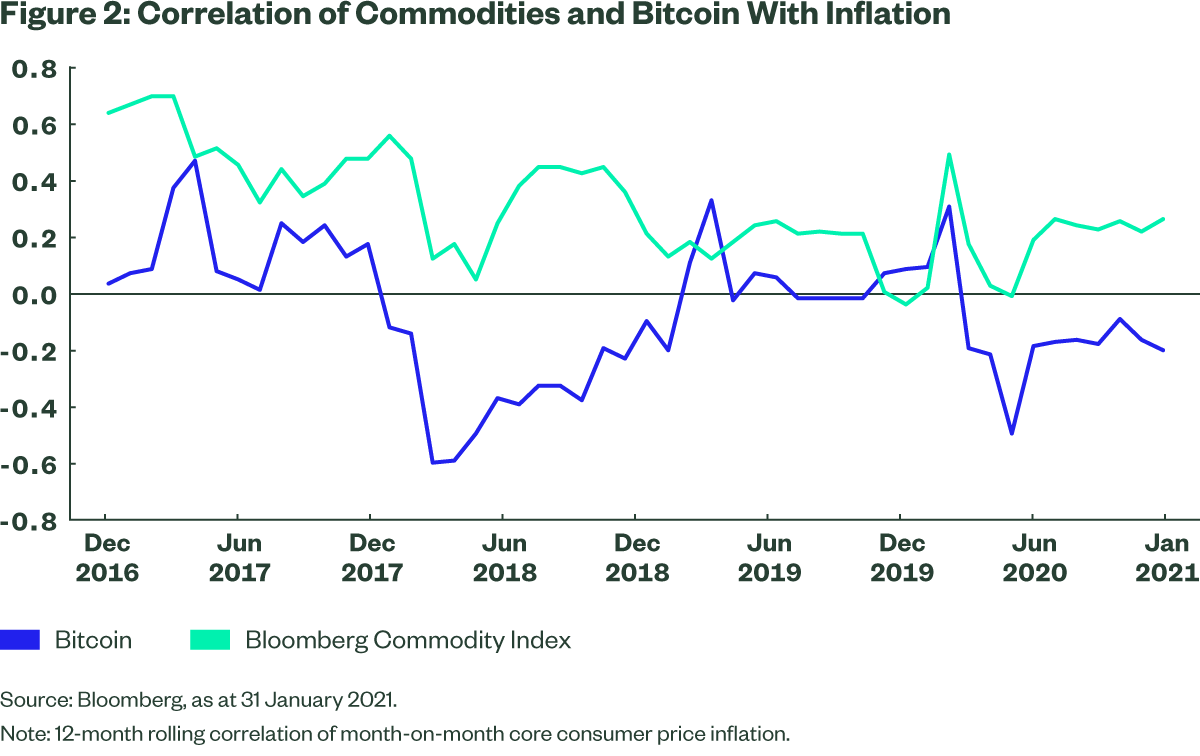

Inflation Hedging. We use the broad commodities complicated as a benchmark for inflation hedging. A restricted provide helps commodities to shortly worth in inflation all through the enterprise cycle. Bitcoin’s provide can be restricted, and the cryptocurrency is usually touted as an inflation hedge as effectively. At this level, nonetheless, the analogy appears tenuous at finest.

Determine 2 shows each commodities’ well-established correlation with inflation and Bitcoin’s lack of correlation with inflation. It is usually necessary to recollect on this dialogue that Bitcoin’s worth historical past is restricted; cryptocurrencies have solely been in circulation throughout a time when inflation has been largely inconsequential.

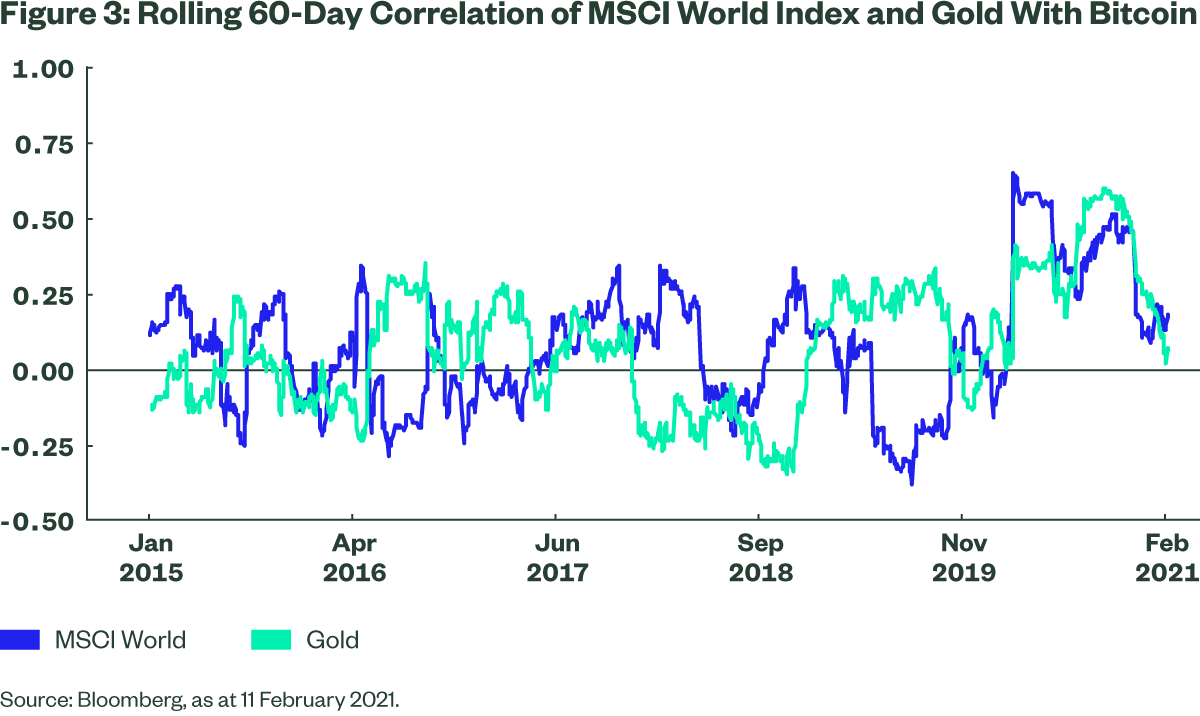

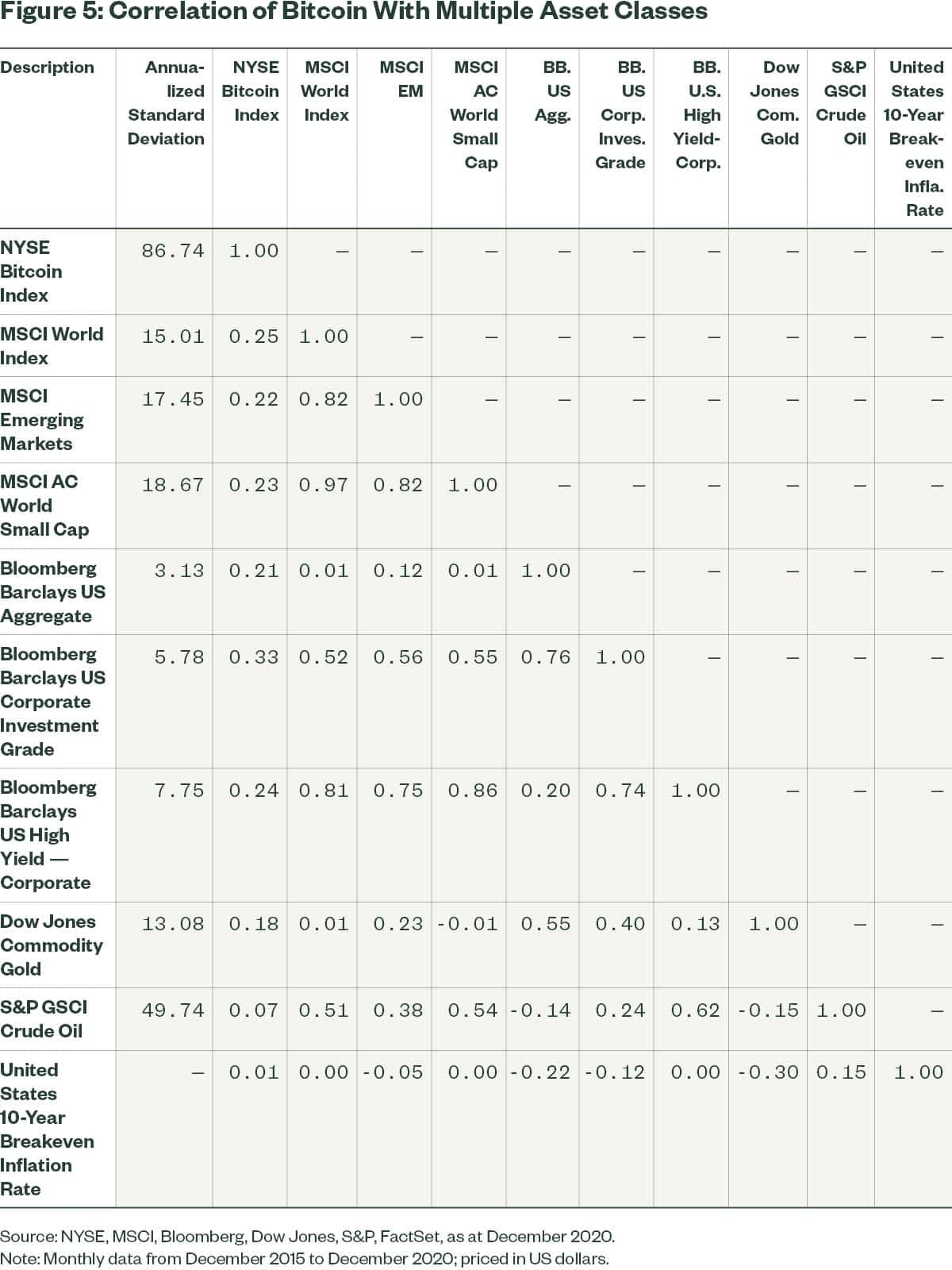

Portfolio Diversification. Bitcoin’s usually low correlations to market actions in different asset lessons over the long term counsel that an allocation to Bitcoin might assist to diversify a broader portfolio (see Determine 3). Inclusion of any uncorrelated asset ceaselessly improves a broad portfolio’s risk-adjusted returns, and a few research have proven that Bitcoin has finished simply that.[4]

Rolling correlations present that any relationships are sporadic. As an example, though the five-year correlation between Bitcoin and the MSCI World Index is 0.25, the rolling correlation gyrates between optimistic and unfavorable territory over that interval.

[wce_code id=192]

Bitcoin could in the end make sense as a portfolio diversifier, however inclusion additionally is dependent upon buyers’ tolerance of excessive volatility and their evaluation of its return potential. For buyers with a excessive tolerance for volatility and a return-potential evaluation that isn’t overly unfavorable, Bitcoin might doubtlessly function a viable allocation on the premise of diversification alone. Put otherwise, Bitcoin might serve a job as a diversifier if its diversification advantages outweigh the excessive volatility and potential for critical loss. See the Appendix for correlations throughout a broad spectrum of asset lessons.

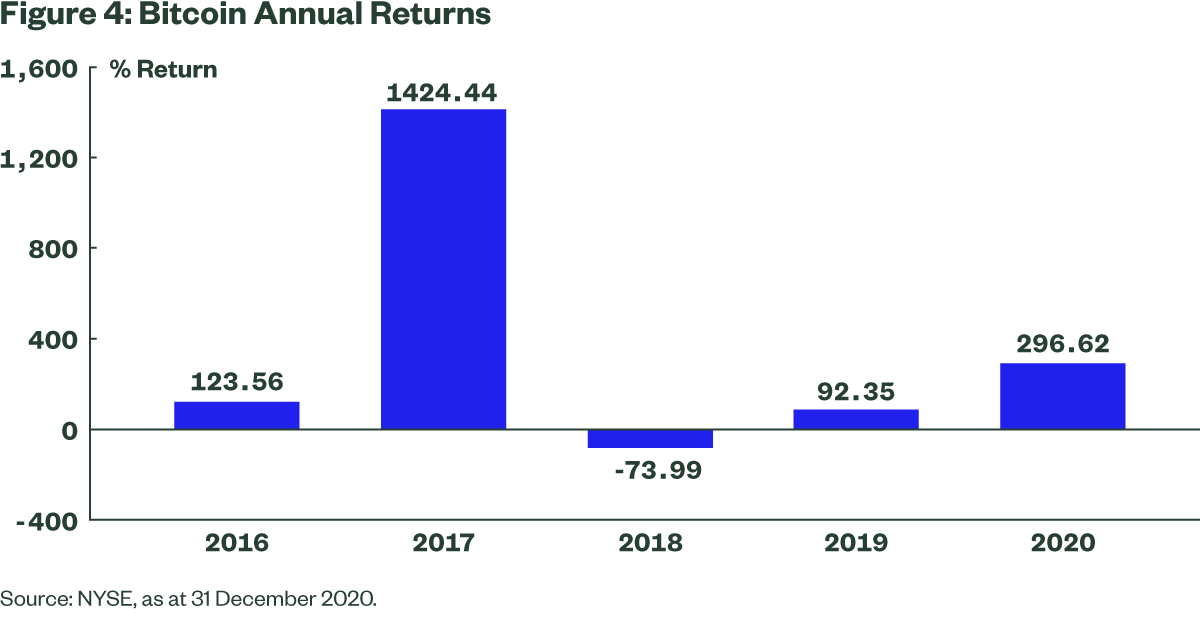

Threat Asset. Volatility is a crucial aspect to think about when investing in Bitcoin. Determine Four exhibits annual Bitcoin returns for the previous 5 years. The worth motion of the cryptocurrency over the previous 5 years exhibits an annualized volatility of 86%,. Statistically, this implies that there’s a 32% likelihood of getting a yearly return higher than +/-86%, assuming a traditional distribution of returns. As an asset class, solely crude oil comes even remotely near this diploma of worth motion, with an annualized volatility of 50%. The inflated volatility suggests potential income from Bitcoin as an funding, which could be interesting throughout low-yield durations, equivalent to the present atmosphere.

With this excessive volatility in thoughts, we imagine that present Bitcoin investments must be largely seen as speculative bets somewhat than progress belongings. Cryptocurrencies are nonetheless a novel asset class, and a real understanding of their valuation and worth motion is elusive in contrast with conventional asset lessons inside a well-diversified portfolio. It’s additionally necessary to do not forget that Bitcoin has solely existed in a world of rising fairness markets and low inflation. That stated, it’s nonetheless helpful to consider the longer term trajectory of Bitcoin and assess the challenges that should be overcome for cryptocurrencies to emerge as a reputable allocation for institutional buyers.

Challenges Dealing with Bitcoin Buyers

Quite a lot of challenges must be overcome to ensure that Bitcoin to be thought-about a defensible alternative for institutional buyers. These embrace valuation considerations, dangers stemming from the complexities inherent to the asset, and the long-term sustainability of the Bitcoin market.

Valuation. The shortage of a tangible backing, yield, or revenue makes assessing the worth of Bitcoin an advanced course of and partly explains its elevated volatility ranges.

The challenges in figuring out the intrinsic worth of an unbacked cryptocurrency equivalent to Bitcoin are quite a few and complicated. Current fiat forex valuations are decided partly through anticipated cashflows and valuation metrics which can be in the end tied to a rustic’s progress and inflation patterns. With Bitcoin, there are not any anticipated future money flows that may be discounted to the current. Valuation is subsequently based mostly solely on provide/demand elements and predicated on the hope that future buyers pays extra for this intangible asset. In consequence, the chance of Bitcoin dropping virtually all of its worth is just not negligible.

The vast dispersion of Bitcoin worth targets amongst totally different market observers is one indicator of the issue in valuing cryptocurrencies. Some commentators imagine that Bitcoin has the potential to displace gold as a main different retailer of worth within the type of “digital gold.” On this vein, based mostly on an equalization with the US$2.7 trillion international non-public inventory of gold, JP Morgan not too long ago urged a long-term goal worth for Bitcoin of US$146,000.[5] In December, the CIO of Guggenheim Investments urged a good worth of US$400,000.[6] Alternatively, UBS not too long ago expressed that they “are considerably skeptical of any important real-world use instances… [and] are cognizant of the actual threat of dropping one’s whole funding.”[7]

Dangers. The boundary between concept and apply is appreciable within the case of cryptocurrencies – and much more so for institutional buyers seeking to achieve publicity to them. Outdoors of valuation, the complexities of investing in Bitcoin are multifaceted and embrace a variety of dangers that few buyers are outfitted to handle. These dangers embrace these posed by a lack of knowledge of the expertise underpinning the crypto; fragmented regulatory frameworks; technical vulnerabilities (e.g., bugs within the code, threat of cybertheft); aggressive dangers (e.g., low boundaries to entry for brand spanking new cryptoassets); uncertainty within the software of accounting guidelines to cryptocurrencies; and environmental considerations associated to the vitality required for mining new Bitcoins.

Sustainability. In a non-asset-backed cryptocurrency market that strikes purely on provide and demand –and is intentionally divorced from all discernible investing fundamentals – a logical query stays as as to whether a selected cryptocurrency will live on over the time horizon of an institutional portfolio. The remark offered by UBS above definitely gave us pause.

The Method Ahead: Regulation

We’re agency believers that the technological innovation that underpins cryptocurrencies will rework the worldwide funds market going ahead. The notion of ready days for a transaction to clear will quickly turn into as archaic as mailing a private verify and ready for the mail service to ship it. The remaining query, nonetheless, is whether or not Bitcoin is that funds future. In the mean time, it isn’t.

Although the prospect of regulation seeks to disclaim the rogue birthright of cryptocurrencies, regulated cryptocurrencies would turn into extra steady mediums of alternate and shops of worth, which might open them up for consideration as a currency-like asset class. With guidelines and laws in place, mainstream acceptance and adoption would observe, and better acceptance would appeal to extra capital to the house, offering extra liquidity and in the end lowering volatility.

Latest regulatory steering in each america[8] and Europe[9] affords examples of regulators’ preliminary makes an attempt to offer readability, which ought to speed up the legitimization means of cryptocurrencies as a complete. Conversely, additional regulation could have the offsetting impact of dampening the curiosity of buyers who’re cautious of authority and who have been drawn to cryptocurrencies by the anonymity they offered. Nonetheless, we imagine regulation is a requirement for widespread institutional adoption.

Closing Ideas

Institutional curiosity in cryptocurrencies has grown over time. Regardless of the potential diversification advantages of Bitcoin, the problem of figuring out its worth and figuring out its elementary threat and return drivers is a significant hurdle to understanding its function and function inside a broader portfolio.

Though Bitcoin is the present cryptocurrency chief, nobody could be assured that this dominant place will final. For buyers who’re decided to tackle a cryptocurrency allocation as a strategic long-term holding, a diversified basket of cryptocurrencies could also be acceptable. Another choice is gaining publicity through trend-following Commodity Buying and selling Advisors or different sorts of hedge funds, lots of which implement real-time threat monitoring with outlined threat pointers.

In the end, we imagine every funding in a portfolio ought to have recognized drivers and relationships that enable buyers to moderately anticipate the environments by which it is going to excel or underperform. We at present characterize Bitcoin’s habits as that of a speculative threat asset; we proceed to observe its growth and look to additional outline its place inside a diversified portfolio.

Initially revealed by State Avenue, 3/9/21

References

Bolliger, Michael, Paul Donovan and Sundeep Gantori. “The rise of Bitcoin.” UBS. January 14, 2021.

Hougan, Matt and David Lawant. “Cryptoassets: The Information to Bitcoin, Blockchain, and Cryptocurrency for Funding Professionals.” CFA Institute Analysis Basis Temporary. 2021.

Nakamoto, Satoshi. “Bitcoin: A Peer-to-Peer Digital Money System.” www.bitcoin.org. October 31, 2008.

Panigirtzoglou, Nikolaos et al. “Flows and Liquidity: Has bitcoin equalized with gold already?” JP Morgan World Markets Technique. January 4, 2021.

Segal-Knowles, Christina. “Funds after the COVID disaster – rising points and challenges.” Webinar: London Faculty of Economics and Centre for Financial Coverage Analysis. June 11, 2020.

Appendix

Learn Extra

1 From finish September 2020 to late February 2021, Bitcoin quintupled in worth from about US$10,700 to over US$53,000. As of March 1, 2021, Bitcoin had a market cap of US$906 billion, and the worldwide cryptocurrency market had over 8,000 currencies with a complete market cap of almost US$1.5 trillion.

2 This dialogue relates solely to non-asset-backed cryptocurrencies, of which Bitcoin is essentially the most outstanding instance. We’ll use “Bitcoin” on this article as a proxy for all non-asset-backed cryptocurrencies. It’s useful to make a distinction between asset-backed and unbacked cryptocurrencies. Central financial institution digital currencies (CBDC) and stablecoins are backed by an asset or basket of belongings equivalent to fiat forex, commodity, or index. The asset-backed precept is designed to scale back the volatility of a cryptocurrency and elevate its use case as a medium of alternate, somewhat than as an funding alternative.

3 Bitcoin is a digital forex that was created in January 2009. It follows the concepts set out in a whitepaper by the mysterious and pseudonymous Satoshi Nakamoto. The identification of the individual or individuals who created the expertise remains to be a thriller.

4 See https://static.bitwiseinvestments.com/Analysis/Bitwise-The-Case-For-Crypto-In-An-Institutional-Portfolio.pdf

5 JP Morgan (January 2021).

6 https://www.bloomberg.com/information/articles/2020-12-16/guggenheim-s-scott-minerd-says-bitcoin-should-be-worth-400-000

7 UBS (January 2021).

8 https://www.occ.gov/news-issuances/news-releases/2021/nr-occ-2021-2a.pdf

9 https://www.politico.eu/wp-content/uploads/2020/09/CLEAN-COM-Draft-Regulation-Markets-in-Crypto-Property.pdf

ssga.com

For advertising and marketing use.

State Avenue World Advisors World Entities

The views expressed on this materials are the views of the Funding Technique and Analysis crew as of March 3, 2021, and are topic to vary based mostly on market and different circumstances. This doc accommodates sure statements which may be deemed forward-looking statements. There isn’t a illustration nor guarantee that such statements are ensures of any future efficiency. Precise outcomes or developments could differ materially from the views expressed. The data offered doesn’t represent funding recommendation and it shouldn’t be relied on as such. It shouldn’t be thought-about a solicitation to purchase or a proposal to promote a safety. It doesn’t take into consideration any investor’s explicit funding aims, methods, tax standing or funding horizon. It is best to seek the advice of your tax and monetary advisor.

Foreign money threat is a type of threat that arises from the change in worth of 1 forex towards one other. At any time when buyers or corporations have belongings or enterprise operations throughout nationwide borders, they face forex threat if their positions aren’t hedged. Cryptocurrencies are topic to a lot of distinctive dangers, together with however not restricted to valuation, enabling expertise, regulatory frameworks, and accounting guidelines. Cryptocurrencies could decline in worth and should at any level be value lower than the unique value of the funding. There’s a threat that non-asset-backed cryptocurrencies could lose most or all of their worth.

All data is from SSGA except in any other case famous and has been obtained from sources believed to be dependable, however its accuracy is just not assured. There isn’t a illustration or guarantee as to the present accuracy, reliability or completeness of, nor legal responsibility for, choices based mostly on such data and it shouldn’t be relied on as such.

Investing includes threat together with the chance of lack of principal.

All of the index efficiency outcomes referred to are offered completely for comparability functions solely. It shouldn’t be assumed that they signify the efficiency of any explicit funding.

The logos and repair marks referenced herein are the property of their respective homeowners.

The entire or any a part of this work will not be reproduced, copied or transmitted or any of its contents disclosed to 3rd events with out SSGA’s categorical written consent.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.