The actual yield, w

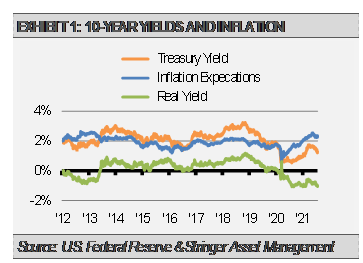

The actual yield, which is the yield an investor receives after adjusting for inflation, on the 10-Yr U.S. Treasury bond just lately reached a document low degree. To calculate the true yield, we merely take the present 10-year Treasury yield and subtract the present 10-year inflation expectations as measured by the Treasury Inflation Protected Safety (TIPS) breakeven unfold. This breakeven inflation price represents a measure of anticipated inflation, and the most recent worth implies what market individuals anticipate inflation to be within the subsequent 10 years on common.

Which means after accounting for inflation expectations, the inflation-adjusted yield on the 10-Yr Treasury bond is now fairly unfavorable. The true yield has been unfavorable on occasion up to now, however it’s now decrease than ever. That is true regardless that the nominal yield is 0.7% greater than its low final August.

[wce_code id=192]

As we now have proven earlier than, 10-Yr Treasury yields are associated to the tempo of financial progress in nominal phrases (NGDP), which incorporates inflation, over time. As an example, low long-term rates of interest normally recommend that the bond market expects low NGDP progress going ahead.

Nonetheless, different elements can play an outsized position over shorter durations. Present inflation expectations are at 2.4%, which is effectively above the U.S. Federal Reserve’s 2% goal. This implies that although 10-year Treasury yields are muted, the bond market is pricing in one thing different than simply low inflation.

Moreover, since tight company bond spreads and wholesome commodity worth traits mirror confidence and expectations of stable financial progress forward, one thing aside from gradual actual financial progress is probably going pushing 10-Yr Treasury yields to very low ranges.

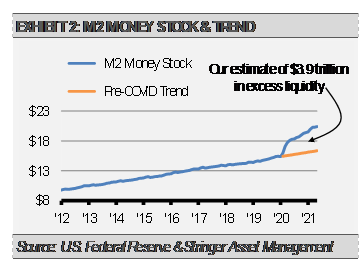

Distinctive to the present surroundings is the large quantity of liquidity stimulus the U.S. Federal Reserve and different world central banks have pushed into the monetary system. As the next graph illustrates, the Fed injected trillions of {dollars} into the U.S. monetary system. We estimate that the present quantity of liquidity within the U.S., as measured by M2 (money, checking accounts, and financial savings deposits, and so forth.), is $3.9 trillion or 25% greater than what it could have been primarily based on the pre-COVID development.

We predict that there’s a lot money within the monetary system in search of a protected space and shopping for U.S. Treasury bonds that it’s pushing bond costs greater and yields decrease than they’d in any other case be. Importantly, because the Fed begins to scale back its ongoing assist within the coming months, we anticipate this development to reverse and 10-Yr Treasury yields to once more transfer greater, and certain a lot greater.

DISCLOSURES

Any forecasts, figures, opinions or funding methods and methods defined are Stringer Asset Administration, LLC’s as of the date of publication. They’re thought of to be correct on the time of writing, however no guarantee of accuracy is given and no legal responsibility in respect to error or omission is accepted. They’re topic to vary with out reference or notification. The views contained herein are to not be taken as recommendation or a advice to purchase or promote any funding and the fabric shouldn’t be relied upon as containing ample data to assist an funding resolution. It ought to be famous that the worth of investments and the earnings from them might fluctuate in accordance with market circumstances and taxation agreements and buyers might not get again the complete quantity invested.

Previous efficiency and yield will not be a dependable information to future efficiency. Present efficiency could also be greater or decrease than the efficiency quoted.

The securities recognized and described might not characterize all the securities bought, bought or really helpful for shopper accounts. The reader shouldn’t assume that an funding within the securities recognized was or shall be worthwhile.

Information is offered by varied sources and ready by Stringer Asset Administration, LLC and has not been verified or audited by an impartial accountant.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.