By Frank Holmes, U.S. Funds By now you will have heard that

By Frank Holmes, U.S. Funds

By now you will have heard that President Donald Trump signed an government order banning People from investing in a choose variety of Chinese language corporations which have ties to China’s army.

Since we make investments closely within the nation and different Asian economies, via our China Area Fund (USCOX), I figured it’d be useful to make clear any issues traders might need.

Merely put, Trump’s ban won’t impression our funding technique in any means. Not one of the 31 corporations listed within the government order, lots of them concerned in development or expertise, was held in USCOX as of September 30.

I don’t imagine the directive will have an effect on very many People’ portfolios, to be sincere. It doesn’t ban new purchases of the businesses till November 2021, and it permits traders to persevering with holding and liquidating the focused securities indefinitely.

Plus, President-Elect Joe Biden may very properly roll again the chief order when he takes workplace in January.

Can China Double the Dimension of Its Financial system by 2035?

Whether or not deserved or not, Trump’s actions in opposition to China carry extra damaging consideration to what I imagine stays a particularly enticing area for traders to think about.

Within the brief time period, China might find yourself being the one main economic system to report development in pandemic-hit 2020. Factories have returned to pre-crisis ranges, and customers are spending once more.

(Look no additional than Alibaba’s blockbuster Singles Day gross sales occasion final week. Chinese language customers bought a file $75.1 billion in items in the course of the 24-hour interval. That’s virtually double the $38.Four billion the e-commerce big reaped in gross sales final 12 months.)

On Monday, China launched financial information for October exhibiting that industrial output accelerated 6.9% over the identical month final 12 months, whereas retails gross sales grew 4.3% year-over-year, up from 3.3% in September.

On a longer-term foundation, I’m extremely bullish on China. Its five-year plan for 2021 – 2026 seeks high-quality development over high-speed development, continued modernization via innovation and technological developments and the promotion of high-end, “inexperienced” manufacturing.

Officers now purpose to double the dimensions of the Chinese language economic system by 2035, which is 15 years from now. Based on the World Financial institution, the nation’s gross home product (GDP) was $14.Three trillion in 2019. You do the mathematics.

Is that even doable? Previous efficiency isn’t any assure of future outcomes, after all, but it surely’s value stating that China managed to increase the dimensions of its economic system by an element of seven within the 15 years between 2004 and 2019, from roughly $2 trillion to greater than $14 trillion.

Meet the Largest Free-Commerce Settlement in Historical past

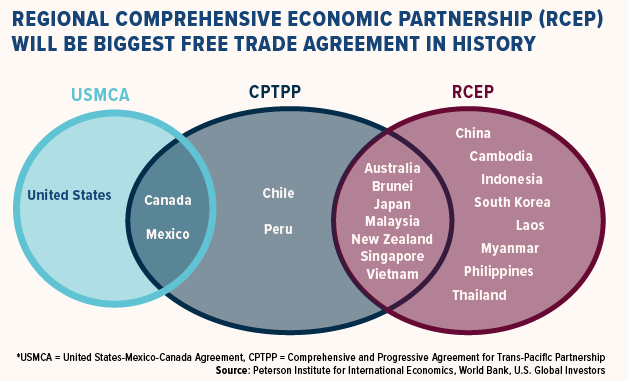

I imagine China’s formidable financial targets must be supported by its inclusion within the just-created Regional Complete Financial Partnership (RCEP). The free-trade settlement (FTA), believed to be the biggest in historical past, brings collectively 15 Asia-Pacific nations—together with, for the primary time ever, China, Japan and South Korea—into one monster buying and selling bloc that may account for 30% of the worldwide economic system and inhabitants.

Beneath you possibly can see the member nations within the RCEP, and the way a few of them are additionally included within the Complete and Progressive Settlement for Trans-Pacific Partnership (CPTPP). That’s the FTA that went into impact in December 2018, and which President Trump pulled the U.S. out of following his inauguration in 2017.

It’s not possible to overstate simply how vital the RCEP is, not just for the area however the world. In June of this 12 months, the Peterson Institute for Worldwide Economics (PIIE) estimated that the RCEP may add $209 billion yearly to world incomes, $500 billion to world commerce by 2030.

The explanation that is such thrilling information is that the settlement wipes away at the very least 92% of all current tariffs between the 15 taking part nations. This could permit items and companies to be traded extra freely, pretty and effectively.

Methods to Get Entry

That profit, I imagine, can be prolonged to items and companies produced by corporations in our China Area Fund (USCOX).

The China area has skilled many modifications because the fund opened in 1994, however we imagine the area continues to carry additional funding alternatives. Many nations within the area possess traits just like the U.S. previous to the economic revolution: a thriving, younger workforce, migration from rural to city areas and shifting sentiment towards consumption.

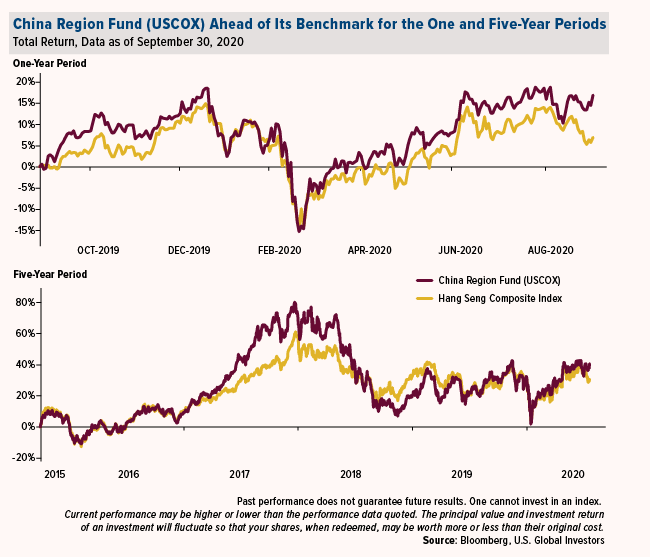

We’re happy with the fund’s efficiency. For the 12-month interval via September 30, 2020, USCOX delivered greater than double the returns of its benchmark, the HSCI—16.93% p.c versus 6.94%. The fund additionally beat its benchmark for the five-year interval, 40.53% versus 30.58%.

To study extra about USCOX, click on right here!

Initially printed by U.S. Funds, 11/19/20

Please think about fastidiously a fund’s funding aims, dangers, expenses and bills. For this and different essential info, get hold of a fund prospectus by clicking right here. Learn it fastidiously earlier than investing. Foreside Fund Companies, LLC, Distributor. U.S. World Traders is the funding adviser.

| Fund | One-12 months | 5-12 months | Ten-12 months | Gross Expense Ratio |

|---|

| China Area Fund (USCOX) | 16.22% | 6.63% | 0.76% | 2.92% |

| Dangle Seng Composite Index | 6.55% | 5.15% | 1.54% | n/a |

Expense ratios as acknowledged in the latest prospectus. The Adviser of the China Area Fund has voluntarily restricted complete fund working bills (unique of acquired fund charges and bills of 0.00%, extraordinary bills, taxes, brokerage commissions and curiosity, and advisory price efficiency changes) to not exceed 2.55%. With the voluntary expense waiver quantity of 0.22%, complete annual bills after reimbursement have been 2.44%. U.S. World Traders, Inc. can modify or terminate the voluntary restrict at any time, which can decrease a fund’s yield or return.

Efficiency information quoted above is historic. Previous efficiency isn’t any assure of future outcomes. Outcomes replicate the reinvestment of dividends and different earnings. For a portion of durations, the fund had expense limitations, with out which returns would have been decrease. Present efficiency could also be increased or decrease than the efficiency information quoted. The principal worth and funding return of an funding will fluctuate in order that your shares, when redeemed, could also be value roughly than their authentic value. Efficiency doesn’t embody the impact of any direct charges described within the fund’s prospectus which, if relevant, would decrease your complete returns. Efficiency quoted for durations of 1 12 months or much less is cumulative and never annualized. Receive efficiency information present to the latest month-end by clicking right here.

The Dangle Seng Composite Index presents a complete Hong Kong market benchmark that covers in regards to the prime 95th percentile of the entire market capitalization of corporations listed on the Predominant Board of the Inventory Trade of Hong Kong. It isn’t doable to spend money on an index.

Mutual fund investing entails threat. Principal loss is feasible. International and rising market investing entails particular dangers reminiscent of forex fluctuation and fewer public disclosure, in addition to financial and political threat. By investing in a selected geographic area, a regional fund’s returns and share worth could also be extra unstable than these of a much less concentrated portfolio.

Fund portfolios are actively managed, and holdings might change each day. Holdings are reported as of the latest quarter-end. Fund holdings shouldn’t be thought of a suggestion to purchase or promote any safety. Holdings within the China Area Fund as a share of internet belongings as of 9/30/2020: Alibaba Group Holdings Ltd. 6.06%.

All opinions expressed and information supplied are topic to vary with out discover. A few of these opinions will not be acceptable to each investor.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.