By MSCI How an index strategy may help buyers align with th

By MSCI

How an index strategy may help buyers align with the Paris Settlement

The worldwide push to arrest local weather change is reshaping industries and placing stress on buyers to align their methods with the 1.5-degree Celsius enhance in international temperature focused by the Paris Settlement.

Challenges to corporations in carbon-intensive industries, the dangers of maximum climate and, particularly in Europe, the setting of requirements for sustainable finance all are reshaping the connection between threat and return and influencing efforts by buyers to navigate the transition to a low-carbon future.

Indexes such because the MSCI Local weather Paris Aligned Index suite provide a path to climate-strategy implementation. The indexes are designed to assist buyers looking for to deal with local weather change holistically over time by minimizing their transition and bodily threat, pursuing inexperienced alternatives and aligning their portfolios accordingly.

The indexes incorporate the suggestions of the Job Drive on Local weather-related Monetary Disclosure, goal to considerably cut back their carbon footprint (together with scope three and supply-chain emissions), elevate the load of corporations with substantiated discount targets, and cut back their publicity to threat from excessive climate and different bodily manifestations of a altering local weather, based mostly on MSCI’s Local weather Worth-at-Threat mannequin (Local weather VaR)

However what could also be vital is that the indexes are also designed to self-decarbonize; that’s, they aim a discount of their carbon footprint by 10% yearly. By design, the speed goals to exceed the minimal EU commonplace to align the indexes with the 1.5-degree Paris goal. An evaluation by MSCI ESG Analysis explains why.

Taking the temperature of the index

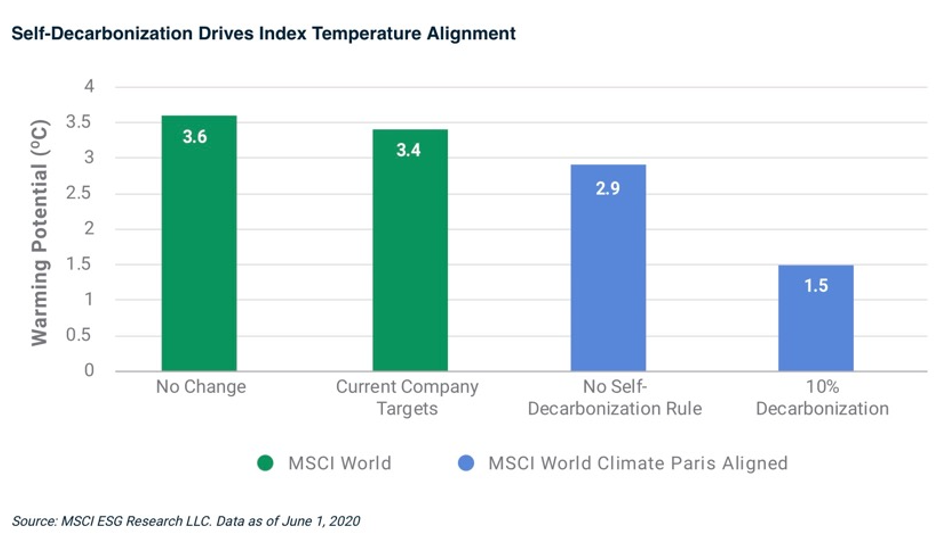

Primarily based on the MSCI’s “warming potential” methodology, which computes the contribution of an organization’s actions towards local weather change, comparatively few corporations are at present aligned with the 1.5-degree state of affairs. Which means the core exclusions and reweighting of the MSCI Local weather Paris Aligned Index could also be helpful for buyers to assist their energetic possession however are inadequate in themselves to restrict the rise in temperature to 1.5°C.

Self-decarbonization made the distinction. With out it, the MSCI Local weather Paris Aligned Index had a temperature of two.9 C, as proven within the chart under. By making use of a 10% self-decarbonization charge via 2030, we noticed a warming potential of 1.5 C for the index along with a optimistic Local weather VaR.

To find out the speed of self-decarbonization, MSCI examined a spread of company-level self-decarbonization charges between 5% and 15%, which is the vary of world carbon emissions required yearly to realize net-zero between 2050 and 2100.

Setting the speed at 10% allowed the index to realize the 1.5-degree goal even when some corporations fell brief of their efforts. In that state of affairs, the index might naturally turn into extra concentrated round corporations that concentrate on renewable power or clear know-how.

Because the evaluation suggests, forward-looking measures of local weather threat and return might assist buyers on the trail to decarbonization. Whether or not used as a benchmark for allocating belongings, a foundation for monetary merchandise, a reference for assessing efficiency or a software for engagement, MSCI’s Local weather Paris Aligned Indexes can anchor a holistic strategy to implementing local weather technique.

Learn the evaluation

Study extra about MSCI’s Local weather Paris Aligned Indexes

Initially revealed by MSCI

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.