Key Factors:Social media’s suspension of President Trump’s social media accounts must be troubling

Key Factors:

- Social media’s suspension of President Trump’s social media accounts must be troubling to everybody, whether or not you assist him or not. Recall Ben Franklin: “They who can provide up important liberty to acquire slightly short-term security deserve neither liberty nor security.”

- Privateness seekers are downloading Sign to interchange WhatsApp.

- Biden’s proposed aid package deal, at $1.9 trillion, is predicted to spice up investor demand for actual belongings, together with gold, Bitcoin and Ethereum.

In my remaining commentary of 2020, I wrote that the U.S. media has a significant belief situation. In keeping with latest polls, most Individuals put little religion in what they see and skim on TV and the web.

These destructive sentiments have been in all probability not improved a lot by large tech corporations’ choice to droop President Donald Trump from their platforms following the assault on the Capitol that left 5 lifeless.

Twitter was the primary to announce a everlasting ban on the Friday earlier than final. Within the blink of an eye fixed, greater than 88 million followers might not go to the U.S. president’s account.

Different platforms quickly adopted swimsuit: Fb, Instagram, Snapchat, TikTok, YouTube, Pinterest.

The choice to muzzle Trump might not technically be unconstitutional—it was made not by the federal government however non-public companies—nevertheless it’s extremely problematic.

Even Twitter CEO Jack Dorsey admits as a lot. Defending his firm’s deletion of Trump’s account, Dorsey tweeted that such bans “fragment the general public dialog” and “restrict the potential for clarification, redemption and studying.” He added that it “units a precedent that I really feel is harmful.”

Lots of Trump’s abroad critics agree. German chancellor Angela Merkel, who’s usually shared an icy relationship along with her U.S. counterpart, known as Twitter’s transfer a breach of Trump’s “elementary proper to free speech.” Clément Beaune, France’s minister of state for European affairs, instructed Bloomberg TV that silencing an elected official “must be determined by residents, not by a CEO.”

The crackdown isn’t restricted to Trump. Parler, a networking app favored by Trump’s supporters, hit roadblocks final week when Apple and Google eliminated the app from its on-line shops. The service, which is financed largely by hedge fund supervisor Robert Mercer, lastly went offline after Amazon dropped it as a webhosting consumer.

I acknowledge these actions have been prompted by a must root out extremism and violence. I be part of others in calling on social media firms to do a greater job at stopping extremism from flourishing. On the identical time, there must be a extra equitable answer than completely shutting down complete channels of free speech.

Founding Father Benjamin Franklin mentioned it greatest: “They who can provide up important liberty to acquire slightly short-term security deserve neither liberty nor security.”

Coinbase realized this lesson the arduous approach. In late September, the digital forex change instated a companywide ban on speaking politics of any variety at work. Inside days of the announcement, as many as 60 Coinbase staff had resigned.

A Sign of Privateness and Free Speech

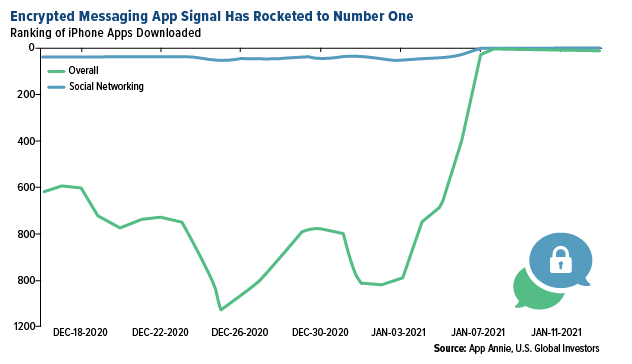

The social media crackdowns have helped gas folks’s seek for different networking platforms. A kind of options is Sign, a little-known messaging service that first debuted in 2014.

Much like WhatsApp, Sign encrypts customers’ messages end-to-end. Not like WhatsApp, although, Sign isn’t owned by Fb—or some other large tech agency, for that matter. It’s run by a tax-exempt non-profit, which means its operations depend on donations.

Up to now this month, the app has seen a large spike in downloads following WhatsApp’s announcement to customers that it was altering its privateness coverage. Tesla chief Elon Musk additionally threw his weight behind the app, tweeting to his 42 million followers: “Use Sign.”

In keeping with app analytics agency App Annie, Sign has ranked primary in iPhone app downloads each day since January 9.

As anticipated, Musk’s tweet triggered not solely downloads but additionally investor curiosity. The issue is that Sign the messaging app isn’t listed, so buyers have been mistakenly shopping for shares of Sign Advance, a thinly-traded medical provides firm. As of January 11, Sign Advance inventory had jumped greater than 10,000% in 30 days, from $0.38 to $38.70. Each day buying and selling quantity surged from as little as a number of thousand shares to over 2 million shares.

An analogous phenomenon occurred final spring when buyers started shopping for the unsuitable Zoom. As an alternative of investing in Zoom Video Communications—whose video conferencing providers have been immediately in excessive demand due to lockdowns—buyers piled into Zoom Applied sciences, now referred to as Minim. (Because of reader Bob Sandler for the correction.)

The Worth of Gold Has Traditionally Stored Tempo with Cash Provide Progress

The World Gold Council (WGC) has launched its 2021 outlook, which you’ll obtain right here, and there’s one chart particularly that stood out to me.

As you may see under, since President Richard Nixon formally ended the gold normal within the early 1970s, the worth of gold has carried out a significantly better job at retaining tempo with international cash provide development than Treasury payments have. Through the years, this has helped buyers and savers protect capital.

I consider preserving your loved ones’s wealth is cause sufficient to make sure you comply with the 10% Golden Rule. As I shared with you lately, we’ve entered an period of report money-printing in an effort to curb the financial results of the pandemic. U.S. cash provide development is up an unheard-of 66% from the identical time final 12 months.

The extra fiat forex that’s in circulation, the extra useful I count on actual belongings like gold to turn into.

President-elect Joe Biden, who’s scheduled to take workplace tomorrow, has known as for a large $1.9 trillion aid package deal that would come with $1,400 checks for American adults. The invoice, if handed, might result in extra money-printing and, consequently, increase inflation.

During which case, you’d need to have some publicity to gold and different actual belongings like actual property and commodities.

HIVE Is Delivering on Working Margin

That features Bitcoin and Ethereum, two fee methods that present end-to-end encryption, very like Sign. The world’s primary and quantity two cryptocurrencies recorded a weekly loss after Bitcoin hit a report excessive of almost $42,000. After such a transfer, a correction is to be anticipated. I see the dip as a shopping for alternative.

Traders looking for different methods to achieve publicity have a number of choices. CME Group already affords Bitcoin futures and choices, and subsequent month, the change will likely be launching Ether futures. That is anticipated to assist demand for Ethereum.

Then there are the miners. In the meanwhile, HIVE Blockchain Applied sciences is the one one which mines each Bitcoin and Ethereum. What’s extra, by one metric, HIVE can also be probably the most worthwhile, beating its friends on working margin for the 10-day, 30-day and 90-day durations.

Curious concerning the distinction between Bitcoin and Ethereum? Watch my newest video to get the total particulars. Click on right here!

Initially printed by U.S. Funds, 1/19/21

Some hyperlinks above could also be directed to third-party web sites. U.S. World Traders doesn’t endorse all data equipped by these web sites and isn’t accountable for their content material. All opinions expressed and knowledge supplied are topic to alter with out discover. A few of these opinions might not be applicable to each investor.

M2 is a calculation of the cash provide that features all parts of M1 in addition to “close to cash.” M1 contains money and checking deposits, whereas close to cash refers to financial savings deposits, cash market securities, mutual funds, and different time deposits. Working margin measures how a lot revenue an organization makes on a greenback of gross sales after paying for variable prices of manufacturing, corresponding to wages and uncooked supplies, however earlier than paying curiosity or tax. It’s calculated by dividing an organization’s working earnings by its web gross sales. Frank Holmes has been appointed non-executive chairman of the Board of Administrators of HIVE Blockchain Applied sciences. Each Mr. Holmes and U.S. World Traders personal shares of HIVE. Efficient 8/31/2018, Frank Holmes serves because the interim govt chairman of HIVE.

Holdings might change every day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. World Traders as of (12/31/2020): Fb Inc., Amazon.com Inc., Alphabet Inc., Apple Inc., Tesla Inc.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.