As the US doubles down on its intent to

As the US doubles down on its intent to fight the damaging results of local weather change, trade traded fund traders have turned to socially accountable methods.

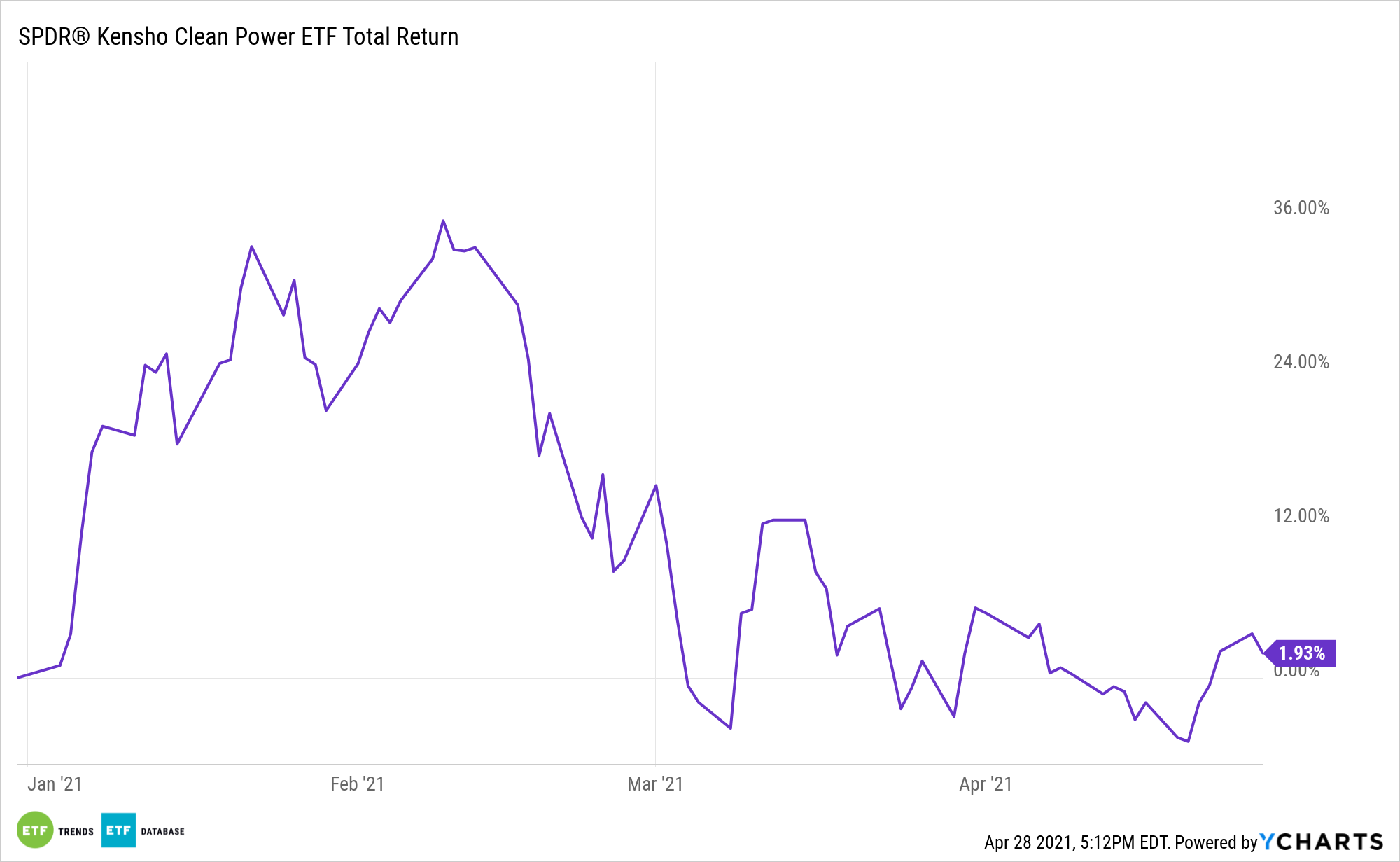

For instance, as a means to assist traders faucet into socially accountable funding alternatives, State Avenue World Advisors presents a collection of socially accountable and ESG-related ETFs. One fund, the SPDR Kensho Clear Energy ETF (CNRG), seeks to supply publicity to the clear energy trade by way of each era and underlying expertise.

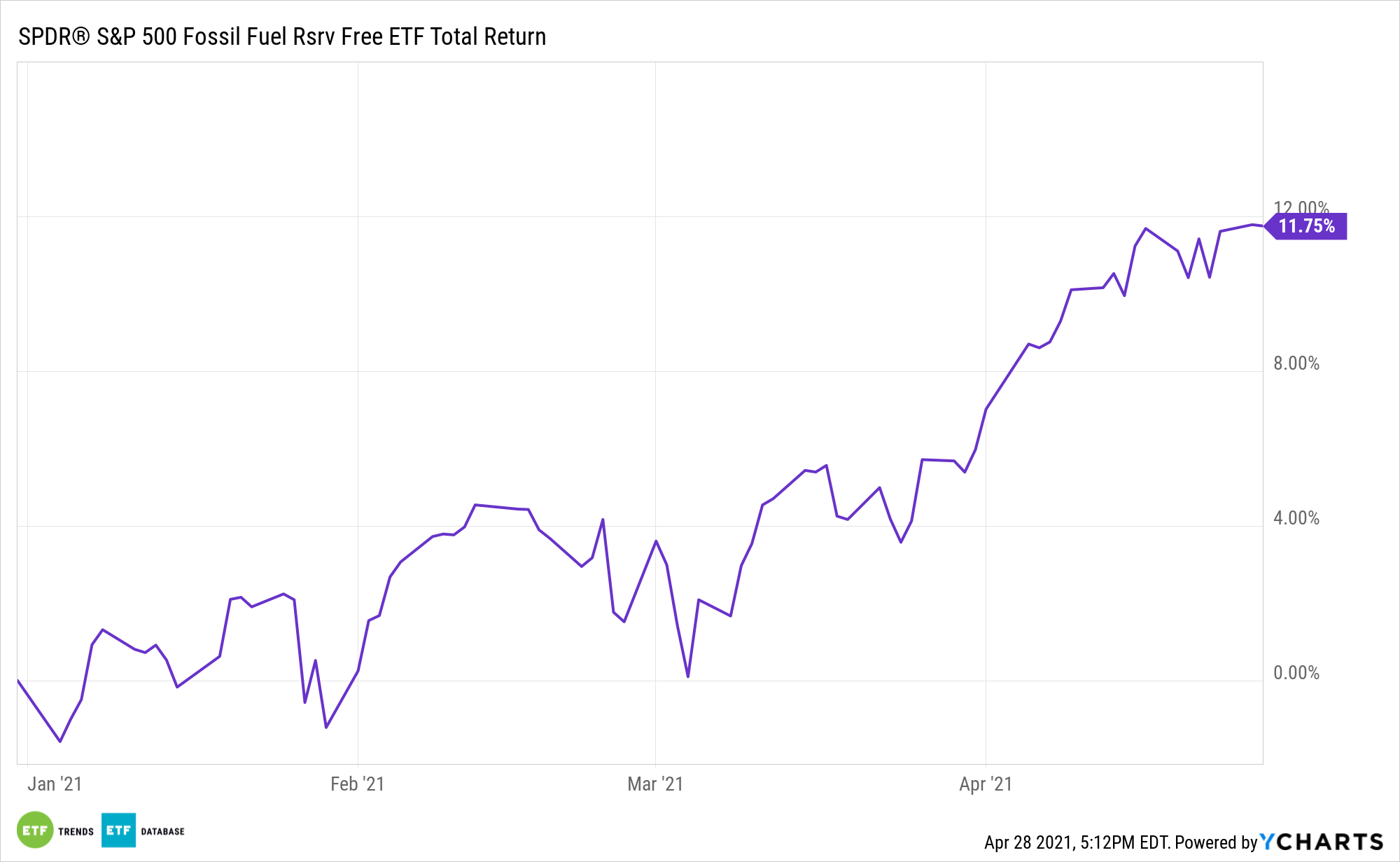

The agency’s SPDR S&P 500 Fossil Gas Free ETF (SPYX) is now a $1 billion fund. As of February, the fund has had 32 consecutive months of inflows – not a single day of outflows in over two years. SPYX tries to permit local weather change-conscious traders to align the core of their funding technique with their values by eliminating firms that personal fossil gas reserves from the S&P 500.

For his or her half, sustainable mutual fund methods might be significantly burdened by adjustments within the Biden tax plan.

“These sustainable mutual funds are in danger,” Matthew Bartolini, Managing Director, Head of SPDR Americas Analysis at SPDR Change Traded Funds (ETFs), instructed ETF Tendencies in a name, pointing to what the Biden administration is doing to fund the local weather plans by way of new tax proposals. “In the event that they’re rising long-term capital features charges as much as 43% on people making greater than $1 million, that’s going to have a extreme affect.”

Bartolini famous that 70% of all mutual funds have paid a minimum of one capital achieve distribution over the previous three years, or what quantities to $12.6 trillion value of mutual funds. On the fairness facet, it’s even worse. About 100% of all fairness mutual funds, listed or lively, have paid a minimum of one capital achieve up to now three years, which covers $9.2 trillion in belongings.

“We’ve seen a shift in how belongings are being invested from the socially aware investor, and clearly with the fee aware investor. And now you’re going to have the tax aware investor. That’s simply going to speed up the bull run of ETF progress. ESG goes to profit, in addition to low-cost,” Bartolini added, referring to environmental, social, and governance methods and associated ETFs.

For extra information, info, and technique, go to the ESG Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.