E-commerce or on-line retail has been a rising pattern that shortly accelerated this 12 months beca

E-commerce or on-line retail has been a rising pattern that shortly accelerated this 12 months because of the coronavirus pandemic. Buyers can even look to alternate traded fund methods to seize this shift in client habits.

“This 12 months has been a very robust development 12 months for on-line searching for all merchandise. As COVID-19 issues saved individuals away from shops, many shopped on-line for the primary time. On-line grocery procuring particularly acquired a lift. Whereas some might even see this as a short lived state of affairs, we don’t agree. In our opinion, the expansion of e-commerce is a basic structural pattern that has been accelerated by latest occasions, one whose ‘demand has been introduced ahead,’ because the economists would say, in order that the bottom stage will stay larger even once we’re previous the pandemic,” George Evans, Chief Funding Officer, International Equities, Invesco; and Alice Fricke, Senior Consumer Portfolio Supervisor, Invesco, stated in a analysis be aware.

A Brief-Time period Leap, A Lengthy-Time period Actuality

“This ‘step-up’ in demand was attributable to an unexpected occasion, however this long-term structural development pattern was and is evident. We anticipate the reorganization of retail to proceed, and we anticipate to proceed discovering funding alternatives amongst corporations benefitting from this theme,” the strategists added.

The brand new structural demand development pattern amongst buyers around the globe can doubtlessly present rewarding alternatives for buyers. Buyers ought to goal these corporations discovered all alongside the chain of actions which might be essential to on-line procuring. For instance, buyers can look to retailers in search of to promote items on-line or e-commerce platform corporations that may present them with the flexibility to construct an retailer.

Moreover, digital funds are a delicate a part of this transaction course of, and there are corporations specialised in on-line funds, offering their providers to the platform corporations.

Resulting from this new business that has produced numerous disruptors within the conventional retail sector, “we’ve seen the rise of some extremely specialised ‘class killers’ with important technological leads, in numerous industries, at every of those chokepoints,” the strategists famous.

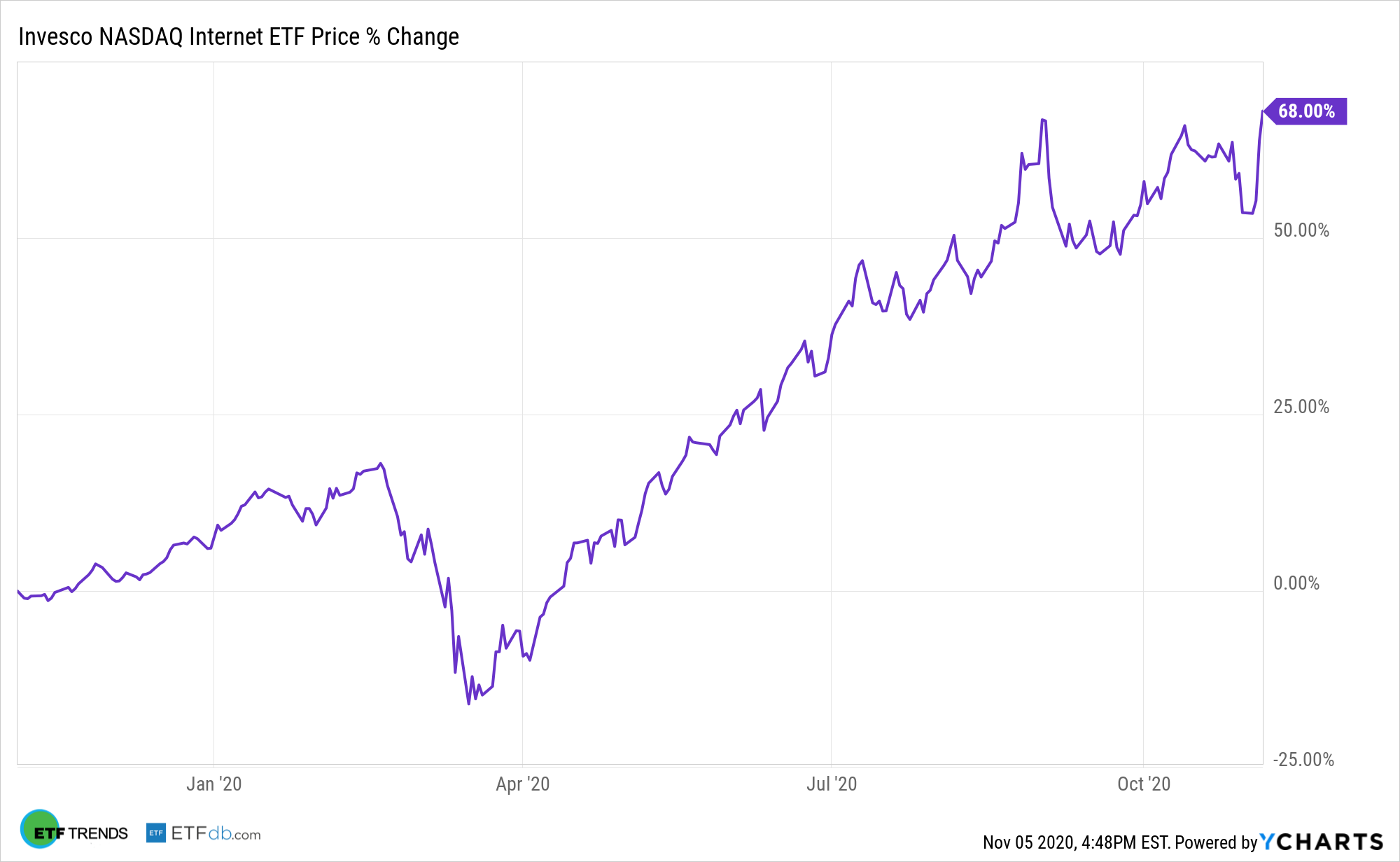

As a strategy to seize this rise in on-line procuring, buyers can look to ETFs just like the Invesco NASDAQ Web ETF (NASDAQ: PNQI). PNQI tracks the NASDAQ Web Index. The underlying index is designed to trace the efficiency of the biggest and most liquid U.S.-listed corporations engaged in Web-related companies which might be listed on one of many three main U.S. inventory exchanges. Prime sector weights embody 30.4% web & direct advertising retail, 23.9% interactive media & providers and 20.8% software program. Prime holdings embody e-commerce giants like Alibaba Group 8.1% and Amazon.com 7.4%.

For extra information and knowledge, go to the Progressive ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.