An attention-grabbing dynamic i

An attention-grabbing dynamic is growing within the issue world.

First, momentum methods have gained a whole lot of media consideration. They’d garnered a repute for being progress methods, since progress was working for therefore lengthy. Lately, worth has taken over.

Twitter has caught on to the declining pprice-to-earnings (P/E) ratio of the MSCI World Momentum Index as proof.

For example:

Supply: https://twitter.com/michael_venuto/standing/1404062272323035138?s=20

One other attention-grabbing dynamic taking maintain is that high quality methods—which choose progress and high quality corporations—are exhibiting valuations that rival conventional worth indexes however with a special composition and sector combine.

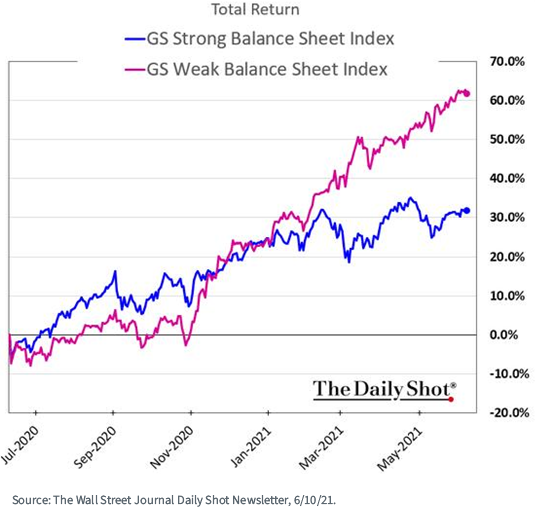

One chart that explains a few of what’s going on is the divergent returns amongst strong-versus-weak steadiness sheet shares, exemplified by this Day by day Shot graphic depicting returns primarily based on steadiness sheet kinds of the market.

Robust steadiness sheet shares are related to higher-quality corporations, and weak steadiness sheet corporations are related to low-quality shares—and this large return dispersion—30 share level differential returns during the last six months or so—are resulting in valuation discrepancies in these baskets.

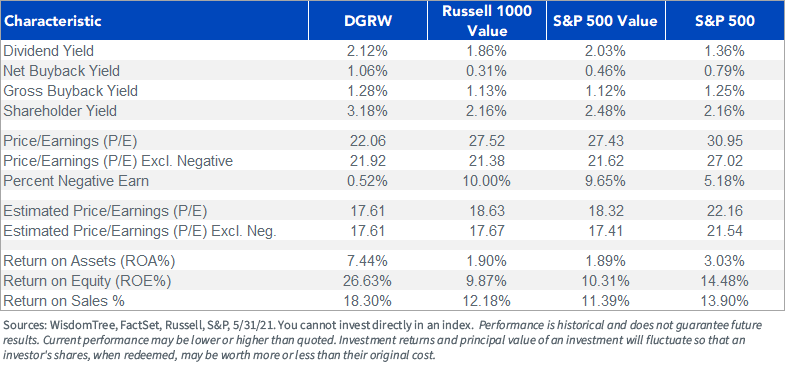

Whereas conventional worth methods choose corporations that earn decrease returns on capital (measured by return on fairness (ROE) and even return on belongings (ROA)), the WisdomTree High quality Dividend Development Fund (DGRW) is exhibiting valuation multiples as compelling as the worth benchmarks however with a course of that focuses on excessive return on capital and powerful steadiness sheet shares.

DGRW has even decrease ahead P/E multiples than both the Russell 1000 Worth Index or the S&P 500 Worth Index, regardless of having an ROE improve and enchancment relative to the S&P 500.

Click on right here to view the 30-Day SEC yield and standardized efficiency.

For definitions of phrases within the desk, please go to the glossary.

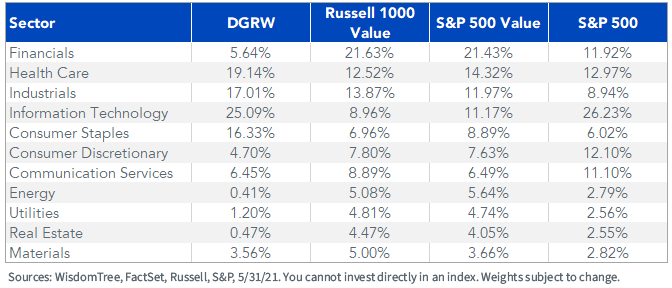

The sector compositions of the hampers that drive these valuations are additionally totally different.

Whereas the S&P 500 Worth and Russell 1000 Worth are weighted highest in Financials—10% over-weight relative to the S&P 500—DGRW has half that Financials publicity, at beneath 6%.

As an alternative, DGRW has over-weight allocations to Well being Care, meaningfully extra weight in Info Know-how shares than worth methods, in addition to over-weight allocations to Client Staples shares.

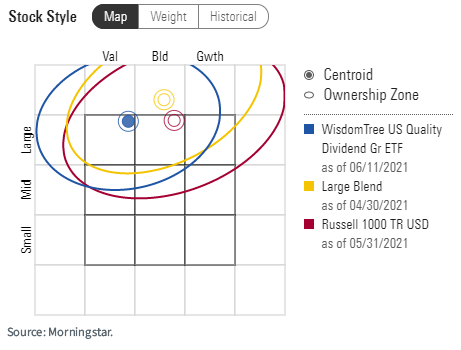

Whereas in worldwide markets this high quality typically ends in a large-cap progress designation, within the U.S., DGRW is presently mapping within the worth bucket because it did for a lot of 2020 as nicely.

Morningstar Model Map

The under chart reveals how DGRW has traditionally been within the “US Fund Massive Mix” class over the previous 5 years, however during the last two years its model—which may deviate from year-to-year with out triggering a class change—has been in Massive Worth.

Historic Model Map

Whether or not Morningstar will reclassify DGRW as a worth technique in time stays to be seen.

Worth’s outperformance is being led by Financials and Power and more and more latest momentum technique purchases. However in the event you consider this outperformance is apt to expire of steam, there’s a method to get what we view to be compelling value-like valuations with an funding course of that favors high-quality, dividend growth-oriented corporations which are being uncared for on a valuation foundation at present.

Initially printed by WisdomTree, 7/1/21

Vital Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. Funds focusing their investments on sure sectors improve their vulnerability to any single financial or regulatory improvement. This will lead to larger share worth volatility. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

There are dangers of investing in worth shares such because the potential {that a} explicit inventory could not rise to its anticipated intrinsic worth and will decline additional in worth.

U.S. buyers solely: Click on right here to acquire a WisdomTree ETF prospectus which comprises funding aims, dangers, expenses, bills, and different data; learn and take into account rigorously earlier than investing.

There are dangers concerned with investing, together with attainable lack of principal. Overseas investing includes foreign money, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations could expertise larger worth volatility. Investments in rising markets, foreign money, mounted earnings and various investments embody further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency is just not indicative of future outcomes. This materials comprises the opinions of the creator, that are topic to alter, and may to not be thought of or interpreted as a advice to take part in any explicit buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There is no such thing as a assure that any methods mentioned will work beneath all market circumstances. This materials represents an evaluation of the market atmosphere at a particular time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation relating to any safety specifically. The person of this data assumes your complete threat of any use manufactured from the knowledge offered herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Traders in search of tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially signify the views of WisdomTree or any of its associates.

The MSCI data could solely be used to your inside use, will not be reproduced or re-disseminated in any kind and will not be used as a foundation for or element of any monetary devices or merchandise or indexes. Not one of the MSCI data is meant to represent funding recommendation or a advice to make (or chorus from making) any sort of funding choice and will not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI data is offered on an “as is” foundation and the person of this data assumes your complete threat of any use manufactured from this data. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI data (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this data, in no occasion shall any MSCI Occasion have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or another damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can’t make investments straight in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.