By Mark Hackett Ra

By Mark Hackett

Rates of interest had been on the rise final week with the 10-year Treasury yield topping 1.0% for the primary time since final March, closing at 1.13% on Friday, January 8. One week into 2021, the benchmark bond yield is up 0.21% because the begin of the yr. This leap poses a irritating problem to an already tough surroundings to generate yield, as traders battle with allocation choices.

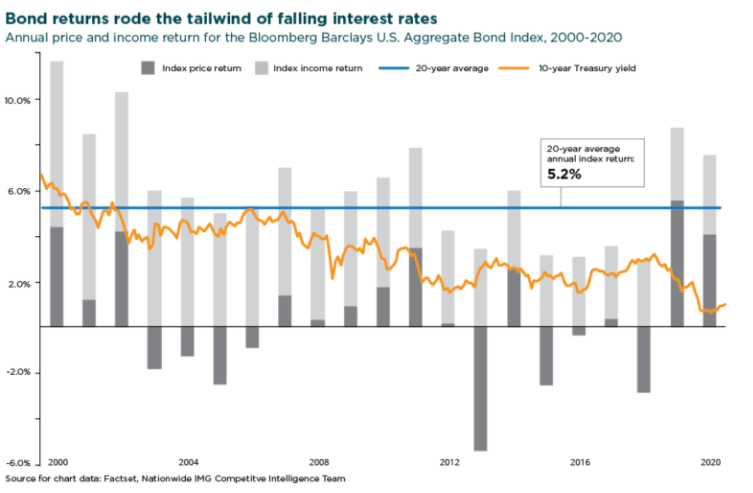

Over a lot of the previous 40 years, rates of interest have been in secular decline, with the 10-year yield falling from a excessive of 15.8% in September 1981 to a low of 0.5% final March. Because of this, bond funds have seen a continuous tailwind of value appreciation to spice up returns properly above the return from curiosity funds. This has been notably true over the previous two years, the place value return contributed 4.0% and 5.5%, respectively, to the whole annual return of the Bloomberg Barclays U.S. Mixture Bond Index.

Rising rates of interest would act as an obstacle for future bond returns. As we noticed in 2018, the two.9% generated from earnings that yr was offset by a 2.9% decline within the value of the Index. That resulted in a flat return in a yr that noticed the 10-year Treasury yield rise from 2.43% to 2.68%, after touching 3.2% in November. With a period of 6.2 years for the Bloomberg Barclays U.S. Mixture Bond Index, a 1% rise within the stage of rates of interest throughout the curve would end in a 6% decline in portfolio worth. With a present yield of simply 1.2%, there may be little earnings buffer to guard in opposition to rising charges. Given the inflow of flows into bond funds lately, traders will not be ready for potential capital losses of their bond holdings.

Initially revealed by Nationwide, 1/14/21

Disclaimers

This materials will not be a advice to purchase, promote, maintain or roll over any asset, undertake an funding technique, retain a particular funding supervisor or use a selected account kind. It doesn’t keep in mind the precise funding aims, tax and monetary situation or specific wants of any particular particular person. Traders ought to focus on their particular state of affairs with their monetary skilled.

Besides the place in any other case indicated, the views and opinions expressed are these of Nationwide as of the date famous, are topic to alter at any time and will not come to go.

Previous efficiency doesn’t assure future outcomes. Present efficiency could also be decrease or larger than the previous efficiency proven.

Bloomberg Barclays US Mixture Bond Index: An unmanaged, market value-weighted index of U.S. dollar-denominated, investment-grade, fastened price, taxable debt points, which incorporates Treasuries, government-related and company securities, mortgage- backed securities (company fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities and business mortgage-backed securities (company and non-agency).

Nationwide Funds are distributed by Nationwide Fund Distributors LLC (NFD), member FINRA, Columbus, Ohio.

Nationwide Funding Companies Company (NISC), member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is in your aspect are service marks of Nationwide Mutual Insurance coverage Firm.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.