By Jeff Weniger, CFA, Director, Asset Allocation, WisdomTr

By Jeff Weniger, CFA, Director, Asset Allocation, WisdomTree

That is the second weblog publish of a three-part collection. Partly one, I laid out how the COVID-19 state of affairs impacts the worth versus development choice. Now let’s discuss in regards to the swing states.

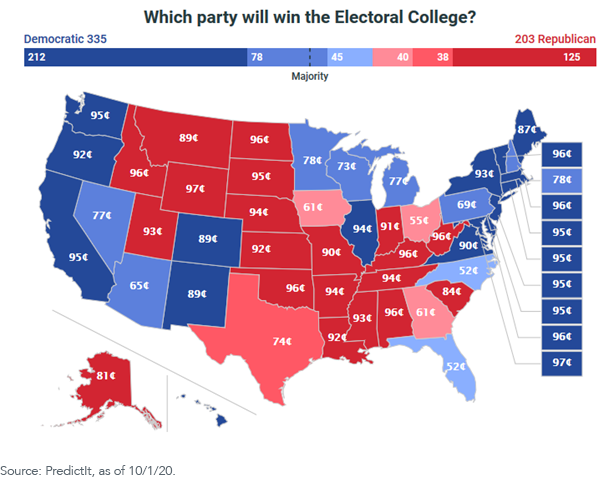

Not like in prior election cycles, the creation of “occasion futures” markets permits us to pinpoint the general public’s notion of candidates’ possibilities.

Proper now, individuals are exchanging actual cash on PredictIt, the Web trade, attempting to revenue off the presidential election. As of October 2, Biden’s contract trades at 63 cents, so a victory for the Democrat pays $1, whereas a loss sends you packing. Trump contracts price 38 cents (the 2 don’t sum to 100 cents due to bid/ask spreads). So Biden has a transparent lead. Apparently these contracts didn’t change a lot upon Trump’s announcement that each he and First Woman had contracted the virus themselves.

Let’s recreation out a fading Biden situation that advantages “Trump trades”—specifically the Power and Financials sectors, each of which populate worth indexes in dimension.

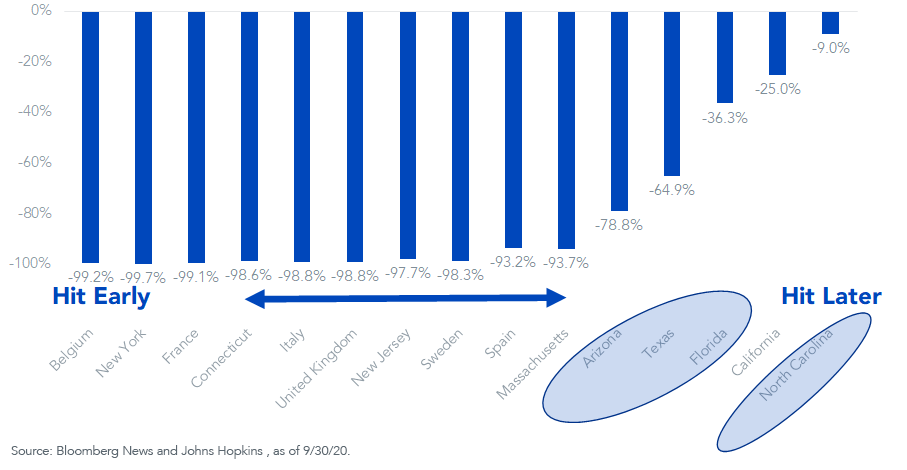

Recall that COVID-19 first hit New York Metropolis, Connecticut and New Jersey. Close by Massachusetts famously had its “tremendous spreader” occasion: a Biogen convention, one of many final large conferences earlier than all of us locked down.

As spring turned to summer season, the COVID-19 information cycle moved to new “flare-up” zones: California, Arizona, Texas, Florida and North Carolina. Outdoors of solidly-for-Biden California, the opposite 4 are swing states.

Deal with Florida’s 29 large electoral school votes, which I feel might go to Trump in his quest for 270 if that state’s coronavirus state of affairs improves in these ultimate weeks. PredictIt’s market is pricing Biden’s Florida likelihood at 52%, so it’s a digital coin toss (determine 1).

Determine 1: PredictIt Election Map

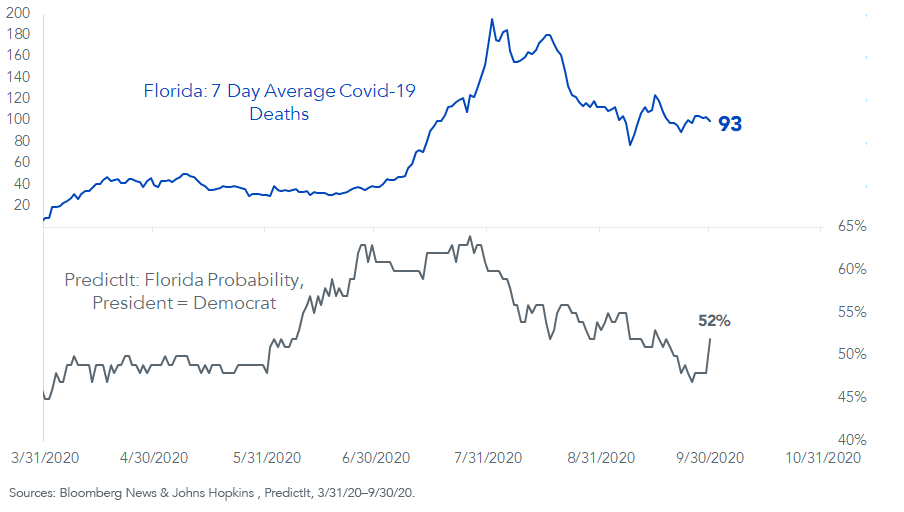

Favoring Trump is Florida’s declining each day COVID-19 demise toll. Whereas the seven-day shifting common received near 200 on the primary day of August, it has since fallen to 93. Together with it, Biden’s 64% PredictIt value in Florida fell to 52%.

Correlation or coincidence? We can’t know for certain. However I feel this election boils right down to one thing like this:

Second Wave = Biden Victory

No Second Wave or a Average October = Trump Victory

With Republican governor Ron DeSantis the face of “opening it up,” the trajectory of the blue line in determine 2 favors the GOP if it retains heading down.

Determine 2: Florida Seven-Day Common COVID-19 Deaths vs. Presidential Likelihood

Determine Three exhibits the 5 summer season headline states, together with the states and nations that had been hit within the preliminary COVID-19 strike. If Florida—together with Texas and Arizona—continues to see COVID-19 severity wane, do undecided voters in these states shift towards Trump? And can North Carolina, which had a tough September, in flip go to Biden?

Determine 3: Whole Decline from Peak: Day by day COVID-19 Deaths (Seven-Day Common)

Suppose Trump comes from behind and wins. I feel that advantages the Financials sector relative to the broad market. When he lower the company tax price from 35% to 21%, it was the banks that noticed one of many largest earnings boosts as a result of many pay one thing near the statutory tax price. Take Biden’s company tax enhance proposal off the desk and out of the blue the sector has purpose to smile.

Moreover, the second alternative for Biden’s Treasury Secretary, behind Lael Brainard of the Federal Reserve, is Massachusetts senator Elizabeth Warren. Ought to Biden give a hat tip to his base by deciding on the senator, it’s vital to notice that one among her initiatives features a monetary transactions tax; each inventory, bond and spinoff commerce would ship a penny or two to the Treasury, probably hindering market liquidity. If we take that prospect off the desk, banks would really feel aid.

Outdoors of Financials, how about Massive Oil? There is no such thing as a larger local weather skeptic within the developed world than Trump. Ship him again for a second time period and you need to assume that provides the group a catalyst to outperform.

With Power and Financials populating worth indexes, that leaves this:

Trump “On” = Worth Shares

Biden “On” = Development Shares

In case you are considering Biden, two of our development Funds are the WisdomTree Cloud Computing Fund (WCLD) and the WisdomTree Development Leaders Fund (PLAT).

Should you’re considering Trump for worth, the WisdomTree U.S. LargeCap Fund (EPS) is chubby in Financials in its 500-stock allocation. If an chubby in Power is your play for a Trump shock, possibly one thing just like the WisdomTree U.S. LargeCap Dividend Fund (DLN) is the angle. Whereas the S&P 500’s Power weight has withered to 2%, DLN has 7% within the sector.

Necessary Dangers Associated to this Article

There are dangers related to investing, together with attainable lack of principal. Funds focusing their investments on sure sectors, reminiscent of DLN and EPS, enhance their vulnerability to any single financial or regulatory growth. This may occasionally lead to larger share value volatility.

International investing includes particular dangers, reminiscent of threat of loss from forex fluctuation or political or financial uncertainty; these dangers could also be enhanced in rising, offshore or frontier markets. Know-how platform firms have important publicity to shoppers and companies, and a failure to draw and retain a considerable variety of such customers to an organization’s merchandise, companies, content material or know-how might adversely have an effect on working outcomes. Technological modifications might require substantial expenditures by a know-how platform firm to switch or adapt its merchandise, companies, content material or infrastructure. Know-how platform firms usually face intense competitors, and the event of recent merchandise is a fancy and unsure course of. Issues relating to an organization’s services or products which will compromise the privateness of customers, or different cybersecurity considerations, even when unfounded, might harm an organization’s status and adversely have an effect on working outcomes. Many know-how platform firms at present function beneath much less regulatory scrutiny, however there’s important threat that prices related to regulatory oversight might enhance sooner or later. PLAT invests within the securities included in, or consultant of, its Index no matter their funding benefit, and the Fund doesn’t try and outperform its Index or take defensive positions in declining markets. The composition of the Index is closely depending on quantitative and qualitative info and information from a number of third events, and the Index could not carry out as supposed.

WCLD invests in cloud computing firms, that are closely depending on the Web and using a distributed community of servers over the Web. Cloud computing firms could have restricted product strains, markets, monetary assets or personnel and are topic to the dangers of modifications in enterprise cycles, world financial development, technological progress and authorities regulation. These firms usually face intense competitors and probably speedy product obsolescence. Moreover, many cloud computing firms retailer delicate client info and might be the goal of cybersecurity assaults and different forms of theft, which might have a detrimental affect on these firms and the Fund. Securities of cloud computing firms are typically extra unstable than securities of firms that rely much less closely on know-how and, particularly, on the Web. Cloud computing firms can usually interact in important quantities of spending on analysis and growth, and speedy modifications to the sector might have a fabric hostile impact on an organization’s working outcomes. The composition of the Index is closely depending on quantitative and qualitative info and information from a number of third events, and the Index could not carry out as supposed.

Please learn every Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.