The worth issue is outpacing developmen

The worth issue is outpacing development to this point in 2021. Add momentum to the combo to get funds just like the First Belief Dorsey Wright Momentum & Worth ETF (DVLU).

DVLU seeks funding outcomes that correspond typically to the value and yield of an index referred to as the Dorsey Wright Momentum Plus Worth Index. The fund makes use of an indexing funding method to copy the efficiency of the Index.

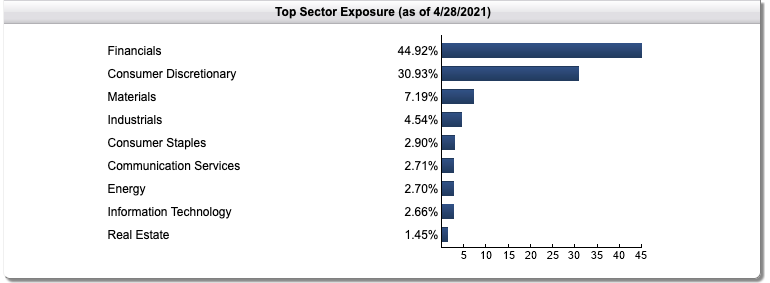

As of April 28, DVLU is skewed in the direction of the monetary and client discretionary sectors. Each sectors comprise about three-fourths of the fund’s internet property.

Pop the hood of DVLU and informal traders won’t simply establish names like Unum Group or PVH Corp. DVLU’s technique delves deeply into undervalued names within the large- to mid-cap equities universe utilizing a basic method by way of 4 metrics: price-to-sales ratio, price-to-book ratio, price-to-earnings ratio, and price-to-cash circulation ratio.

The fund’s technique additionally seems to be for equities which might be experiencing sturdy relative power. Traders conversant in momentum perceive that when it will get going, it is laborious to cease.

“Every safety is assigned a percentile rank for every of the 4 metrics listed above, and a cumulative worth rating is then calculated for every safety by averaging the percentile scores for every of the worth metrics,” the First Belief web site famous. “The securities are then ranked based mostly upon their worth scores, and the highest 50 securities with the best worth scores are chosen for inclusion within the index.”

“The securities are then weighted, with better weights given to securities with increased worth scores,” the web site added.

Worth and Momentum: A Dynamic Duo

Worth paired with momentum could make for sturdy good points when in comparison with the S&P 500 Worth index and the S&P 500 momentum index. Thus far this yr, DVLU is up over 30%, outpacing each the S&P 500 worth and momentum indices in 2021.

The identical outperformance is proven when trying on the performances of DVLU and the indexes over the previous 12 months. In reality, the disparity in efficiency virtually doubles.

For extra information and data, go to the Sensible Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.