Brexit is again within the information at this time, with the broad strokes of a possible U.Okay./E.U. divorce deal being launched. Nonetheless, t

Brexit is again within the information at this time, with the broad strokes of a possible U.Okay./E.U. divorce deal being launched. Nonetheless, the EUR/USD stays in a bearish place this week. Charges are actually beneath 1.2200 and holding agency. Make no mistake, the announcement of a proper Brexit deal seems imminent. For those who’re buying and selling the euro or pound Sterling, it will likely be a good suggestion to maintain one eye on a breaking information feed.

Minutes in the past, Reuters launched a considerably ambiguous report from the U.Okay./E.U. negotiations. Included have been quotes from “unnamed sources” that issues have been continuing closely in favor of E.U. management:

- “The British have made big concessions within the negotiations prior to now 48 hours.”

- “On fishing specifically, the newest British place was removed from the 3-year entry to British waters and 80% discount in quotas provided per week in the past.”

As a result of the report is from Reuters, most individuals take it as being largely truthful. And, it could very nicely be. Nonetheless, quotes that come from “unnamed sources” are extremely suspect. For those who’re scanning for dependable buying and selling information, it will likely be greatest to attend for official statements from E.U. or U.Okay. negotiators. As of this writing, studies are circulating from Bloomberg {that a} deal-in-principle has been reached.

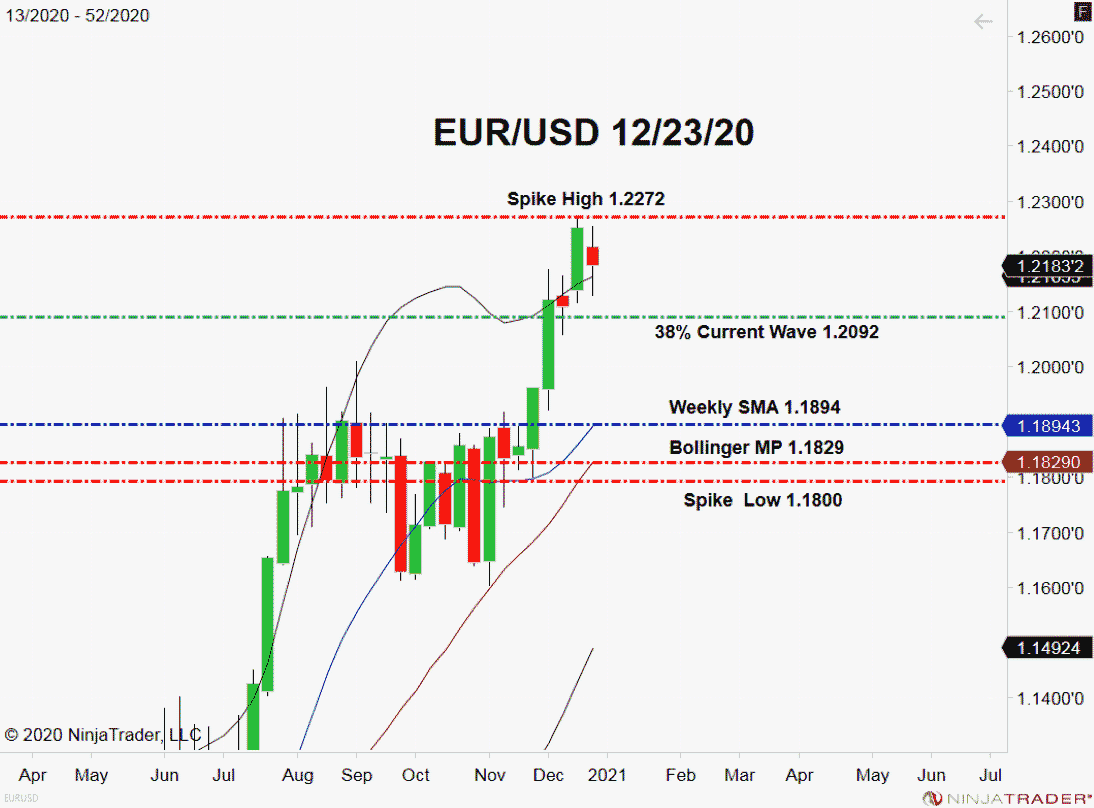

Within the meantime, the EUR/USD is inside placing distance of a key Fibonacci degree. Let’s dig into the weekly technicals and see if there’s a strong buying and selling alternative available.

EUR/USD Holds In Bearish Territory

The weekly bullish development is unbroken for the EUR/USD. Nonetheless, if we see a post-divorce deal pullback, a shopping for alternative could arrange for later this week.

+2020_52+(11_19_48+AM).png)

Backside Line: Ought to a take a look at of the 38% Present Wave Retracement (1.2092) come to cross, a shopping for alternative for the EUR/USD will seemingly come into play. So long as the Spike Excessive (1.2272) is the periodic prime of this market, I’ll have purchase orders within the queue from 1.2109. With an preliminary cease loss at 1.2048, this commerce produces 50 pips on a barely sub-1:1 threat vs reward ratio.