It has been a turbulent day on the crypto markets as whipsaw motion has been the rule. On the halfway level of the U.S. buying and selling day, Bit

It has been a turbulent day on the crypto markets as whipsaw motion has been the rule. On the halfway level of the U.S. buying and selling day, Bitcoin BTC (-2.47%), Ethereum ETH (-5.25%), Litecoin LTC (-8.82%), and XRP (-3.38%) have all rebounded from steep sell-offs.

As at all times, the motion in crypto is pushed by a little bit of rumor, reality, and obscure expertise. Accordingly, these tales might have had one thing to do with at this time’s turbulence:

- Jamie Dimon: JP Morgan head Jamie Dimon issued a letter to shareholders stating that the regulatory standing of cryptocurrencies is a “critical rising problem that must be handled.” This follows JP Morgan’s $130,000 topside goal for Bitcoin issued final week. So, will Dimon and JP Morgan enter the cryptosphere if extra regulation is enacted? With such a bullish estimate for BTC, it’s laborious to think about that they may keep out.

- Taproot: The ultimate strokes have been placed on Bitcoin’s Taproot improve. Programmers have determined that median time handed (MTP) can be used for Taproot’s activation timeline. At this level, estimates recommend that Taproot can be absolutely built-in in November.

In the end, these two information objects level to a bullish BTC over the intermediate time period. Given a much-needed system improve, in addition to extra institutional adoption, Bitcoin is positioned to at the least maintain 2021’s features for the close to future.

Bitcoin Pulls Again, $55,000 In Play

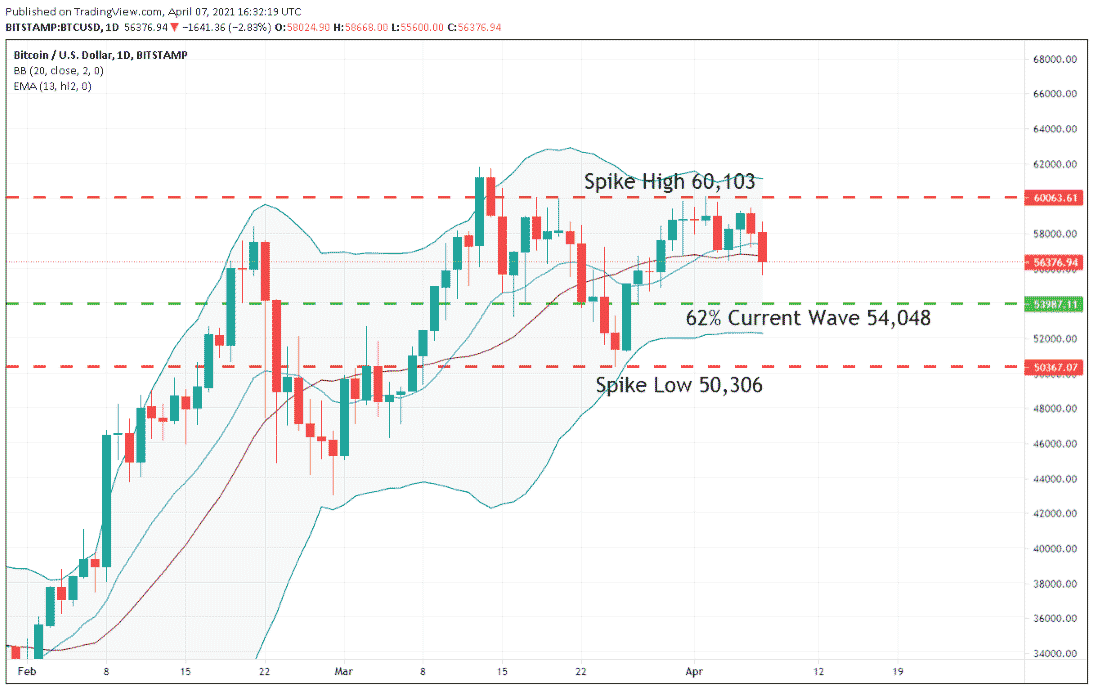

The every day Bitcoin chart under offers us take a look at the place BTC stands. Costs are within the midst of a two-day slide however are holding above $55,000.

Right here’s one degree to look at till Friday’s closing bell:

- Help(1): 62% Present Wave Retracement, $54,048

Backside Line: If BTC continues to drag again, a shopping for alternative might come into play. Till elected, I’ll be seeking to purchase Bitcoin from $54,075. With an preliminary cease loss at $51,075, this commerce returns 5.5% ($3000) on a normal 1:1 threat vs reward ratio.