The crypto-sphere has been comparatively quiet at this time as the key cash are buying and selling combined. Over the previous 24-hours, Bitcoin BT

The crypto-sphere has been comparatively quiet at this time as the key cash are buying and selling combined. Over the previous 24-hours, Bitcoin BTC (-0.72%), Ethereum ETH (+2.09%), and Litecoin LTC (-1.09%) are all hovering close to flat. With the April Fed bulletins due out at 2:00 PM EST at this time, it seems to be like buyers are in a holding sample forward of the FOMC’s commentary.

Nonetheless, there may be one breaking information merchandise dealing with cryptocurrencies that’s price noting. In a press launch from earlier at this time, the U.S. Securities and Change Fee (SEC) moved again the approval timeline for the VanEck BTC ETF providing. Within the assertion, the SEC offers that inside 45-90 days, they are going to make a judgment on a proposed CBOE BZX Change rule change that will permit or commerce of a BTC ETF. That is an attention-grabbing level in that it additional delays VanEck’s last Bitcoin ETF approval. Up so far, the SEC has refused to log off on any such choices.

On the Fed entrance, Chairman Jerome Powell is scheduled to provide his coverage presser this afternoon at 2:30 PM EST. Most analysts agree that it’s to be extra of the identical out of Powell. Be looking out for a dovish tone and extra discuss of prolonged QE. After all, if there are any surprises, the FX Leaders group will deliver you the important thing occasions.

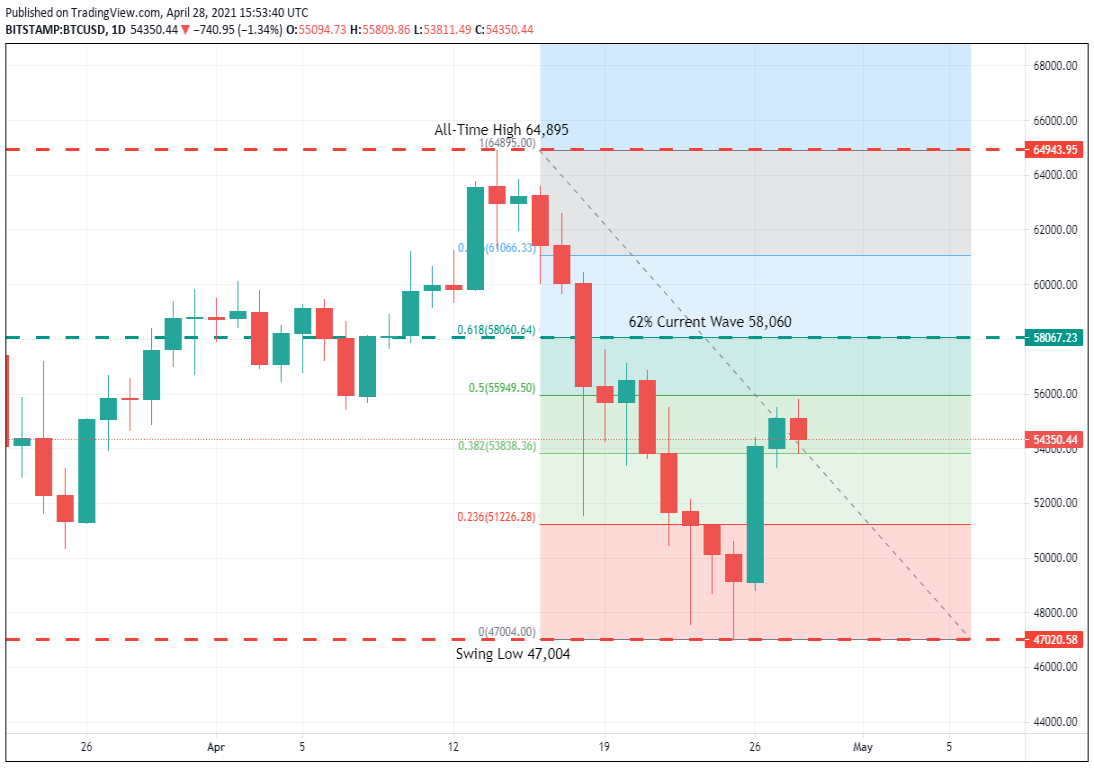

Bitcoin (BTC) Approaches Day by day 62% Resistance Stage

It has been a strong week for Bitcoin as merchants have rallied values greater than $4000. For now, it seems to be like crypto merchants preserve the BTC bullish bias that has dominated 2021.

Backside Line: At press time (about 12:45 PM EST), there may be one key degree on my radar for Bitcoin ― $58,060. That is April’s 62% Fibonacci retracement and could possibly be an essential resistance degree transferring ahead.

Till elected, I’ll have promote orders within the queue from $57,900. With an preliminary cease loss at $62,000, this commerce produces 7% ($4100) on a regular 1:1 danger vs reward buying and selling plan.