Nonfarm payrolls: A battle between danger taking and security – Foreign exchange Information Preview Poste

Nonfarm payrolls: A battle between danger taking and security – Foreign exchange Information Preview

Posted on July 1, 2020 at 11:30 am GMTChristina Parthenidou, XM Funding Analysis Desk

The ISM manufacturing PMI is due at this time at 14:00 GMT and June’s Nonfarm payrolls will likely be launched on Thursday, a day sooner than regular, at 12:30 GMT as US markets will likely be shut on Friday for July 4th celebrations. Whereas one other upbeat end result is predicted to spice up danger sentiment, buyers would possibly catch themselves between virus fears and enhancing knowledge, capping any potential beneficial properties.

Covid-19 resurgence: a worldwide wake-up name

The well being group has been repeatedly warning that the removing of lockdown measures within the absence of an efficient vaccine could expose economies to a second wave of infections. That point appears to have come, and it has discovered markets unprepared as buyers didn’t anticipate that to occur earlier than autumn. Apparently, the small outbreak of recent virus instances in China, which was the primary to see its curve flattening, was not taken very significantly. However the Covid-19 resurgence within the US this month topped earlier peaks and extra international locations reported a spike in new infections, whereas some others didn’t see a breakthrough in any respect, bringing buyers again to actuality.

Encouragingly, central banks and governments hold reiterating that they’ll do no matter it takes to help customers and companies after releasing huge stimulus packages in earlier months, sustaining inventory indices in an uptrend. Fed chief Powell was the newest to remind markets of that on Tuesday. Concurrently, the energy within the gold worth, which hit contemporary highs lately, means that buyers could not simply abandon safe-haven property, particularly if extra economies resolve to reverse or delay their re-opening plans. So, gold and shares may observe an analogous route if present circumstances stay as they’re, except the resumption of restrictions continues , leading to disappointing knowledge releases.

Upbeat knowledge anticipated, however the state of affairs has modified

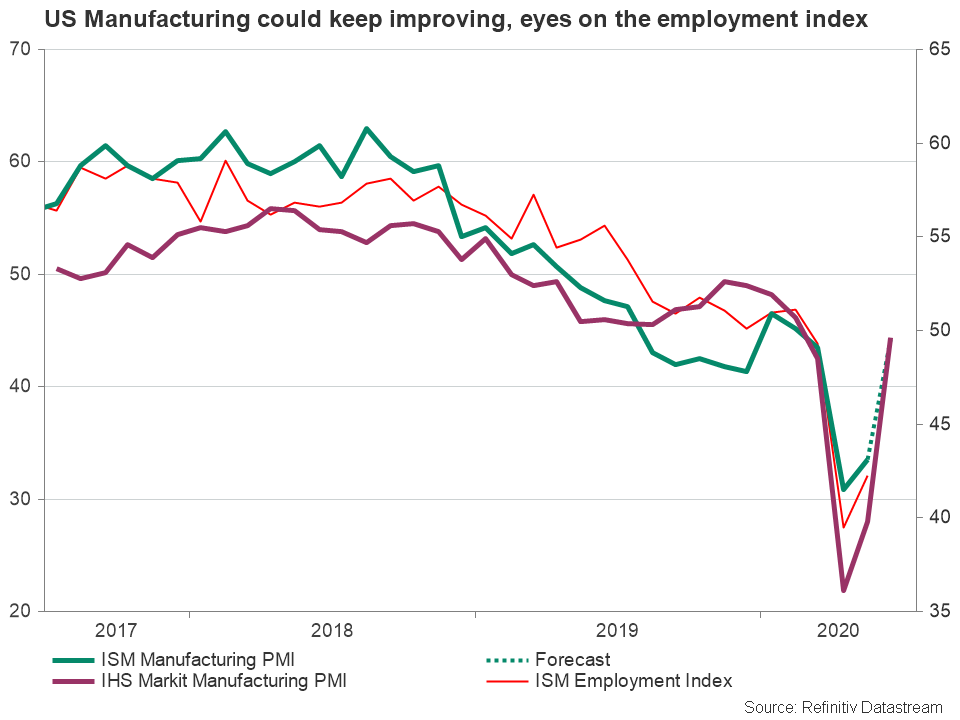

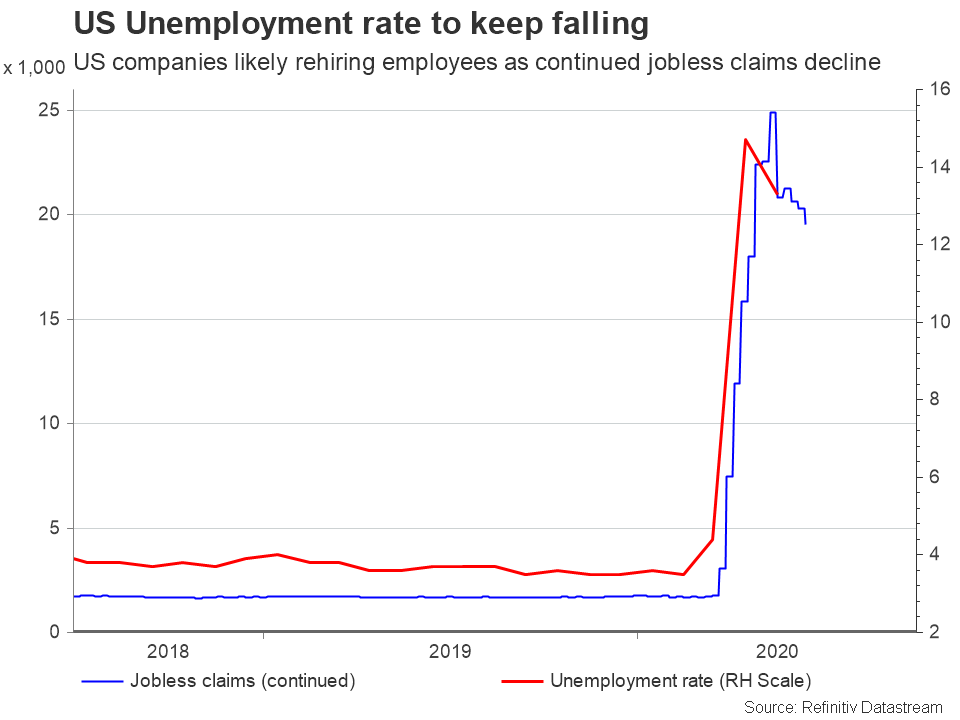

On Monday, a stronger-than-expected month-to-month development in pending residence gross sales for June favored US shares and the greenback. Trying forward, the ISM Manufacturing PMI for June may additionally carry smiles to buyers’ faces on Wednesday if it manages to beat expectations of 49.5, particularly if new orders and, extra importantly, the employment sub-index present additional enhancements. The latter may entice particular consideration because it may present an early indication of what needs to be anticipated from Thursday’s NFP jobs report, which is forecast to point out a report improve of three.zero million in new job positions in June in comparison with 2.5 million within the previous month. The ADP non-public employment survey may also be carefully watched for a similar cause later at this time.

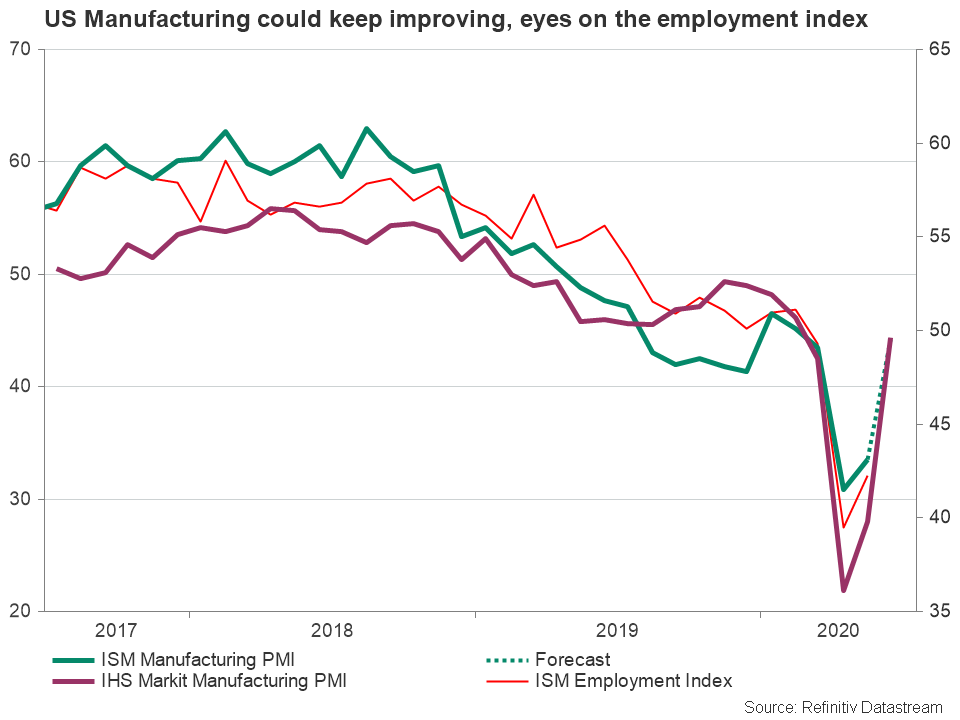

Maybe a second consecutive drop within the unemployment fee, which is claimed to fall to 12.3% from 13.3% in Could, might be the principle set off for an even bigger response within the greenback, hinting that the stimulus is certainly supporting rehiring in companies. In different knowledge, common hourly earnings are projected to rise at a softer tempo of 5.3% y/y versus 6.7% beforehand. But, this will not weigh on buyers’ sentiment and could be thought of a reasonably optimistic growth for the reason that return of low-income staff to work is what’s including draw back stress to common earnings. Markets may additionally welcome one other slowdown in preliminary and continued jobless claims tracked within the week ending June 27 – contains newer unemployment knowledge than the NFP.

An upbeat NFP report may have doubtlessly brightened the outlook for the US economic system just a few weeks in the past when markets had been extra sure that the continual removing of restrictions would end in additional knowledge enchancment. However circumstances have modified over the previous week and this assertion could also be in consideration following the latest virus spikes and the resumption of some social boundaries. Therefore, it’s nearly sure {that a} adverse shock on this week’s knowledge may solely damage danger urge for food, signaling that the restoration could have began to lose steam earlier than the brand new virus outbreak. Alternatively, better-than-expected readings would come at a nasty time and might be seen as cautiously optimistic, with merchants possible ready for upcoming releases for higher clues on whether or not the virus state of affairs has began to weigh on the information restoration.

Greenback response

Turning to FX markets, the greenback has a twin function, appearing each as a safe-haven and a danger asset. So, so long as the Covid-19 resurgence shouldn’t be completely a US story, the greenback may nonetheless survive draw back pressures within the wake of disappointing numbers. Nevertheless, upside corrections could also be restricted too given fears that the information enchancment could not proceed within the coming months. In different phrases, it might be a battle between security and danger taking.

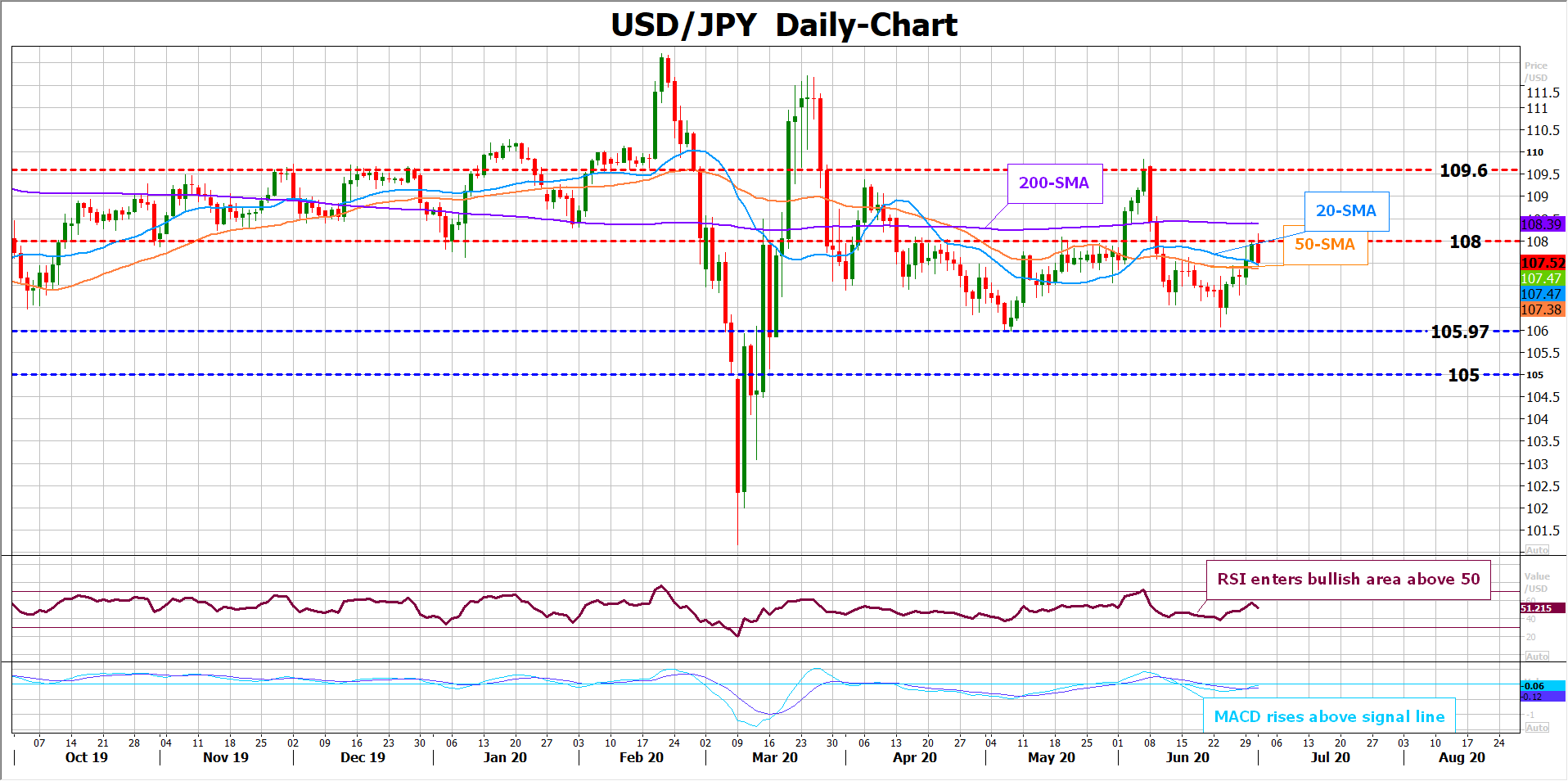

Taking a look at USD/JPY, the pair bottomed twice round 105.90 earlier than reversing increased, setting the stage for an additional bullish run. That mentioned, the bulls may have to beat the lure throughout the 108.00-108.40 zone with a view to revisit the 109.60 resistance space.

In any other case, a pull again beneath the 20-day easy transferring common (SMA) may carry the 105.97 low again into view, a break of which is required to achieve the 105.00 spherical degree.

USDJPY