Gold, Silver, US Actual Charges, Inflation Expectations, US Greenback – Speaking Factors:Climbing inflation expectations, falling

Gold, Silver, US Actual Charges, Inflation Expectations, US Greenback – Speaking Factors:

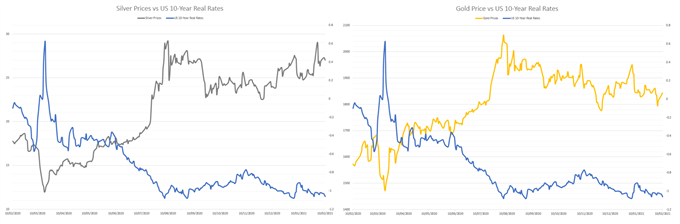

- Climbing inflation expectations, falling actual charges of return, and a weaker USD could bolster treasured steel costs.

- Gold costs approaching key inflection level on the 200-MA.

- Silver costs persevering with to trace the uptrend extending from the March 2020 nadir. Are additional positive factors within the offing?

As talked about in earlier stories, the mix of climbing inflation expectations, falling actual charges, and a weaker US Greenback could present a tailwind for gold and silver costs within the coming months. The approaching supply of a considerable fiscal help bundle will seemingly restrict the Dollar’s potential upside and in flip pave the best way for treasured metals to get better misplaced floor.

Democrats in each the Home and Senate filed joint funds resolutions that may enable President Biden to go the vast majority of his proposed $1.9 trillion stimulus bundle with a easy majority – in a course of known as reconciliation.

Coronavirus circumstances have additionally markedly declined since peaking on January eight at 308,000, which may enable the economic system to return to a degree of normalcy in Q2 of 2020.

Knowledge Supply – Bloomberg

The supply of further fiscal help, and the expectation {that a} sooner-than-expected reopening will enable the discharge of pent-up demand, may see inflation expectations prolong their latest push increased.

Nevertheless, the Federal Reserve’s dedication to proceed buying a minimum of $80 billion of Treasury securities and $40 billion of company mortgage-backed securities “till substantial progress has been made towards the Committee’s most employment and value stability targets”, will seemingly maintain the lid on actual charges of return for the foreseeable future.

With that in thoughts, gold and silver costs could trudge increased within the coming weeks on the again of fiscal assist progress, the Federal Reserve’s dovish stance and climbing expectations for client value development.

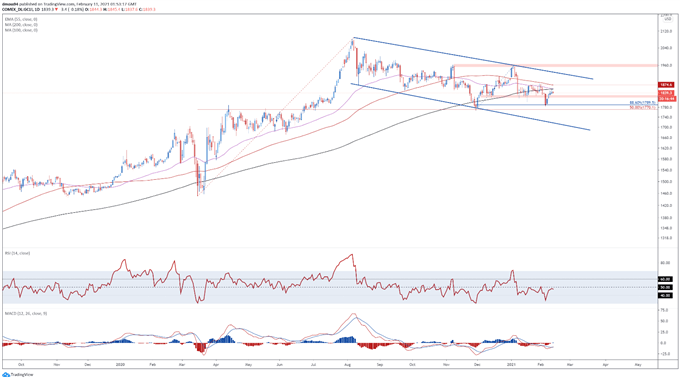

Gold Worth Each day Chart – Probing Sentiment-Defining 200-MA

Gold futures each day chart created utilizing Tradingview

Gold costs have continued to slip decrease during the last 6 months, as costs stay confined inside a Descending Channel formation.

Nevertheless, with value remaining constructively perched above the 50% Fibonacci retracement of the transfer from the March 2020 nadir to the August excessive, the long-term outlook appears skewed to the topside.

However, with value struggling to breach the sentiment-defining 200-day transferring common (1856) and each the RSI and MACD monitoring under their respective impartial midpoints, additional losses are definitely not out of the query.

That being stated, gold may prolong its latest rebound increased if vary help at 1820 – 1830 efficiently stifles promoting strain. A each day shut above the 55-EMA (1858) seemingly required to carve a path for value to problem channel resistance and the December 2020 excessive (1912).

Alternatively a each day shut under 1820 may sign the resumption of the secondary downtrend and clear a path for sellers to drive bullion again in the direction of the 88.6% Fibonacci (1789).

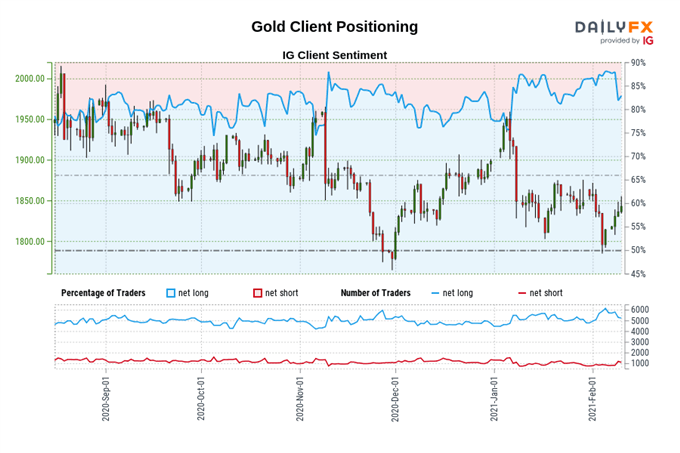

The IG Shopper Sentiment Report reveals 82.70% of merchants are net-long with the ratio of merchants lengthy to brief at 4.78 to 1. The variety of merchants net-long is 0.71% decrease than yesterday and 10.47% decrease from final week, whereas the variety of merchants net-short is 4.94% decrease than yesterday and 18.61% increased from final week.

We usually take a contrarian view to crowd sentiment, and the very fact merchants are net-long suggests Gold costs could proceed to fall.

Positioning is extra net-long than yesterday however much less net-long from final week. The mixture of present sentiment and up to date adjustments offers us an extra blended Gold buying and selling bias.

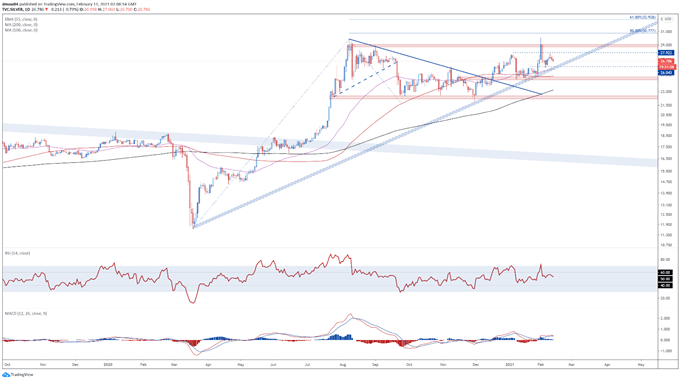

Silver Worth Each day Chart – Monitoring 11-Month Uptrend

Silver value each day chart created utilizing Tradingview

Silver seems poised to increase its climb increased, as costs monitor firmly above all three transferring averages and proceed to respect the uptrend extending from the March 2020 lows.

With the RSI perched above its impartial midpoint, and the slope of the 55-EMA notably steepening, the trail of least resistance appears increased.

If former resistance-turned-support on the January 21 excessive (26.04) stays intact, a push to problem vary resistance at 28.75 – 29.10 appears seemingly. A each day shut above that’s required to sign the resumption of the first uptrend and convey the psychologically imposing 31.00 mark into focus.

Nevertheless, slicing under 26.00 may intensify near-term promoting strain and generate a pullback to the January low (24.06).

— Written by Daniel Moss, Analyst for DailyFX

Observe me on Twitter @DanielGMoss

Really helpful by Daniel Moss

High Buying and selling Classes