USD Technical OutlookUS Greenback Index (DXY) inverse head-and-shoulders sampleEUR/USD rolling over and difficult the March trend

USD Technical Outlook

- US Greenback Index (DXY) inverse head-and-shoulders sample

- EUR/USD rolling over and difficult the March trend-line

USD sample, trend-line break could be bullish

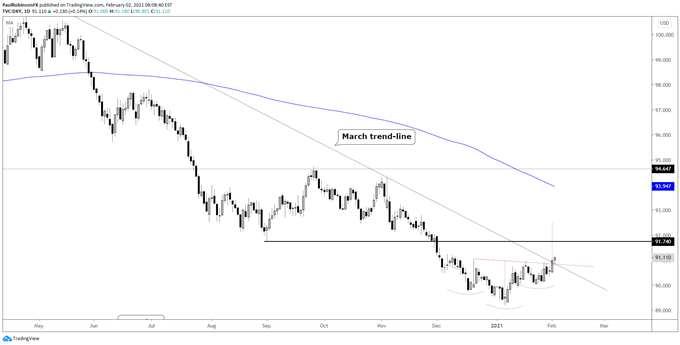

The US Greenback Index (DXY) is on the verge of turning greater because it tries to spherical its method out of an inverse head-and-shoulders (H&S) formation. Including extra weight to the importance of this sample is the March trend-line in confluence with the neckline of the H&S sample.

In the intervening time worth is beginning to poke above the confluent threshold, and will it firmly shut above there at the moment (or very quickly if knocked again decrease near-term), then the bullish buying and selling bias will proceed to achieve additional traction.

The primary massive stage to look at on a breakout arrives on the September 1 low at 91.74, and can be an necessary threshold to cross if the rally is to no less than meet or exceed the measured transfer implied by the depth of the inverse head-and-shoulders. That transfer could be to round 92.50 or greater.

Really helpful by Paul Robinson

Take a look at the Q1 USD Forecast

US Greenback Index (DXY) Day by day Chart (inverse H&S)

DXY Chart by TradingView

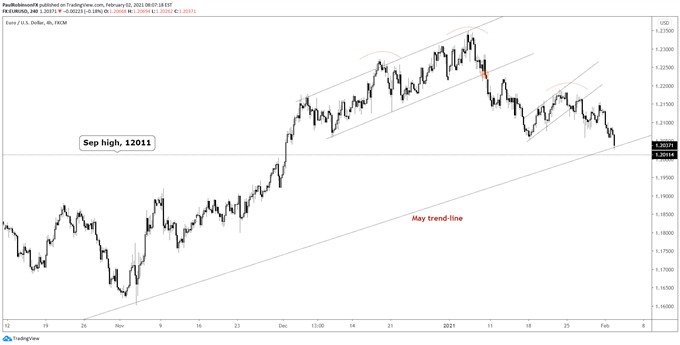

If the DXY is popping greater then the index’s most closely weighted constituent, EUR (57.6% weight), is popping decrease. The “anti-dollar”. It has been rolling down out of a head-and-shoulder sort sample as properly, and it even broke a bit bear-flag just lately.

This has the Might trend-line in focus, which is the equal of the DXY’s March trend-line. A break under is seen as probably accelerating the transfer decrease if the September 1 excessive, which is nearly in confluence, can break as properly.

A breakdown beneath 12011 is seen as the actual stage to commerce under to extend odds in favor of sellers. A maintain of help wouldn’t essentially flip the outlook bullish, however it will be prudent to take a impartial stance at least. Help is help till damaged. To show the image bullish some work will should be achieved.

EUR/USD 4-hr Chart (12011 help)

EUR/USD Chart by TradingView

Assets for Foreign exchange Merchants

Whether or not you’re a new or skilled dealer, we now have a number of assets out there that will help you; indicator for monitoring dealer sentiment, quarterly buying and selling forecasts, analytical and academic webinars held day by day, buying and selling guides that will help you enhance buying and selling efficiency, and one particularly for individuals who are new to foreign exchange.

—Written by Paul Robinson, Market Analyst

You possibly can comply with Paul on Twitter at @PaulRobinsonFX