New Zealand Dollar Stages Six-Day Rally Ahead of RBNZ Rate DecisionNZD/USD trades back above the former support zone around the December low (0.6701)

New Zealand Dollar Stages Six-Day Rally Ahead of RBNZ Rate Decision

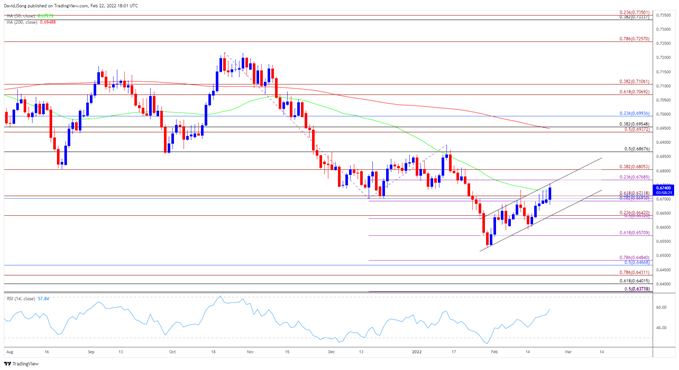

NZD/USD trades back above the former support zone around the December low (0.6701) as it stages a six-day rally, and the exchange rate may continue to retrace the decline from the yearly high (0.6891) as it pushes above the 50-Day SMA (0.6728) for the first time since January.

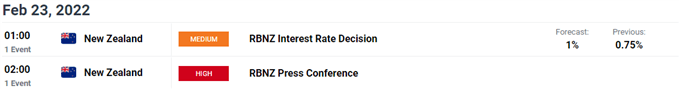

NZD/USD appears to be trading within an ascending channel after registering the monthly low (0.6566) on February 1, and it remains to be seem if the Reserve Bank of New Zealand (RBNZ) interest rate decision will sway the exchange rate as the central bank is expected to increase the official cash rate (OCR) to 1.00% from 0.75% following the back-to-back rate hikes in 2021.

NZD/USD Rate Daily Chart

Source: Trading View

NZD/USD extends the advance from the previous week after defending the monthly low (0.6590), and a close above the former support zone around 0.6690 (38.2% expansion) to 0.6710 (61.8% expansion), which incorporates the December low (0.6701), keeps the Fibonacci overlap around 0.6770 (23.6% expansion) to 0.6810 (38.2% expansion) on the radar as it trades to fresh monthly highs.

Next area of interest comes in around 0.6870 (50% retracement), with a break above the January high (0.6891) opening up the overlap 0.6940 (50% expansion) to 0.6990 (23.6% retracement), but the six-day rally has pushed NZD/USD up against channel resistance, and lack of momentum to push above the Fibonacci overlap around 0.6770 (23.6% expansion) to 0.6810 (38.2% expansion) may lead to a near-term exhaustion especially if the exchange rate struggles to hold above the 50-Day SMA (0.7627).

Failure to hold above the 0.6690 (38.2% expansion) to 0.6710 (61.8% expansion) zone may push NZD/USD back towards the 0.6630 (50% expansion) to 0.6640 (23.6% expansion) region, and the advance from the January low (0.6529) may turn out to be a correction in the broader trend if the exchange rate snaps channel support and slips toward the 0.6570 (61.8% expansion) area.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com