NZD/USD halts a four-day rally as Federal Reserve Chairman Jerome Powell insists that the central bank could “move more aggressively by raising the f

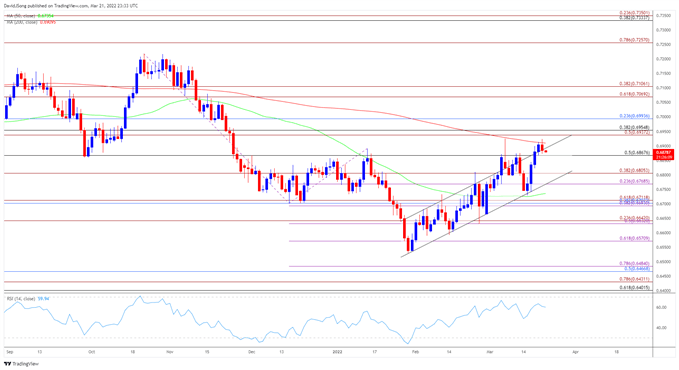

NZD/USD halts a four-day rally as Federal Reserve Chairman Jerome Powell insists that the central bank could “move more aggressively by raising the federal funds rate by more than 25 basis points,” and the exchange rate appears to be falling back from channel resistance after struggling to test the yearly high (0.6926).

At the same time, NZD/USD seems to be responding to the 200-Day SMA (0.6910) amid the string of failed attempts to close above the moving average, and the exchange rate may fall back towards channel support once it snaps the series of higher highs and lows from the monthly low (0.6729).

NZD/USD Rate Daily Chart

Source: Trading View

NZD/USD appears to be reversing course after failing to clear the Fibonacci overlap around 0.6940 (50% expansion) to 0.6990 (23.6% retracement), with a move below the 0.6870 (50% retracement) region bringing the 0.6770 (23.6% expansion) to 0.6810 (38.2% expansion) region back on the radar, which largely lines up with channel support.

NZD/USD needs to hold above the 50-Day SMA (0.6735) to keep the ascending channel larger intact, but a break below the moving average may push the exchange rate towards the 0.6690 (38.2% expansion) to 0.6710 (61.8% expansion) region, with the next area of interest coming in around 0.6630 (50% expansion) to 0.6640 (23.6% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com