US Greenback Value Motion Speaking Factors:The US Greenback has built-in a short-term vary up to now in August, approaching the h

US Greenback Value Motion Speaking Factors:

- The US Greenback has built-in a short-term vary up to now in August, approaching the heels of an aggressively bearish outing within the month of July.

- US Greenback value motion set a doji for final week’s commerce, maintaining the door open to short-term pullback/reversal themes. This can be a sought-after theme in EUR/USD.

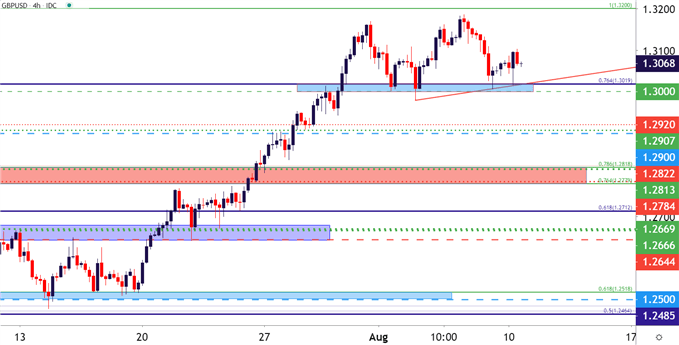

- For brief-side continuation of USD-weakness, GBP/USD could maintain some attract because the pair has now thrice examined assist within the 1.3000-1.3018 zone for assist in August.

US Greenback Coils After a Large Outing in July

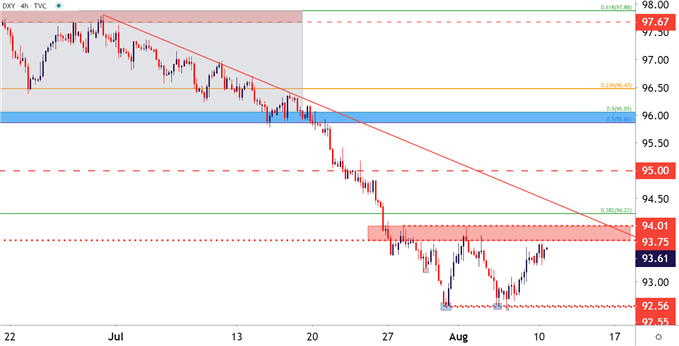

We’re not fairly on the half-way level for Q3 however, already, it’s been a troublesome outing for the US Greenback. The forex got here into the quarter holding on to a range-bound formation that’d been in-play for a number of weeks already. However after pushing all the way down to assist in mid-July, patrons went on hiatus and the underside fell out of value motion because the US Greenback fell, and fell and fell. Ultimately the Dollar discovered assist across the 92.50 stage on the ultimate day of July. Since then value motion has been displaying extra imply reversion with one other check of that very same assist on Wednesday and Thursday of final week.

US Greenback 4-Hour Value Chart

Chart ready by James Stanley; USD, DXY on Tradingview

Friday introduced a fast pop within the USD, helped alongside by the Non-Farm Payrolls report. That energy has continued to point out within the early-portion of this week, with USD value motion making an strategy in the direction of vary resistance at 93.75-94.00; with the previous of these costs beforehand functioning because the two-year-low till it was taken out a few weeks in the past.

Beneficial by James Stanley

Obtain our Q3 USD Forecast

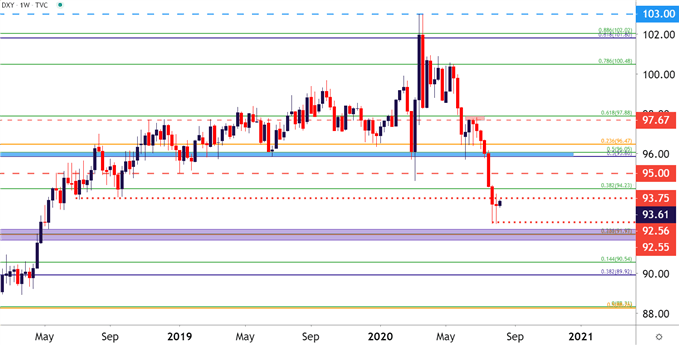

On the weekly chart under, discover how final week’s Doji follows that prior assist check. Ought to this week current a backdrop of energy, there could also be a morning star formation to work with and for USD bulls this may very well be an merchandise of pleasure, as that formation will typically be approached with the purpose of reversals.

Begins in:

Reside now:

Aug 11

( 17:08 GMT )

James Stanley’s Tuesday Webinar

Buying and selling Value Motion

This places much more give attention to the short-term resistance checked out above. For a morning star formation to return alive this week, near-term value motion might want to push by way of that key zone of resistance; which might hold the door open for short-term methods of energy across the US Greenback.

US Greenback Weekly Value Chart

Chart ready by James Stanley; USD, DXY on Tradingview

EUR/USD Finds Resistance at Lengthy-Time period Trendline

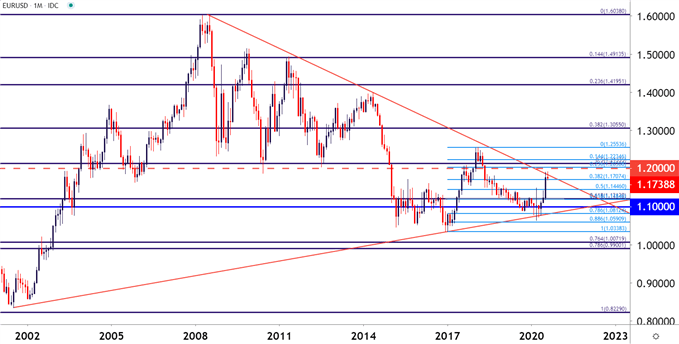

The robust factor about trendlines are the subjectivity surrounding them. Which trendline is correct? Whereas there’s a number of mechanisms purporting to supply some ingredient of reply the truth of it’s the most operable trendline is the one which works… and till that trendline or doable trendline comes into play, there’s actually no manner of figuring out which is ‘proper.’

To be taught extra about drawing trendlines, take a look at Introduction to Fundamental Trendline Evaluation within the DailyFX Schooling Part.

Beneficial by James Stanley

Constructing Confidence in Buying and selling

EUR/USD Month-to-month Value Chart

Chart ready by James Stanley; EUR/USD on Tradingview

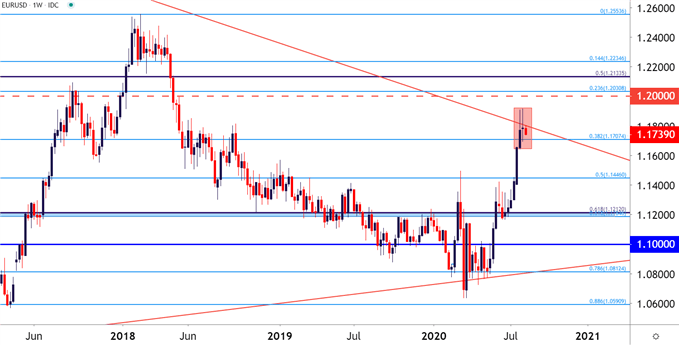

That is related on EUR/USD as there’s a trendline that I’ve seen drawn in a variety of methods from a variety of analysts. There’s no definitive ‘proper’ right here. However, if one connects the 2008-2014 swing-highs, there’s a current merchandise of relevance as EUR/USD value motion bumped into this projection two weeks in the past. Final week noticed one other outing of resistance respecting this stage; and similar to the mirror picture of the US Greenback above, there’s two of the primary three steps for a night star formation. Such formations will typically be approached with the purpose of bearish reversals, and given the synchronicity to the USD setup above, this may very well be an operative space for USD-bulls and EUR/USD bears to observe this week; in search of a maintain of that resistance and for costs to push again in the direction of the 1.1700 and 1.1600 areas.

EUR/USD Weekly Value Chart

Chart ready by James Stanley; EUR/USD on Tradingview

GBP/USD Trades in Tighter Band, Holds the 1.3000 Spot

After a very sturdy month of July the development in GBP/USD has cooled and a good quantity of imply reversion has confirmed up to now in August. One fixed up to now within the early month has been an adherence to assist across the 1.3000 psychological stage. However, at this level, GBP/USD bulls have regarded very unwilling to revisit the March excessive, perched on the 1.3200 stage, and there’s been two separate pullbacks which have developed forward of a check of that key resistance. Provided that the second failed try at 1.3200 did produce a higher-high, there’s nonetheless potential for bulls right here, and this will hold the door open to topside themes, in search of a check of that 1.3200 swing excessive that hasn’t been touched in 5 months.

GBP/USD Each day Value Chart

Chart ready by James Stanley; GBP/USD on Tradingview

— Written by James Stanley, Strategist for DailyFX.com

Contact and observe James on Twitter: @JStanleyFX